Tradeweb Investor Presentation Deck

SIMPLE PHILOSOPHY

Capital Management

●

●

1.

2.

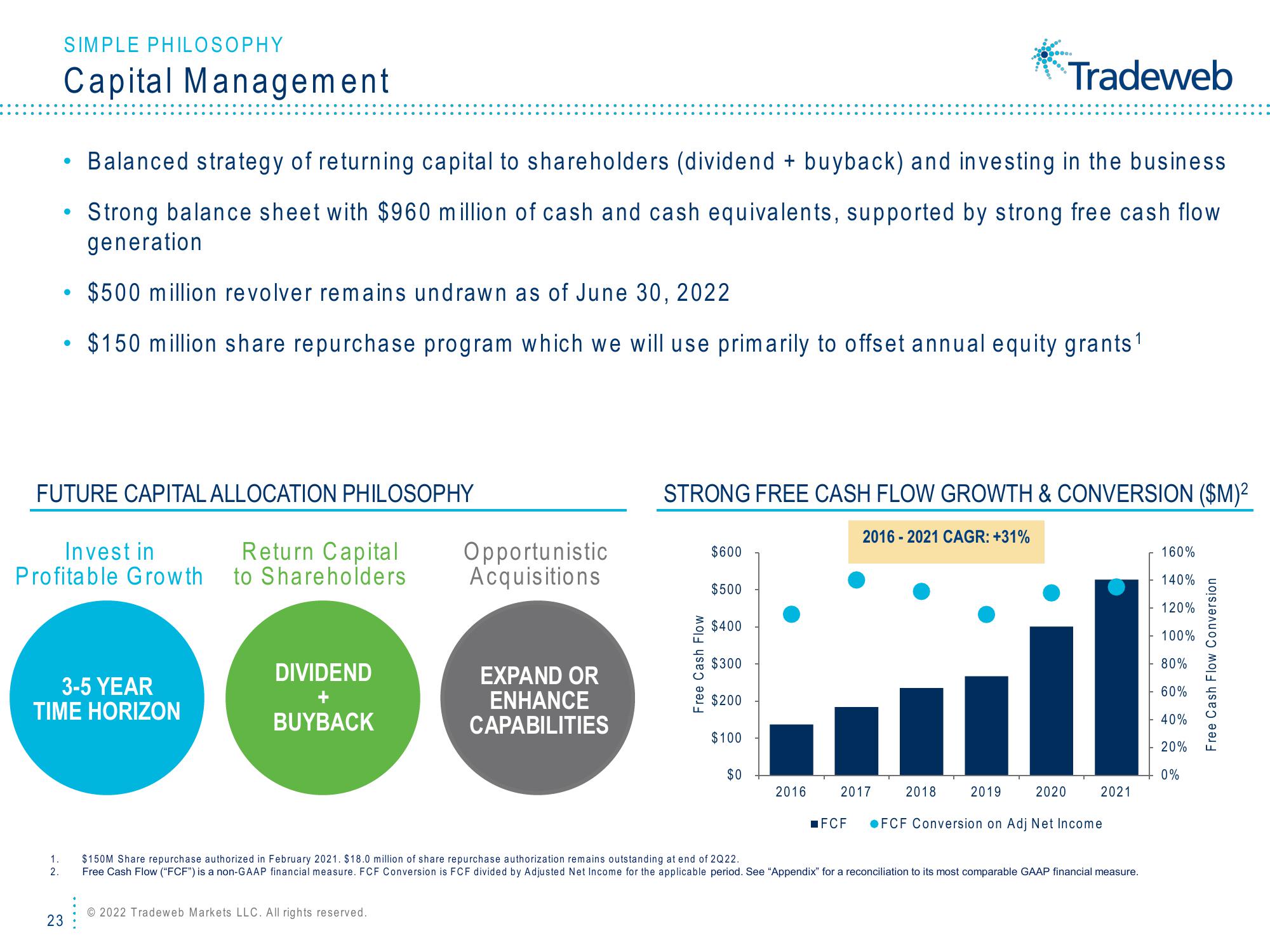

FUTURE CAPITAL ALLOCATION PHILOSOPHY

Invest in

Profitable Growth

Balanced strategy of returning capital to shareholders (dividend + buyback) and investing in the business

Strong balance sheet with $960 million of cash and cash equivalents, supported by strong free cash flow

generation

• $500 million revolver remains undrawn as of June 30, 2022

$150 million share repurchase program which we will use primarily to offset annual equity grants ¹

3-5 YEAR

TIME HORIZON

23

Return Capital

to Shareholders

DIVIDEND

BUYBACK

Opportunistic

Acquisitions

© 2022 Tradeweb Markets LLC. All rights reserved.

EXPAND OR

ENHANCE

CAPABILITIES

Free Cash Flow

STRONG FREE CASH FLOW GROWTH & CONVERSION ($M)²

2016-2021 CAGR: +31%

$600

$500

$400

$300

$200

$100

$0

2016

....

2017

2018

Tradeweb

2019

2020

2021

■FCF FCF Conversion on Adj Net Income

$150M Share repurchase authorized in February 2021. $18.0 million of share repurchase authorization remains outstanding at end of 2Q22.

Free Cash Flow ("FCF") is a non-GAAP financial measure. FCF Conversion is FCF divided by Adjusted Net Income for the applicable period. See "Appendix" for a reconciliation to its most comparable GAAP financial measure.

160%

140%

120%

100%

80%

60%

40%

20%

0%

Free Cash Flow ConversionView entire presentation