WeWork Restructuring Presentation Deck

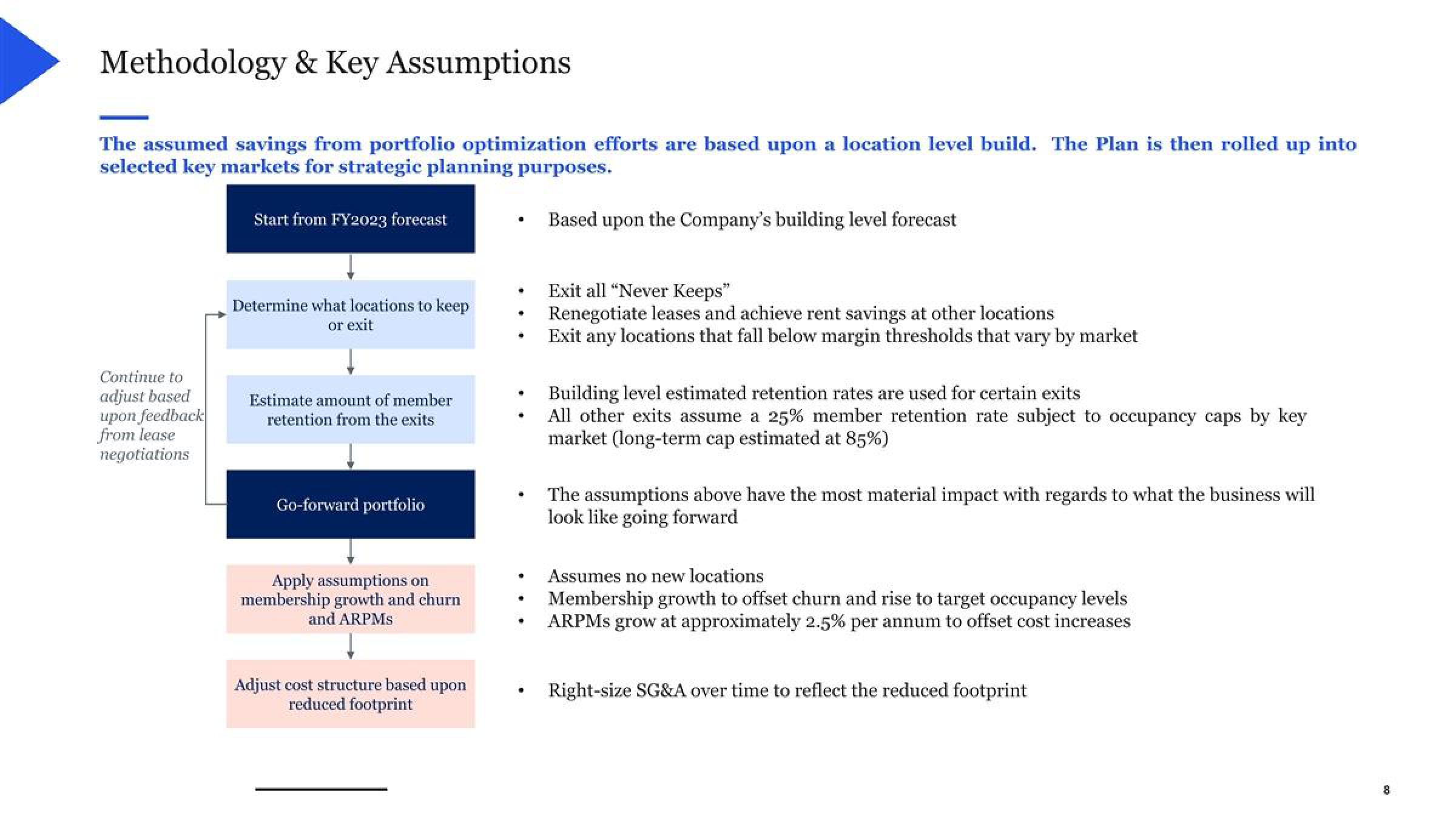

Methodology & Key Assumptions

The assumed savings from portfolio optimization efforts are based upon a location level build. The Plan is then rolled up into

selected key markets for strategic planning purposes.

Based upon the Company's building level forecast

Continue to

adjust based

upon feedback

from lease

negotiations

Start from FY2023 forecast

Determine what locations to keep

or exit

Estimate amount of member

retention from the exits

Go-forward portfolio

Apply assumptions on

membership growth and churn

and ARPMs

Adjust cost structure based upon

reduced footprint

•

.

•

•

•

.

Exit all "Never Keeps"

Renegotiate leases and achieve rent savings at other locations

Exit any locations that fall below margin thresholds that vary by market

Building level estimated retention rates are used for certain exits

All other exits assume a 25% member retention rate subject to occupancy caps by key

market (long-term cap estimated at 85%)

The assumptions above have the most material impact with regards to what the business will

look like going forward

Assumes no new locations

Membership growth to offset churn and rise to target occupancy levels

ARPMs grow at approximately 2.5% per annum to offset cost increases

Right-size SG&A over time to reflect the reduced footprint

8View entire presentation