VinFast Investor Presentation Deck

V

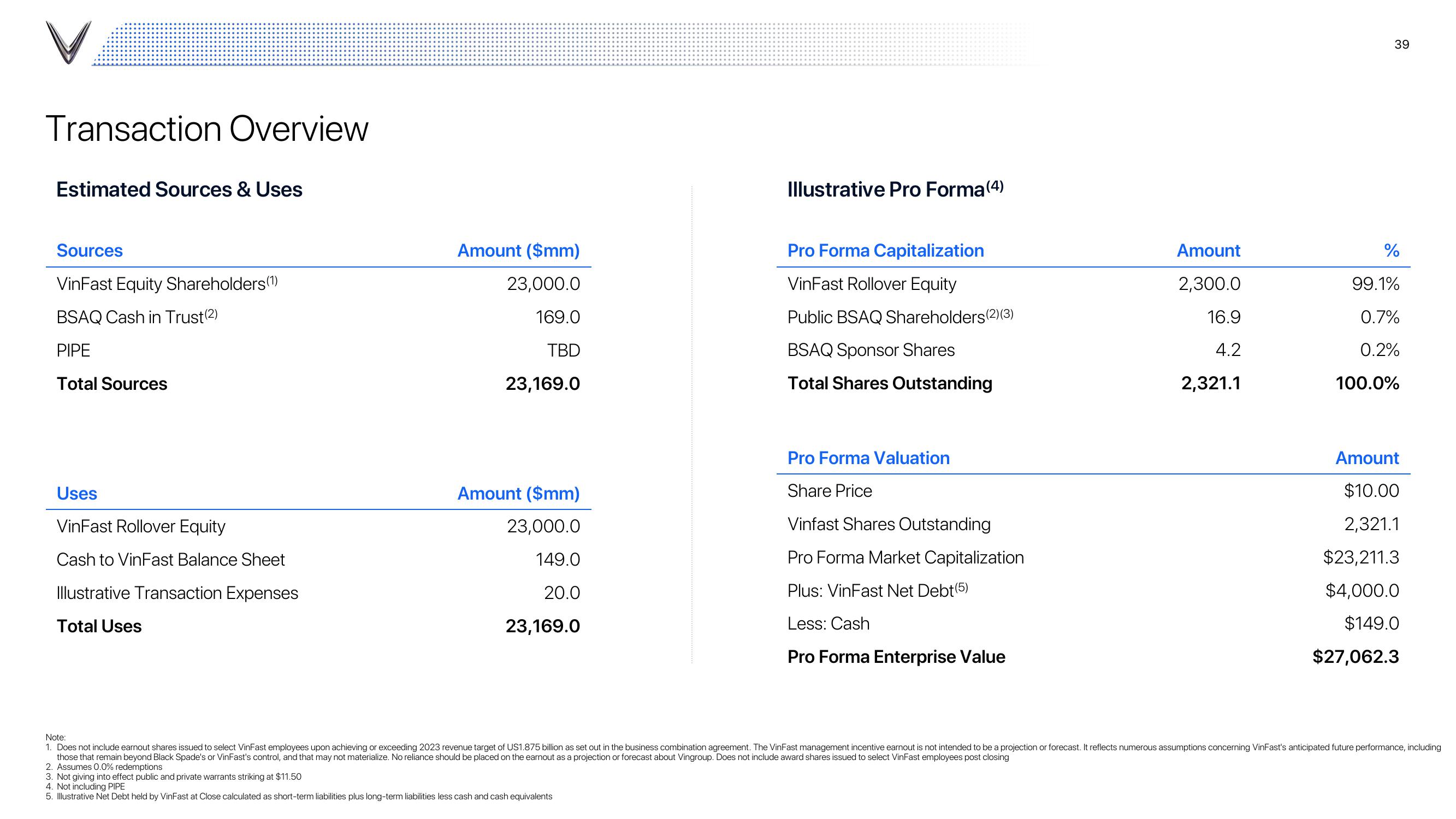

Transaction Overview

Estimated Sources & Uses

Sources

VinFast Equity Shareholders (1)

BSAQ Cash in Trust(2)

PIPE

Total Sources

Uses

VinFast Rollover Equity

Cash to VinFast Balance Sheet

Illustrative Transaction Expenses

Total Uses

Amount ($mm)

23,000.0

169.0

TBD

23,169.0

Amount ($mm)

23,000.0

149.0

20.0

23,169.0

Illustrative Pro Forma (4)

Pro Forma Capitalization

VinFast Rollover Equity

Public BSAQ Shareholders(2)(3)

BSAQ Sponsor Shares

Total Shares Outstanding

Pro Forma Valuation

Share Price

Vinfast Shares Outstanding

Pro Forma Market Capitalization

Plus: VinFast Net Debt (5)

Less: Cash

Pro Forma Enterprise Value

Amount

2,300.0

16.9

4.2

2,321.1

39

%

99.1%

0.7%

0.2%

100.0%

Amount

$10.00

2,321.1

$23,211.3

$4,000.0

$149.0

$27,062.3

Note:

1. Does not include earnout shares issued to select VinFast employees upon achieving or exceeding 2023 revenue target of US1.875 billion as set out in the business combination agreement. The VinFast management incentive earnout is not intended to be a projection or forecast. It reflects numerous assumptions concerning VinFast's anticipated future performance, including

those that remain beyond Black Spade's or VinFast's control, and that may not materialize. No reliance should be placed on the earnout as a projection or forecast about Vingroup. Does not include award shares issued to select VinFast employees post closing

2. Assumes 0.0% redemptions

3. Not giving into effect public and private warrants striking at $11.50

4. Not including PIPE

5. Illustrative Net Debt held by VinFast at Close calculated as short-term liabilities plus long-term liabilities less cash and cash equivalentsView entire presentation