Vici Investor Presentation

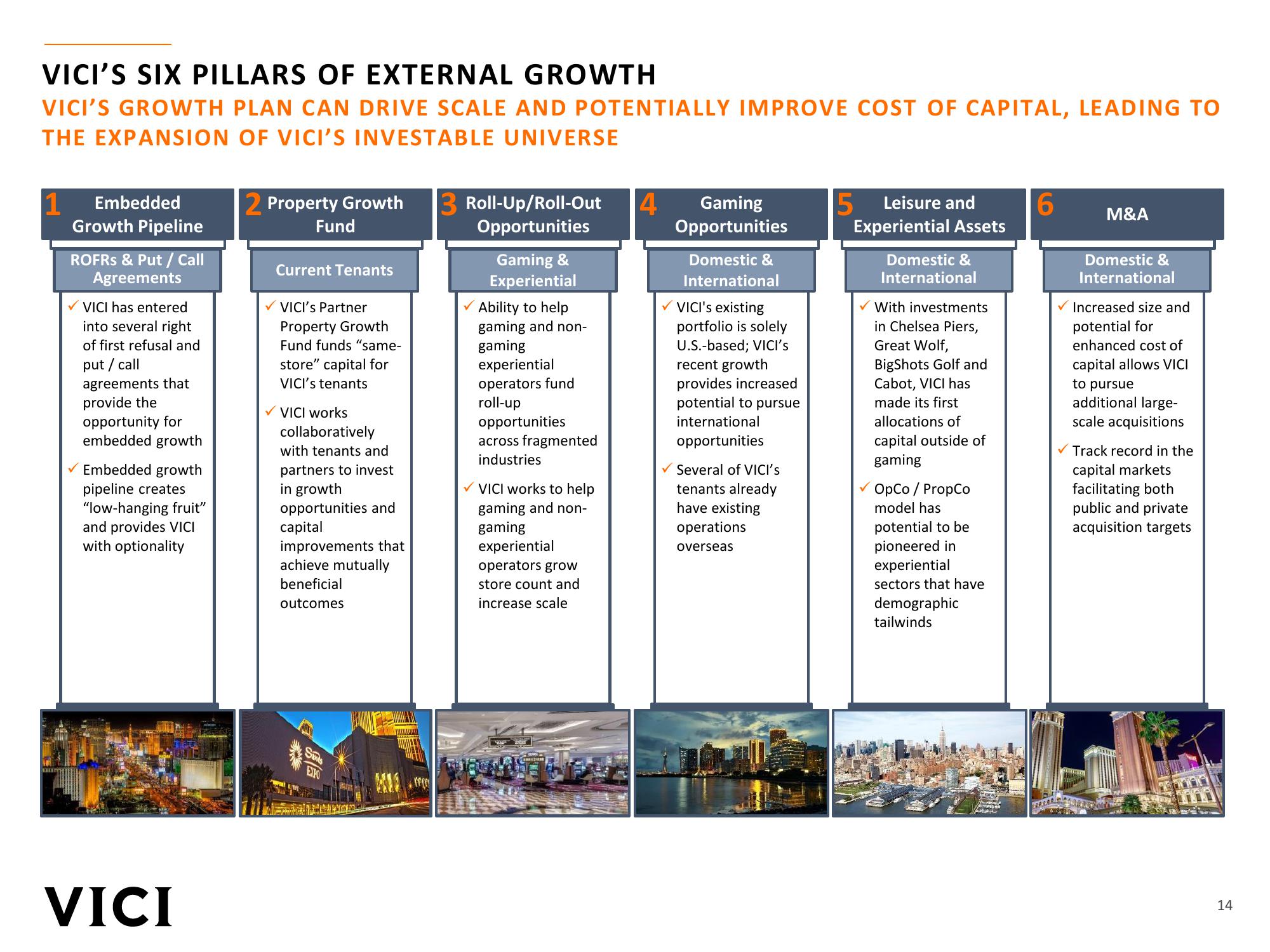

VICI'S SIX PILLARS OF EXTERNAL GROWTH

VICI'S GROWTH PLAN CAN DRIVE SCALE AND POTENTIALLY IMPROVE COST OF CAPITAL, LEADING TO

THE EXPANSION OF VICI'S INVESTABLE UNIVERSE

Embedded

Growth Pipeline

ROFRS & Put / Call

Agreements

✓ VICI has entered

into several right

of first refusal and

put / call

agreements that

provide the

opportunity for

embedded growth

✓ Embedded growth

pipeline creates

"low-hanging fruit"

and provides VICI

with optionality

VICI

2 Property Growth

Fund

Current Tenants

✓ VICI's Partner

Property Growth

Fund funds "same-

store" capital for

VICI's tenants

✓ VICI works

collaboratively

with tenants and

partners to invest

in growth

opportunities and

capital

improvements that

achieve mutually

beneficial

outcomes

Sams

EXPO

Roll-Up/Roll-Out 4 Gaming

Opportunities

Opportunities

Gaming &

Experiential

Ability to help

gaming and non-

gaming

experiential

operators fund

roll-up

opportunities

across fragmented

industries

✓ VICI works to help

gaming and non-

gaming

experiential

operators grow

store count and

increase scale

Domestic &

International

✓VICI's existing

portfolio is solely

U.S.-based; VICI's

recent growth

provides increased

potential to pursue

international

opportunities

✓ Several of VICI's

tenants already

have existing

operations

overseas

5 Leisure and

Experiential Assets

Domestic &

International

✓ With investments

in Chelsea Piers,

Great Wolf,

BigShots Golf and

Cabot, VICI has

made its first

allocations of

capital outside of

gaming

✓

OpCo / PropCo

model has

potential to be

pioneered in

experiential

sectors that have

demographic

tailwinds

6

211

FIRLAR

M&A

Domestic &

International

Increased size and

potential for

enhanced cost of

capital allows VICI

to pursue

additional large-

scale acquisitions

Track record in the

capital markets

facilitating both

public and private

acquisition targets

14View entire presentation