Hanmi Financial Results Presentation Deck

Total Balance

Average

Median

(3)

Top Quintile Balance

Top Quintile Loan Size

Top Quintile Average

Top Quintile Median

Owner

Occupied

$763

$1.01

$0.32

$573

$1.2 or more

$3.82

$2.09

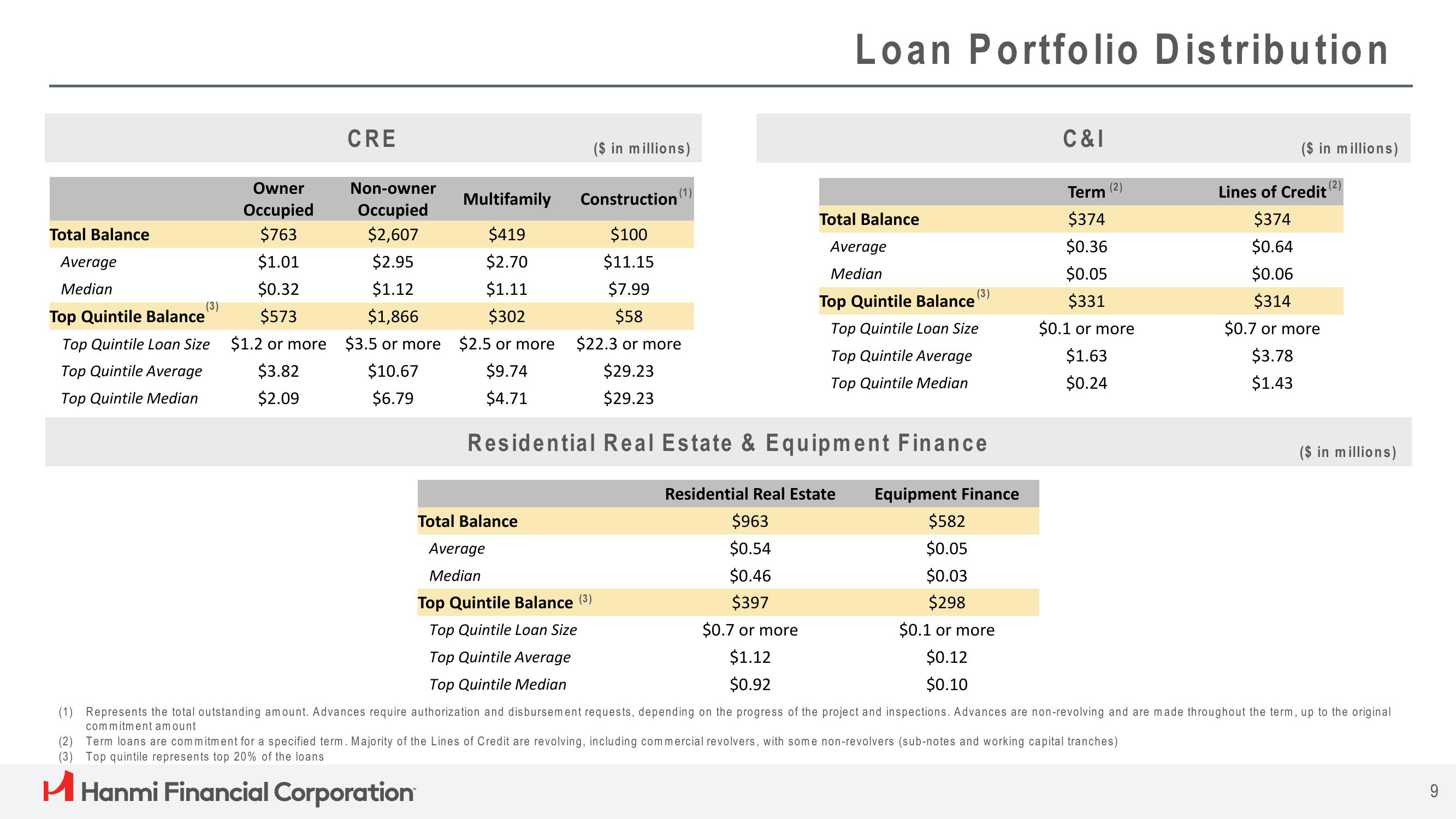

CRE

Non-owner

Occupied

$2,607

$2.95

$1.12

$1,866

$3.5 or more

$10.67

$6.79

Multifamily

$419

$2.70

$1.11

$302

$2.5 or more

$9.74

$4.71

Total Balance

Average

Median

($ in millions)

Top Quintile Balance (³)

Top Quintile Loan Size

Top Quintile Average

Top Quintile Median

(1)

Construction

$100

$11.15

$7.99

$58

$22.3 or more

$29.23

$29.23

Residential Real Estate & Equipment Finance

Loan Portfolio Distribution

Total Balance

Average

Median

Residential Real Estate

$963

$0.54

$0.46

$397

$0.7 or more

$1.12

$0.92

(3)

Top Quintile Balance

Top Quintile Loan Size

Top Quintile Average

Top Quintile Median

Equipment Finance

$582

$0.05

$0.03

$298

$0.1 or more

$0.12

$0.10

C&I

(2)

Term

$374

$0.36

$0.05

$331

$0.1 or more

$1.63

$0.24

(1)

(2) Term loans are commitment for a specified term. Majority of the Lines of Credit are revolving, including commercial revolvers, with some non-revolvers (sub-notes and working capital tranches)

(3) Top quintile represents top 20% of the loans

H Hanmi Financial Corporation

($ in millions)

(2)

Lines of Credit

$374

$0.64

$0.06

$314

$0.7 or more

$3.78

$1.43

($ in millions)

Represents the total outstanding amount. Advances require authorization and disbursement requests, depending on the progress of the project and inspections. Advances are non-revolving and are made throughout the term, up to the original

commitment amount

9View entire presentation