Spirit Mergers and Acquisitions Presentation Deck

》》》

●

●

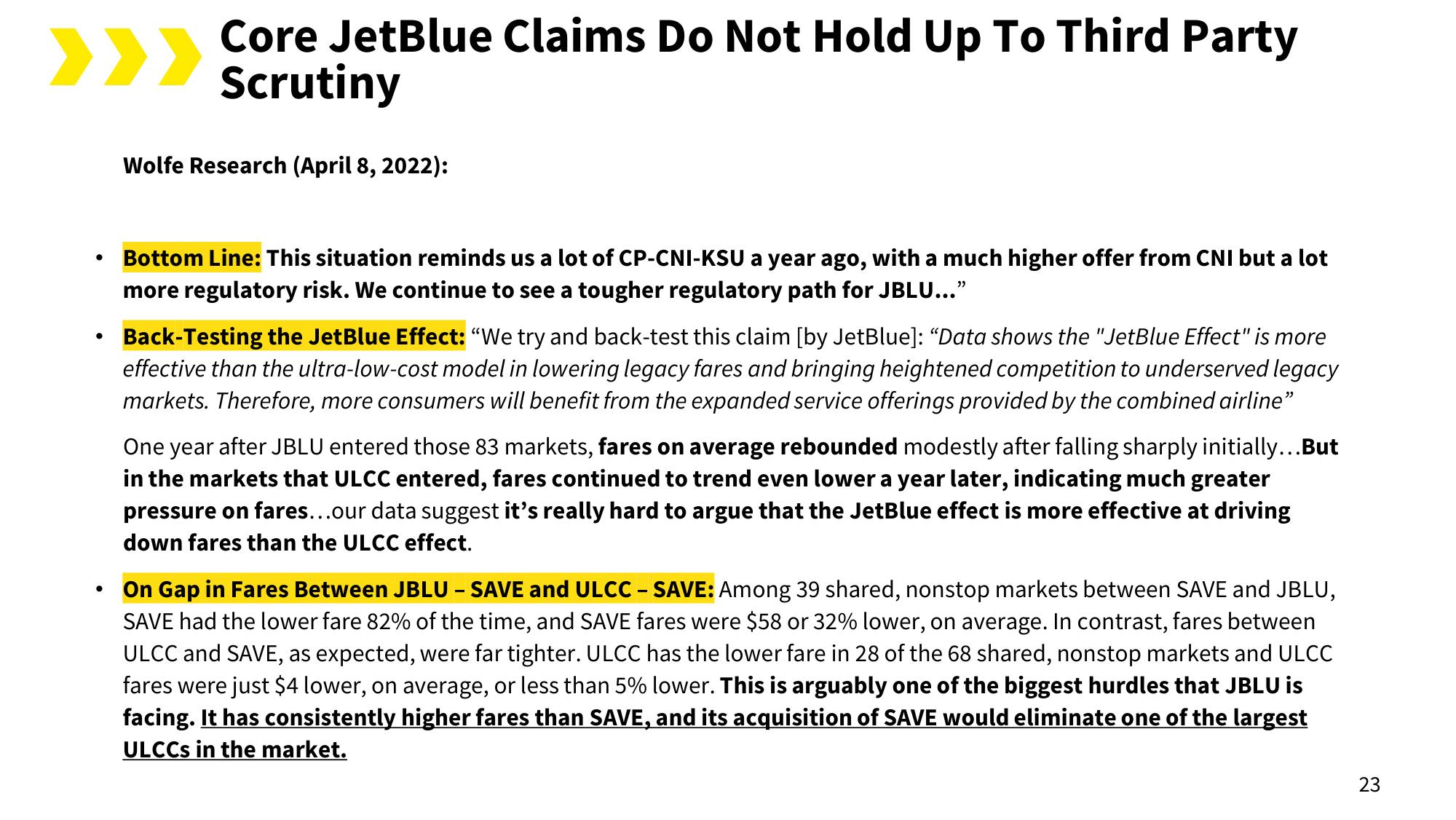

Core JetBlue Claims Do Not Hold Up To Third Party

Scrutiny

Wolfe Research (April 8, 2022):

Bottom Line: This situation reminds us a lot of CP-CNI-KSU a year ago, with a much higher offer from CNI but a lot

more regulatory risk. We continue to see a tougher regulatory path for JBLU..."

Back-Testing the JetBlue Effect: "We try and back-test this claim [by JetBlue]: "Data shows the "JetBlue Effect" is more

effective than the ultra-low-cost model in lowering legacy fares and bringing heightened competition to underserved legacy

markets. Therefore, more consumers will benefit from the expanded service offerings provided by the combined airline"

One year after JBLU entered those 83 markets, fares on average rebounded modestly after falling sharply initially...But

in the markets that ULCC entered, fares continued to trend even lower a year later, indicating much greater

pressure on fares...our data suggest it's really hard to argue that the JetBlue effect is more effective at driving

down fares than the ULCC effect.

On Gap in Fares Between JBLU - SAVE and ULCC - SAVE: Among 39 shared, nonstop markets between SAVE and JBLU,

SAVE had the lower fare 82% of the time, and SAVE fares were $58 or 32% lower, on average. In contrast, fares between

ULCC and SAVE, as expected, were far tighter. ULCC has the lower fare in 28 of the 68 shared, nonstop markets and ULCC

fares were just $4 lower, on average, or less than 5% lower. This is arguably one of the biggest hurdles that JBLU is

facing. It has consistently higher fares than SAVE, and its acquisition of SAVE would eliminate one of the largest

ULCCS in the market.

23View entire presentation