DraftKings SPAC Presentation Deck

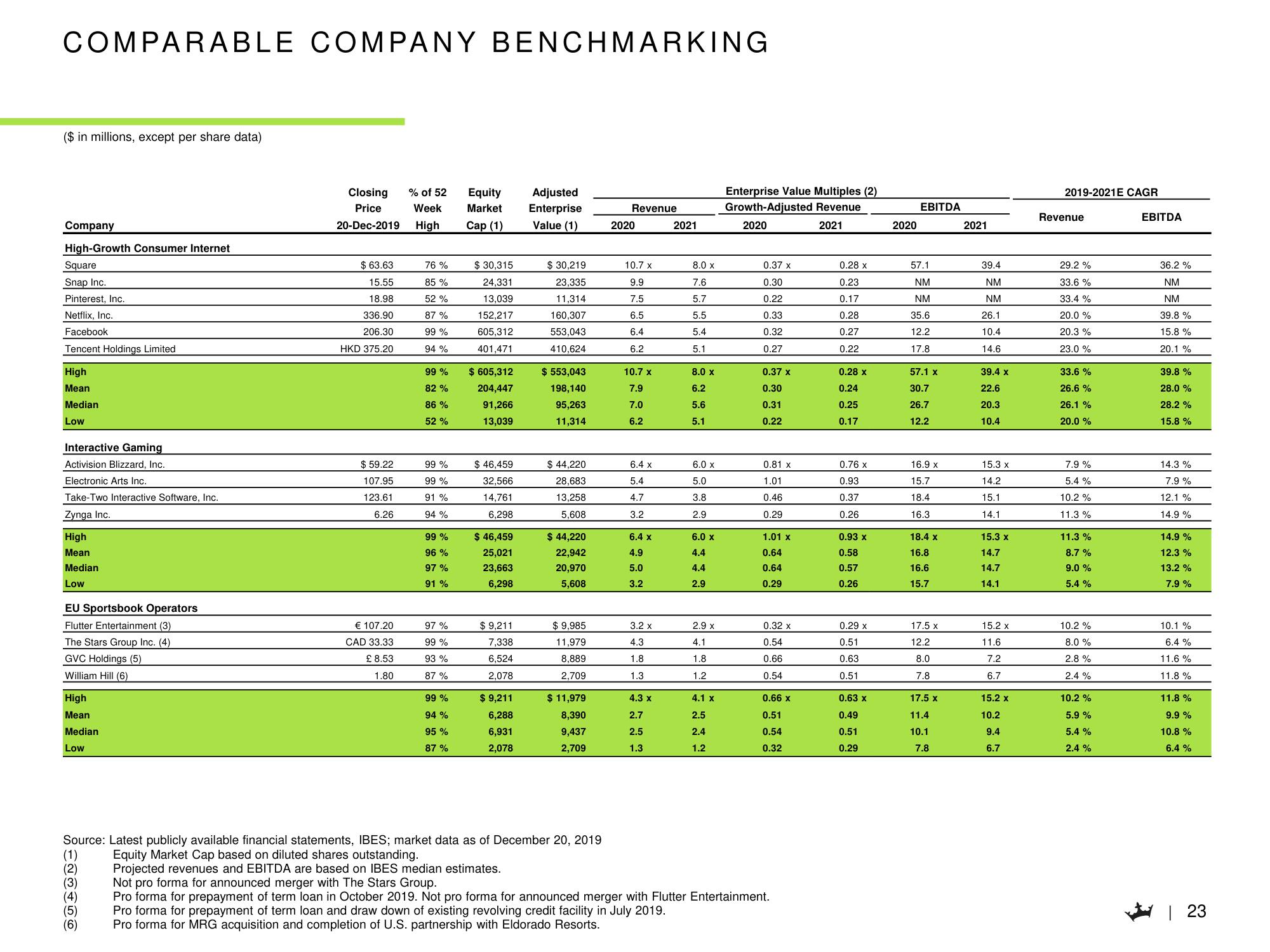

COMPARABLE COMPANY BENCHMARKING

($ in millions, except per share data)

Company

High-Growth Consumer Internet

Square

Snap Inc.

Pinterest, Inc.

Netflix, Inc.

Facebook

Tencent Holdings Limited

High

Mean

Median

Low

Interactive Gaming

Activision Blizzard, Inc.

Electronic Arts Inc.

Take-Two Interactive Software, Inc.

Zynga Inc.

