SmileDirectClub Investor Presentation Deck

●

●

●

Q4 2022 results.

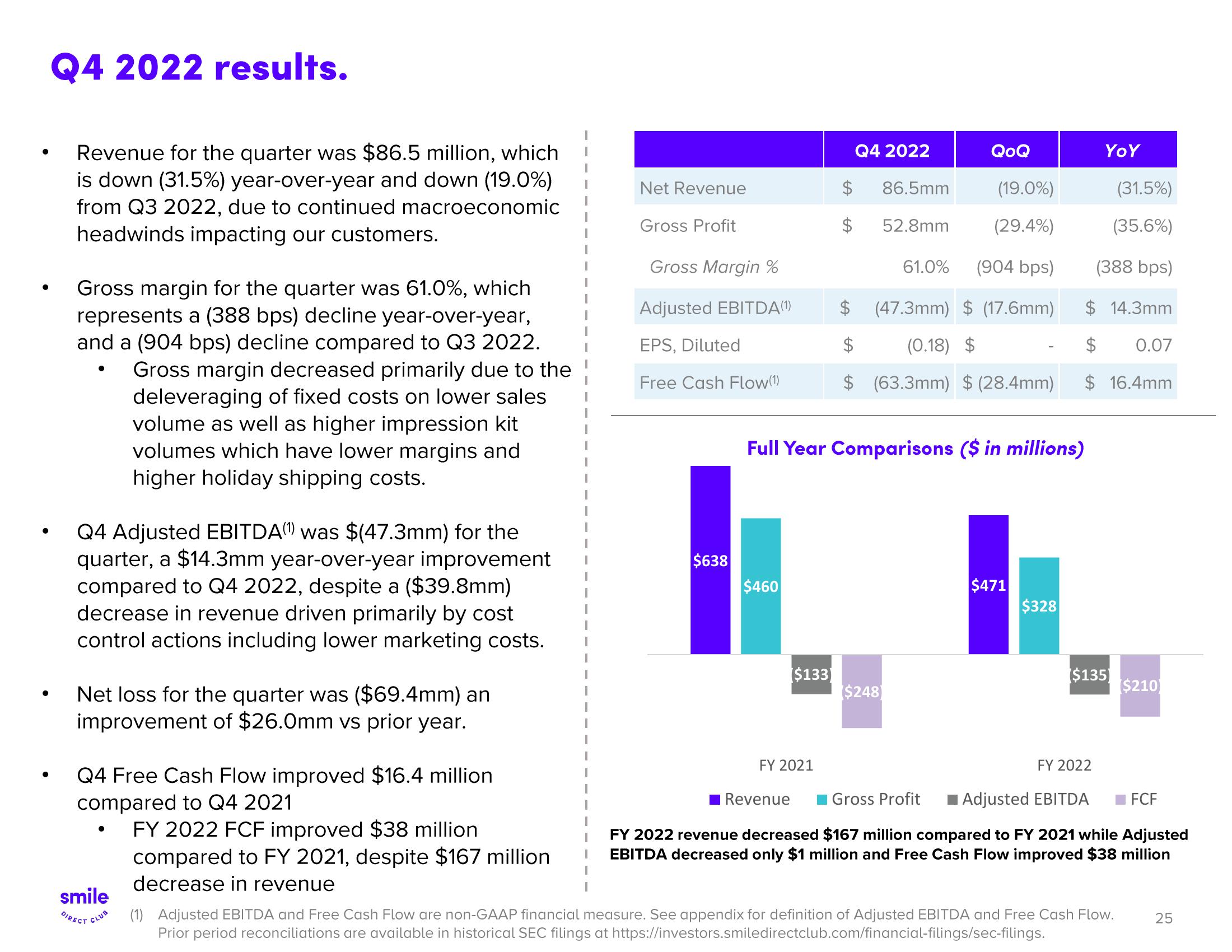

Revenue for the quarter was $86.5 million, which

is down (31.5%) year-over-year and down (19.0%)

from Q3 2022, due to continued macroeconomic

headwinds impacting our customers.

Gross margin for the quarter was 61.0%, which

represents a (388 bps) decline year-over-year,

and a (904 bps) decline compared to Q3 2022.

Gross margin decreased primarily due to the

deleveraging of fixed costs on lower sales

volume as well as higher impression kit

volumes which have lower margins and

higher holiday shipping costs.

●

Q4 Adjusted EBITDA) was $(47.3mm) for the

quarter, a $14.3mm year-over-year improvement

compared to Q4 2022, despite a ($39.8mm)

decrease in revenue driven primarily by cost

control actions including lower marketing costs.

Net loss for the quarter was ($69.4mm) an

improvement of $26.0mm vs prior year.

Q4 Free Cash Flow improved $16.4 million

compared to Q4 2021

●

smile

DIRECT CLUB

FY 2022 FCF improved $38 million

compared to FY 2021, despite $167 million

decrease in revenue

Net Revenue

Gross Profit

Gross Margin %

Adjusted EBITDA (1)

EPS, Diluted

Free Cash Flow(1)

$638

$460

$133)

FY 2021

Revenue

$

tA

Q4 2022

Full Year Comparisons ($ in millions)

86.5mm

52.8mm

(19.0%)

(29.4%)

(904 bps)

(47.3mm) $ (17.6mm)

(0.18) $

$ (63.3mm) $ (28.4mm)

$248

61.0%

QoQ

Gross Profit

$471

$328

YOY

(31.5%)

(35.6%)

(388 bps)

$14.3mm

$ 0.07

$ 16.4mm

FY 2022

($135)

$210)

■Adjusted EBITDA

FY 2022 revenue decreased $167 million compared to FY 2021 while Adjusted

EBITDA decreased only $1 million and Free Cash Flow improved $38 million

(1) Adjusted EBITDA and Free Cash Flow are non-GAAP financial measure. See appendix for definition of Adjusted EBITDA and Free Cash Flow.

Prior period reconciliations are available in historical SEC filings at https://investors.smiledirectclub.com/financial-filings/sec-filings.

FCF

25View entire presentation