3Q24 Investor Update

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

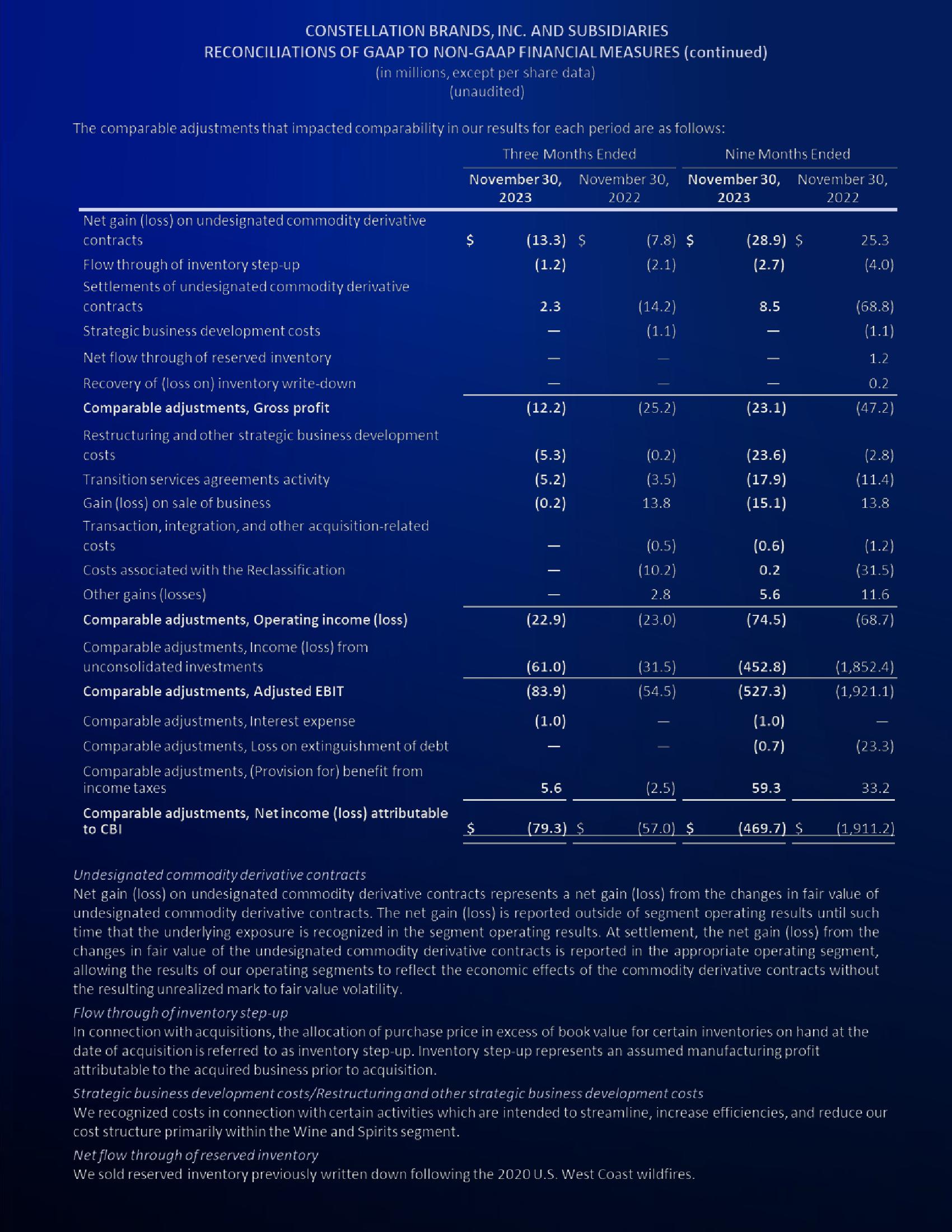

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

The comparable adjustments that impacted comparability in our results for each period are as follows:

Three Months Ended

Net gain (loss) on undesignated commodity derivative

contracts

Flow through of inventory step-up

Settlements of undesignated commodity derivative

contracts

Strategic business development costs

Net flow through of reserved inventory

Recovery of (loss on) inventory write-down

Comparable adjustments, Gross profit

Restructuring and other strategic business development

costs

Transition services agreements activity

Gain (loss) on sale of business

Transaction, integration, and other acquisition-related

costs

Costs associated with the Reclassification

Other gains (losses)

Comparable adjustments, Operating income (loss)

Comparable adjustments, Income (loss) from

unconsolidated investments

Comparable adjustments, Adjusted EBIT

Comparable adjustments, Interest expense

Comparable adjustments, Loss on extinguishment of debt

Comparable adjustments, (Provision for) benefit from

income taxes

Comparable adjustments, Net income (loss) attributable

to CBI

November 30, November 30,

2023

2022

$

(13.3) $

(1.2)

2.3

-

N|||

(12.2)

(5.3)

(5.2)

(0.2)

| | || 9

(22.9)

(61.0)

(83.9)

(1.0)

|

5.6

(79.3) $

(7.8) $

(2.1)

(14.2)

(1.1)

(25.2)

(0.2)

(3.5)

13.8

(0.5)

(10.2)

2.8

(23.0)

(31.5)

(54.5)

Nine Months Ended

November 30, November 30,

2023

2022

(2.5)

(57.0) $

(28.9) $

(2.7)

8.5

(23.1)

Net flow through of reserved inventory

We sold reserved inventory previously written down following the 2020 U.S. West Coast wildfires.

(23.6)

(17.9)

(15.1)

(0.6)

0.2

5.6

(74.5)

(452.8)

(527.3)

(1.0)

(0.7)

59.3

(469.7) $

25.3

(4.0)

(68.8)

(1.1)

1.2

0.2

(47.2)

(2.8)

(11.4)

13.8

(1.2)

(31.5)

11.6

(68.7)

(1,852.4)

(1,921.1)

(23.3)

33.2

(1,911.2)

Undesignated commodity derivative contracts

Net gain (loss) on undesignated commodity derivative contracts represents a net gain (loss) from the changes in fair value of

undesignated commodity derivative contracts. The net gain (loss) is reported outside of segment operating results until such

time that the underlying exposure is recognized in the segment operating results. At settlement, the net gain (loss) from the

changes in fair value of the undesignated commodity derivative contracts is reported in the appropriate operating segment,

allowing the results of our operating segments to reflect the economic effects of the commodity derivative contracts without

the resulting unrealized mark to fair value volatility.

Flow through of inventory step-up

In connection with acquisitions, the allocation of purchase price in excess of book value for certain inventories on hand at the

date of acquisition is referred to as inventory step-up. Inventory step-up represents an assumed manufacturing profit

attributable to the acquired business prior to acquisition.

Strategic business development costs/Restructuring and other strategic business development costs

We recognized costs in connection with certain activities which are intended to streamline, increase efficiencies, and reduce our

cost structure primarily within the Wine and Spirits segment.View entire presentation