Avantor Results Presentation Deck

Capital allocation update

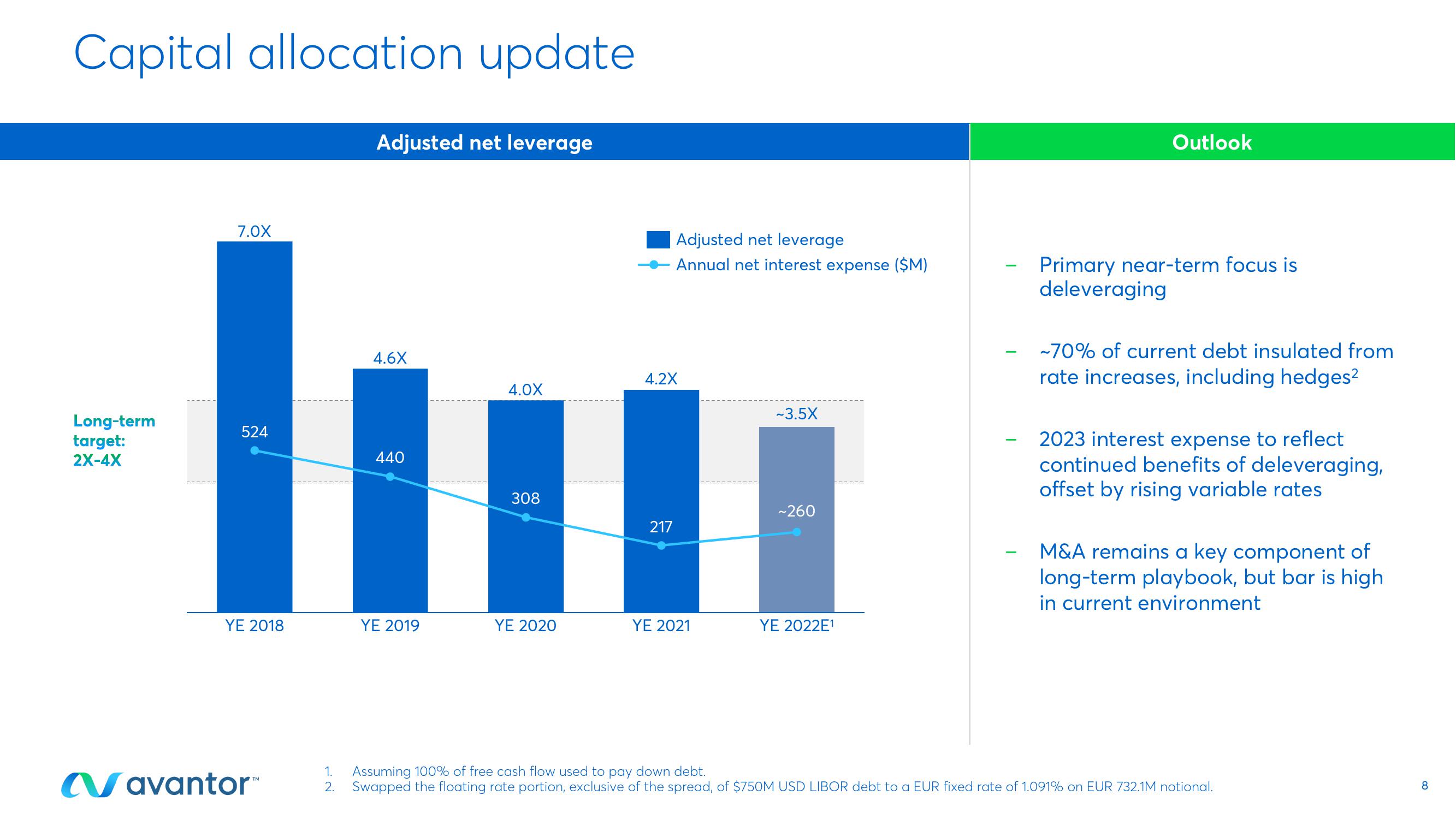

Long-term

target:

2X-4X

7.0X

524

YE 2018

Navantor™

Adjusted net leverage

4.6X

440

YE 2019

4.0X

308

YE 2020

Adjusted net leverage

Annual net interest expense ($M)

4.2X

217

YE 2021

-3.5X

~260

YE 2022E¹

-

Outlook

Primary near-term focus is

deleveraging

~70% of current debt insulated from

rate increases, including hedges²

2023 interest expense to reflect

continued benefits of deleveraging,

offset by rising variable rates

M&A remains a key component of

long-term playbook, but bar is high

in current environment

1. Assuming 100% of free cash flow used to pay down debt.

2. Swapped the floating rate portion, exclusive of the spread, of $750M USD LIBOR debt to a EUR fixed rate of 1.091% on EUR 732.1M notional.

8View entire presentation