Comcast Results Presentation Deck

Connectivity

& Platforms

Adj.

EBITDA

Margin

6

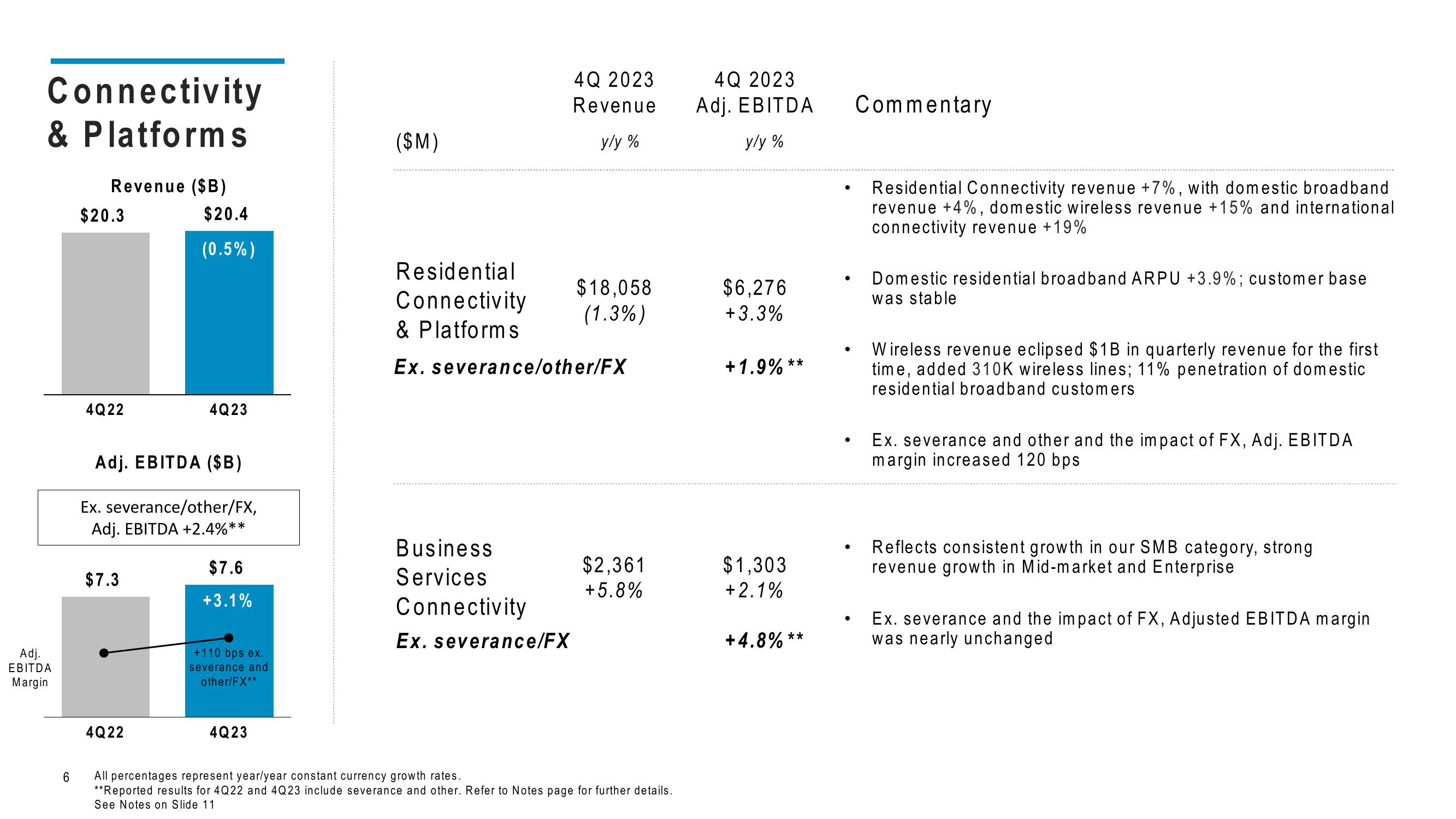

Revenue ($B)

$20.3

4Q22

$7.3

$20.4

(0.5%)

Adj. EBITDA ($B)

Ex. severance/other/FX,

Adj. EBITDA +2.4%**

4Q22

4Q23

$7.6

+3.1%

+110 bps ex.

severance and

other/FX**

4Q23

($M)

4Q 2023

Revenue

y/y%

Residential

Connectivity

& Platforms

Ex. severance/other/FX

Business

Services

Connectivity

Ex. severance/FX

$18.058

(1.3%)

$2,361

+5.8%

All percentages represent year/year constant currency growth rates.

**Reported results for 4Q22 and 4Q23 include severance and other. Refer to Notes page for further details.

See Notes on Slide 11

4Q 2023

Adj. EBITDA

y/y%

$6,276

+3.3%

+1.9% **

$1,303

+ 2.1%

+ 4.8%

**

●

●

●

Commentary

Residential Connectivity revenue +7%, with domestic broadband

revenue +4%, domestic wireless revenue +15% and international

connectivity revenue +19%

Domestic residential broadband ARPU +3.9%; customer base

was stable

Wireless revenue eclipsed $1B in quarterly revenue for the first

time, added 310K wireless lines; 11% penetration of domestic

residential broadband customers

Ex. severance and other and the impact of FX, Adj. EBITDA

margin increased 120 bps

Reflects consistent growth in our SMB category, strong

revenue growth in Mid-market and Enterprise

Ex. severance and the impact of FX, Adjusted EBITDA margin

was nearly unchangedView entire presentation