Altus Power Investor Presentation Deck

Statement of

Operations

ALTUSPOWER

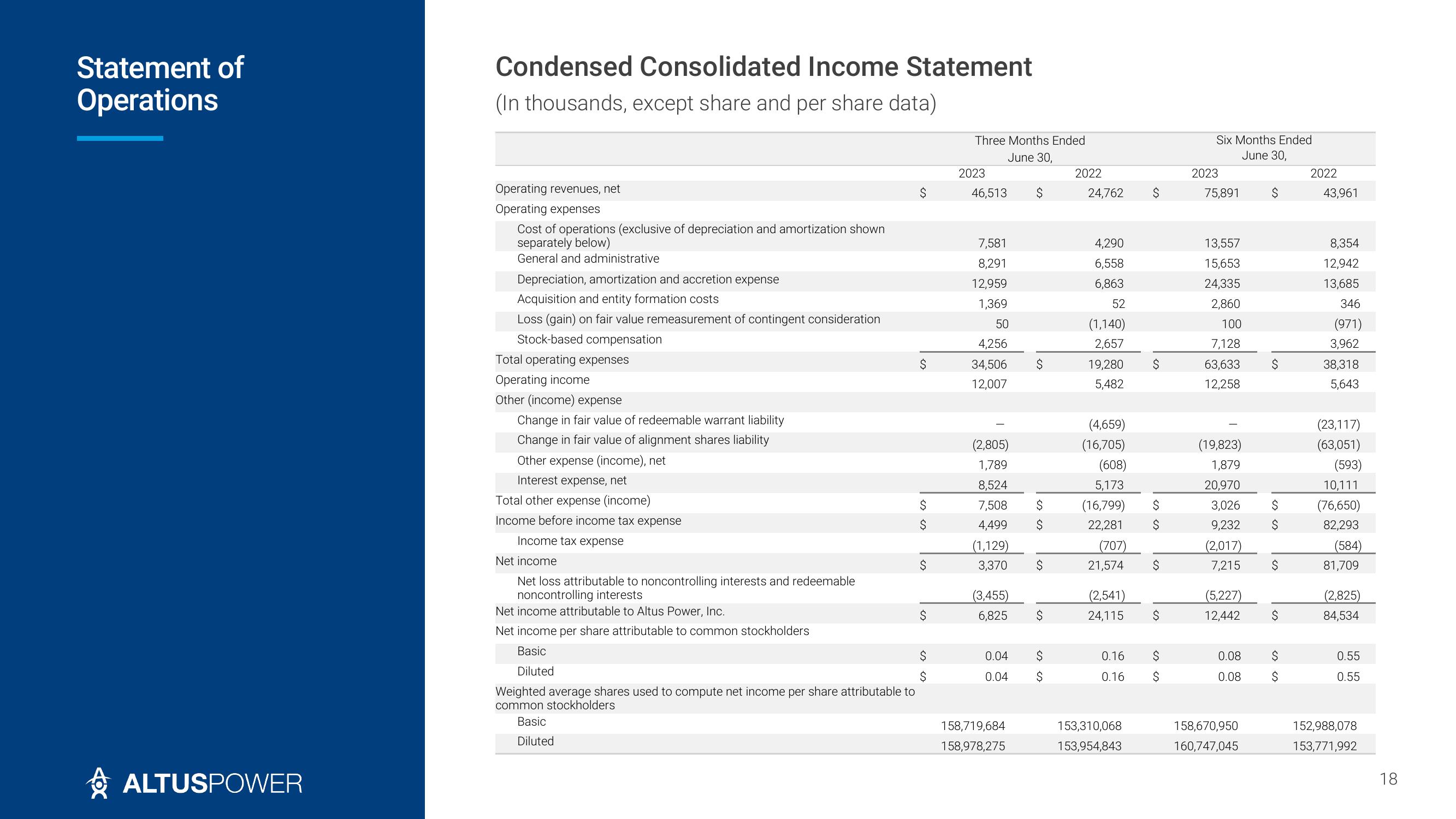

Condensed Consolidated Income Statement

(In thousands, except share and per share data)

Operating revenues, net

Operating expenses

Cost of operations (exclusive of depreciation and amortization shown

separately below)

General and administrative

Depreciation, amortization and accretion expense

Acquisition and entity formation costs

Loss (gain) on fair value remeasurement of contingent consideration

Stock-based compensation

Total operating expenses

Operating income

Other (income) expense

Change in fair value of redeemable warrant liability

Change in fair value of alignment shares liability

Other expense (income), net

Interest expense, net

Total other expense (income)

Income before income tax expense

Income tax expense

Net income

Net loss attributable to noncontrolling interests and redeemable

noncontrolling interests

Net income attributable to Altus Power, Inc.

Net income per share attributable to common stockholders

Basic

Diluted

$

$

$

$

$

$

$

$

Weighted average shares used to compute net income per share attributable to

common stockholders

Basic

Diluted

Three Months Ended

June 30,

2023

46,513

7,581

8,291

12,959

1,369

50

4,256

34,506

12,007

(2,805)

1,789

8,524

7,508 $

4,499 $

(1,129)

3,370

(3,455)

6,825

$

158,719,684

158,978,275

$

$

0.04 Ś

0.04 $

2022

24,762

4,290

6,558

6,863

52

(1,140)

2,657

19,280

5,482

0.16

0.16

Ś

(4,659)

(16,705)

(608)

5,173

(16,799) $

22,281 $

(707)

21,574 $

(2,541)

24,115

153,310,068

153,954,843

$

$

$

Six Months Ended

June 30,

2023

75,891

13,557

15,653

24,335

2,860

100

7,128

63,633

12,258

(19,823)

1,879

20,970

3,026

9,232

(2,017)

7,215

(5,227)

12,442

0.08

0.08

158,670,950

160,747,045

$

Ś

$

$

$

$

$

$

2022

43,961

8,354

12,942

13,685

346

(971)

3,962

38,318

5,643

(23,117)

(63,051)

(593)

10,111

(76,650)

82,293

(584)

81,709

(2,825)

84,534

0.55

0.55

152,988,078

153,771,992

18View entire presentation