Ares US Real Estate Opportunity Fund III

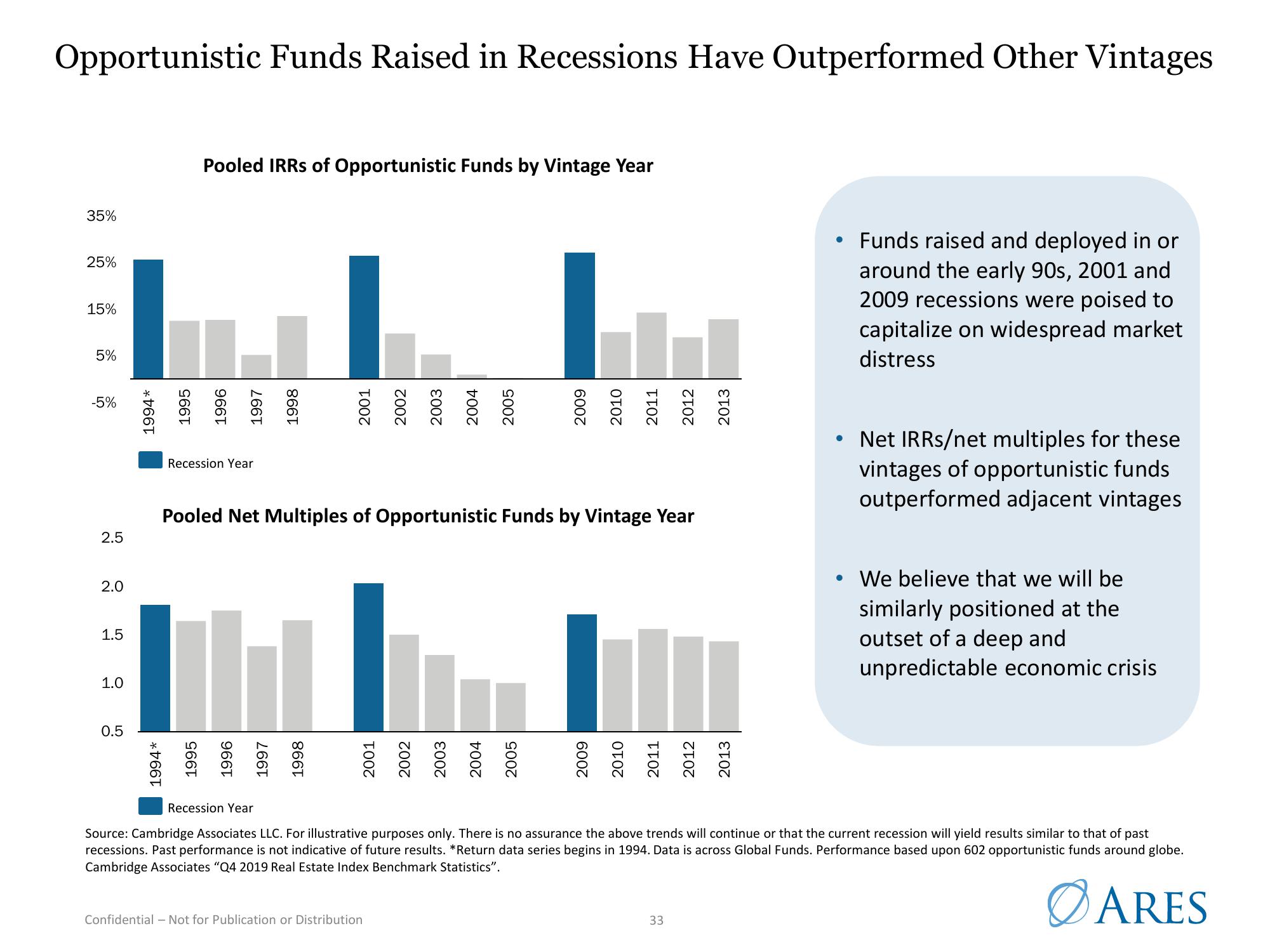

Opportunistic Funds Raised in Recessions Have Outperformed Other Vintages

35%

25%

15%

5%

-5%

2.5

2.0

1.5

1.0

0.5

1994*

1995

Pooled IRRs of Opportunistic Funds by Vintage Year

1996

1997

Recession Year

1998

Recession Year

2001

1998

2002

2003

Confidential - Not for Publication or Distribution

2004

2005

2009

Pooled Net Multiples of Opportunistic Funds by Vintage Year

2005

2010

2011

2012

33

2013

●

Funds raised and deployed in or

around the early 90s, 2001 and

2009 recessions were poised to

capitalize on widespread market

distress

Net IRRs/net multiples for these

vintages of opportunistic funds

outperformed adjacent vintages

Source: Cambridge Associates LLC. For illustrative purposes only. There is no assurance the above trends will continue or that the current recession will yield results similar to that of past

recessions. Past performance is not indicative of future results. *Return data series begins in 1994. Data is across Global Funds. Performance based upon 602 opportunistic funds around globe.

Cambridge Associates "Q4 2019 Real Estate Index Benchmark Statistics".

ARES

We believe that we will be

similarly positioned at the

outset of a deep and

unpredictable economic crisisView entire presentation