Harley Davidson SPAC Presentation Deck

Proposed Transaction Summary

Harley-Davidson's LiveWire EV Motorcycle Business to Combine With

AEA-Bridges to Create Separate Public Company

!!!

N

83

LIVEWIRE TRANSACTION OVERVIEW

AEA Bridges Impact Corporation ("ABIC") entered into business combination agreement with LiveWire

Attractive risk-adjusted investment opportunity in EV space; aligns with UN Sustainable Development Goals

- Transaction partner KYMCO, a Taiwanese motorcycle & sport vehicle manufacturer, helps accelerate

penetration in key global markets and light motorcycle & scooter segments via low-cost manufacturing

Transaction expected to close in H1 2022; LiveWire will trade on the NYSE under ticker LVW

LIVEWIRE CAPITAL STRUCTURE

Transaction financed by ABIC's $400 million cash held in trust, Harley-Davidson's $100 million PIPE

investment, and KYMCO's $100 million PIPE investment

Financing yields $545 million of net cash proceeds - funds strategic plan to accelerate go-to-market

strategy, invest in new product development, and enhance global manufacturing & distribution capabilities

Harley-Davidson backstopping up to $100 million in redemptions; commitments from Harley-Davidson,

KYMCO, and ABIC will satisfy minimum cash condition

LIVEWIRE VALUATION

Transaction implies a pro forma enterprise value of $1.77 billion; post money equity value of $2.31 billion

-1.0x 2026E revenue of $1,769 million and 16% of Harley-Davidson's current enterprise value

- Experienced public company management team focused on achievability of financial projections

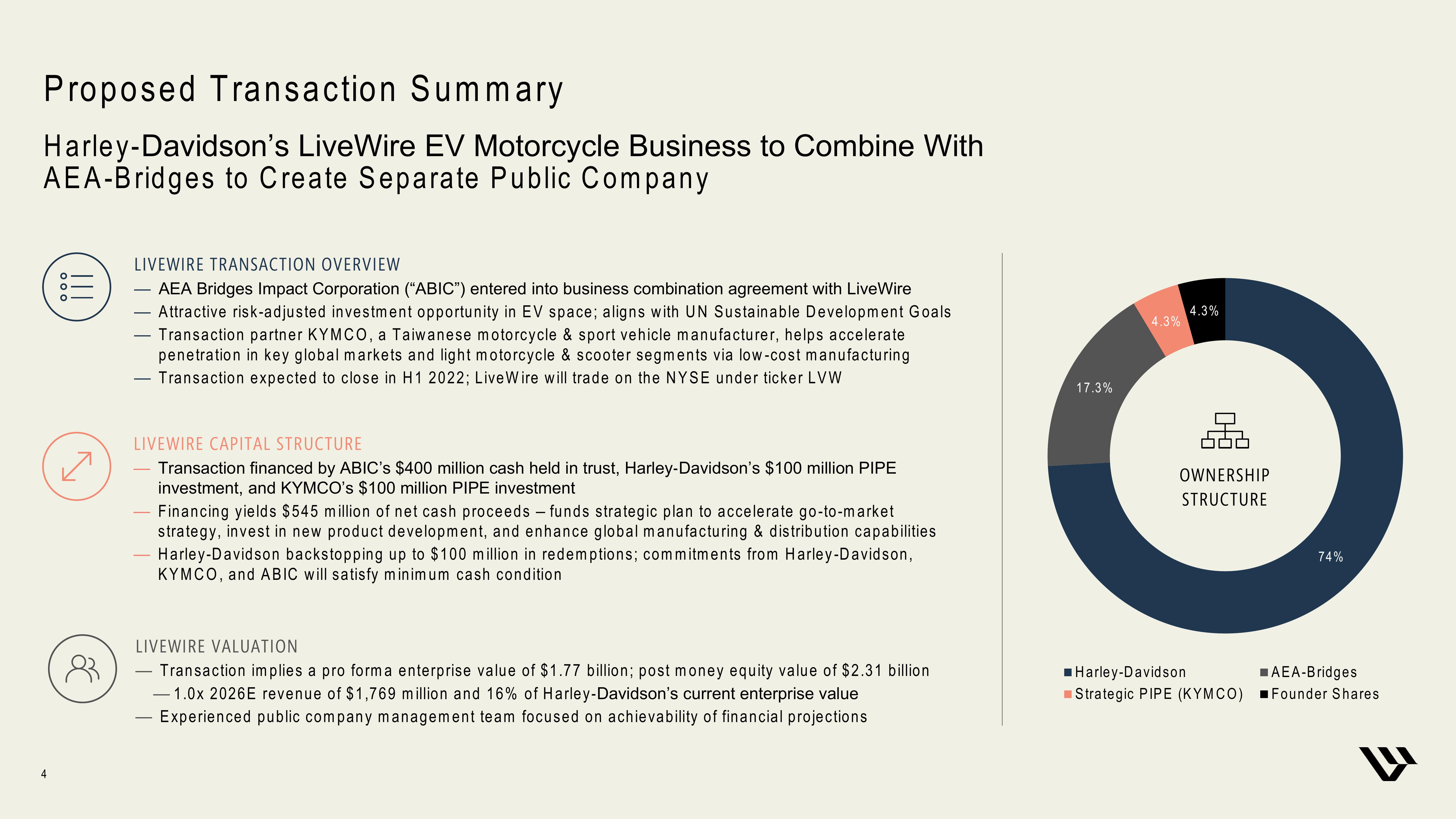

17.3%

4.3%

4.3%

OWNERSHIP

STRUCTURE

74%

■Harley-Davidson

■AEA-Bridges

Strategic PIPE (KYMCO) ■Founder SharesView entire presentation