High

Mean

Median

Low

EU Sportsbook Operators

Flutter Entertainment (3)

The Stars Group Inc. (4)

GVC Holdings (5)

William Hill (6)

High

Mean

Median

Low

(1)

(2)

(3)

Closing

Price

20-Dec-2019

(5)

(6)

$63.63

15.55

18.98

336.90

206.30

HKD 375.20

$ 59.22

107.95

123.61

6.26

€ 107.20

CAD 33.33

£ 8.53

1.80

% of 52

Week

High

76%

85 %

52 %

87%

99%

94%

99 %

82%

86%

52 %

99 %

99 %

91 %

94 %

99 %

96 %

97 %

91 %

97%

99 %

93 %

87%

99%

94%

95%

87%

Equity Adjusted

Market Enterprise

Cap (1) Value (1)

$30,315

24,331

13,039

152,217

605,312

401,471

$ 605,312

204,447

91,266

13,039

$ 46,459

32,566

14,761

6,298

$ 46,459

25,021

23,663

6,298

$ 9,211

7,338

6,524

2,078

$ 9,211

6,288

6,931

2,078

$ 30,219

23,335

11,314

160,307

553,043

410,624

$ 553,043

198,140

95,263

11,314

$ 44,220

28,683

13,258

5,608

$ 44,220

22,942

20,970

5,608

$ 9,985

11,979

8,889

2,709

$ 11,979

8,390

9,437

2,709

Revenue

2020

10.7 x

9.9

7.5

6.5

6.4

6.2

10.7 x

7.9

7.0

6.2

6.4 x

5.4

4.7

3.2

6.4 x

4.9

5.0

3.2

3.2 x

4.3

1.8

1.3

4.3 x

2.7

2.5

1.3

2021

8.0 x

7.6

5.7

5.5

5.4

5.1

8.0 x

6.2

5.6

5.1

6.0 x

5.0

3.8

2.9

6.0 x

4.4

4.4

2.9

2.9 x

4.1

1.8

1.2

4.1 x

2.5

2.4

1.2

Enterprise Value Multiples (2)

Growth-Adjusted Revenue

2020

2021

0.37 x

0.30

0.22

0.33

0.32

0.27

0.37 x

0.30

0.31

0.22

0.81 x

1.01

0.46

0.29

1.01 X

0.64

0.64

0.29

0.32 x

0.54

0.66

0.54

Source: Latest publicly available financial statements, IBES; market data as of December 20, 2019

Equity Market Cap based on diluted shares outstanding.

Projected revenues and EBITDA are based on IBES median estimates.

Not pro forma for announced merger with The Stars Group.

Pro forma for prepayment of term loan in October 2019. Not pro forma for announced merger with Flutter Entertainment.

Pro forma for prepayment of term loan and draw down of existing revolving credit facility in July 2019.

Pro forma for MRG acquisition and completion of U.S. partnership with Eldorado Resorts.

0.66 x

0.51

0.54

0.32

0.28 x

0.23

0.17

0.28

0.27

0.22

0.28 x

0.24

0.25

0.17

0.76 x

0.93

0.37

0.26

0.93 x

0.58

0.57

0.26

0.29 x

0.51

0.63

0.51

0.63 x

0.49

0.51

0.29

2020

EBITDA

57.1

NM

NM

35.6

12.2

17.8

57.1 x

30.7

26.7

12.2

16.9 x

15.7

18.4

16.3

18.4 x

16.8

16.6

15.7

17.5 x

12.2

8.0

7.8

17.5 x

11.4

10.1

7.8

2021

39.4

NM

NM

26.1

10.4

14.6

39.4 x

22.6

20.3

10.4

15.3 x

14.2

15.1

14.1

15.3 x

14.7

14.7

14.1

15.2 x

11.6

7.2

6.7

15.2 x

10.2

9.4

6.7

2019-2021E CAGR

Revenue

29.2 %

33.6%

33.4 %

20.0 %

20.3%

23.0%

33.6%

26.6 %

26.1 %

20.0 %

7.9%

5.4 %

10.2%

11.3%

11.3%

8.7 %

9.0 %

5.4 %

10.2 %

8.0 %

2.8%

2.4 %

10.2 %

5.9 %

5.4 %

2.4 %

EBITDA

36.2 %

NM

NM

39.8%

15.8%

20.1%

39.8 %

28.0 %

28.2 %

15.8 %

14.3%

7.9 %

12.1 %

14.9 %

14.9 %

12.3%

13.2 %

7.9 %

10.1 %

6.4 %

11.6 %

11.8%

11.8%

9.9 %

10.8 %

6.4 %

| 23View entire presentation