First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

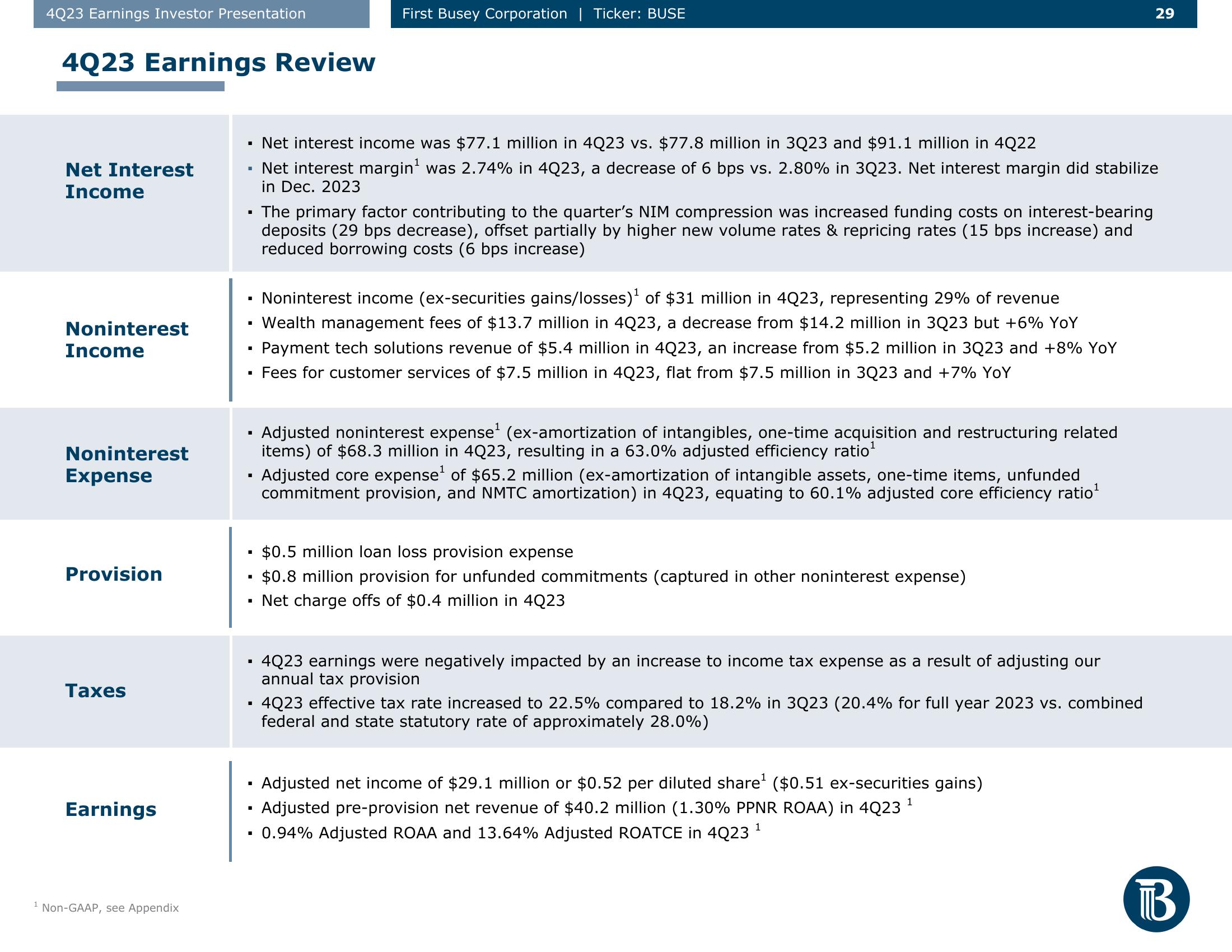

4Q23 Earnings Review

Net Interest

Income

Noninterest

Income

Noninterest

Expense

Provision

Taxes

Earnings

¹ Non-GAAP, see Appendix

▪ The primary factor contributing to the quarter's NIM compression was increased funding costs on interest-bearing

deposits (29 bps decrease), offset partially by higher new volume rates & repricing rates (15 bps increase) and

reduced borrowing costs (6 bps increase)

■

Noninterest income (ex-securities gains/losses)¹ of $31 million in 4Q23, representing 29% of revenue

▪ Wealth management fees of $13.7 million in 4Q23, a decrease from $14.2 million in 3Q23 but +6% YoY

Payment tech solutions revenue of $5.4 million in 4Q23, an increase from $5.2 million in 3Q23 and +8% YoY

Fees for customer services of $7.5 million in 4Q23, flat from $7.5 million in 3Q23 and +7% YoY

■

First Busey Corporation | Ticker: BUSE

■

Net interest income was $77.1 million in 4Q23 vs. $77.8 million in 3Q23 and $91.1 million in 4Q22

Net interest margin¹ was 2.74% in 4Q23, a decrease of 6 bps vs. 2.80% in 3Q23. Net interest margin did stabilize

in Dec. 2023

▪ Adjusted core expense¹ of $65.2 million (ex-amortization of intangible assets, one-time items, unfunded

commitment provision, and NMTC amortization) in 4Q23, equating to 60.1% adjusted core efficiency ratio¹

■

▪ $0.5 million loan loss provision expense

▪ $0.8 million provision for unfunded commitments (captured in other noninterest expense)

Net charge offs of $0.4 million in 4Q23

■

Adjusted noninterest expense¹ (ex-amortization of intangibles, one-time acquisition and restructuring related

items) of $68.3 million in 4Q23, resulting in a 63.0% adjusted efficiency ratio ¹

4Q23 earnings were negatively impacted by an increase to income tax expense as a result of adjusting our

annual tax provision

4Q23 effective tax rate increased to 22.5% compared to 18.2% in 3Q23 (20.4% for full year 2023 vs. combined

federal and state statutory rate of approximately 28.0%)

Adjusted net income of $29.1 million or $0.52 per diluted share¹ ($0.51 ex-securities gains)

1

Adjusted pre-provision net revenue of $40.2 million (1.30% PPNR ROAA) in 4Q23 ¹

29

1

0.94% Adjusted ROAA and 13.64% Adjusted ROATCE in 4Q23 ¹

BView entire presentation