Trian Partners Activist Presentation Deck

How Separating into Two Smaller Companies Could Lead to Further

Shareholder Value Enhancement

• Coatings multiples will likely continue to be supported by strategic optionality

■

■

■

Consolidation in coatings has been driven by economies of scale on raw material

purchasing, manufacturing, distribution, sales and R&D

The coatings supply chain has also been consolidating – both upstream suppliers and large

customers (i.e., retail, industrial, automotive)

By separating into two smaller companies, we believe PPG could participate more easily in

prudent M&A (more organizational capacity to do strategic acquisitions)

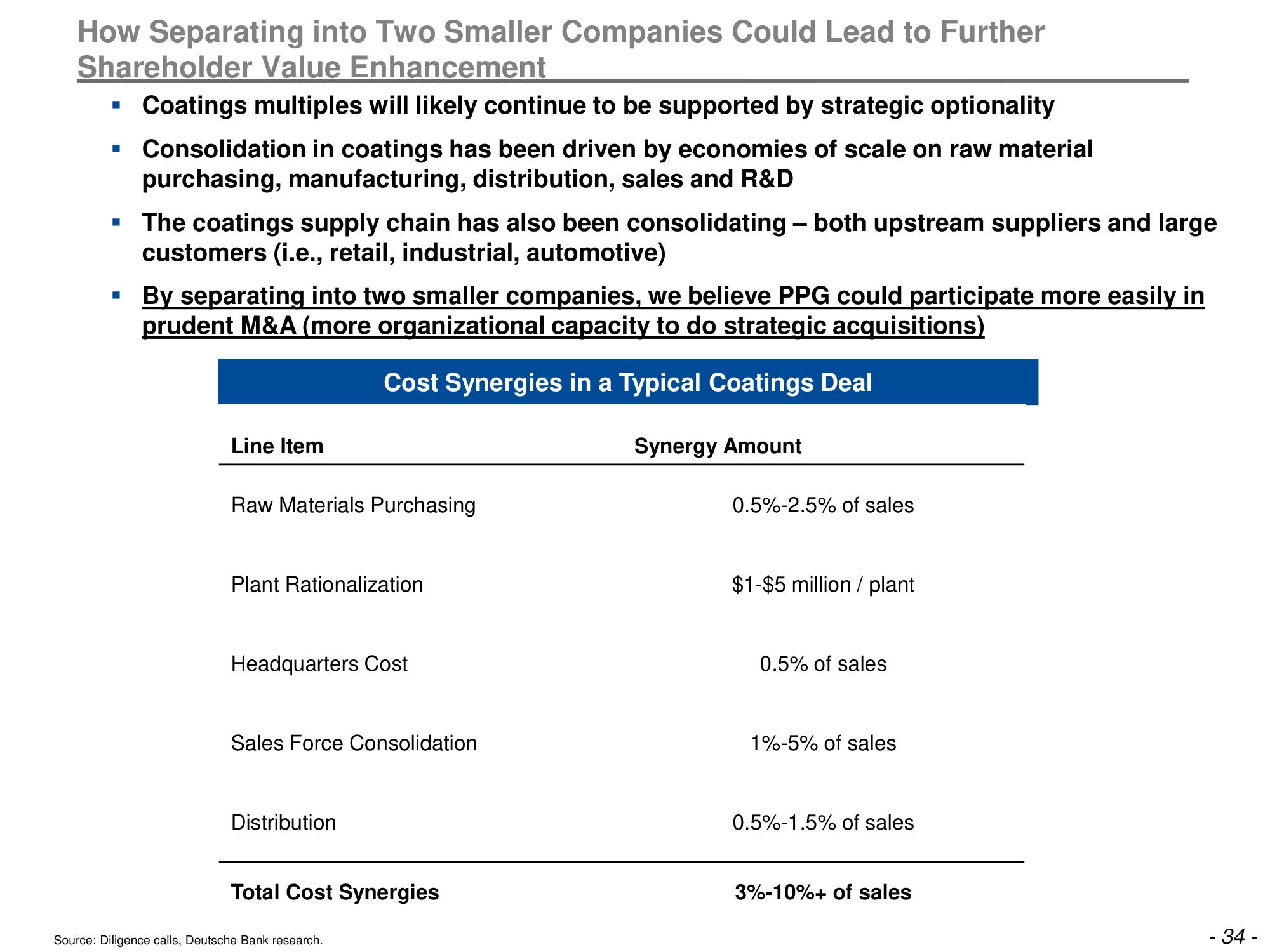

Cost Synergies in a Typical Coatings Deal

Synergy Amount

Line Item

Raw Materials Purchasing

Plant Rationalization

Headquarters Cost

Sales Force Consolidation

Distribution

Total Cost Synergies

Source: Diligence calls, Deutsche Bank research.

0.5%-2.5% of sales

$1-$5 million/ plant

0.5% of sales

1%-5% of sales

0.5%-1.5% of sales

3%-10%+ of sales

- 34 -View entire presentation