NioCorp Investor Presentation Deck

Titanium

O

60

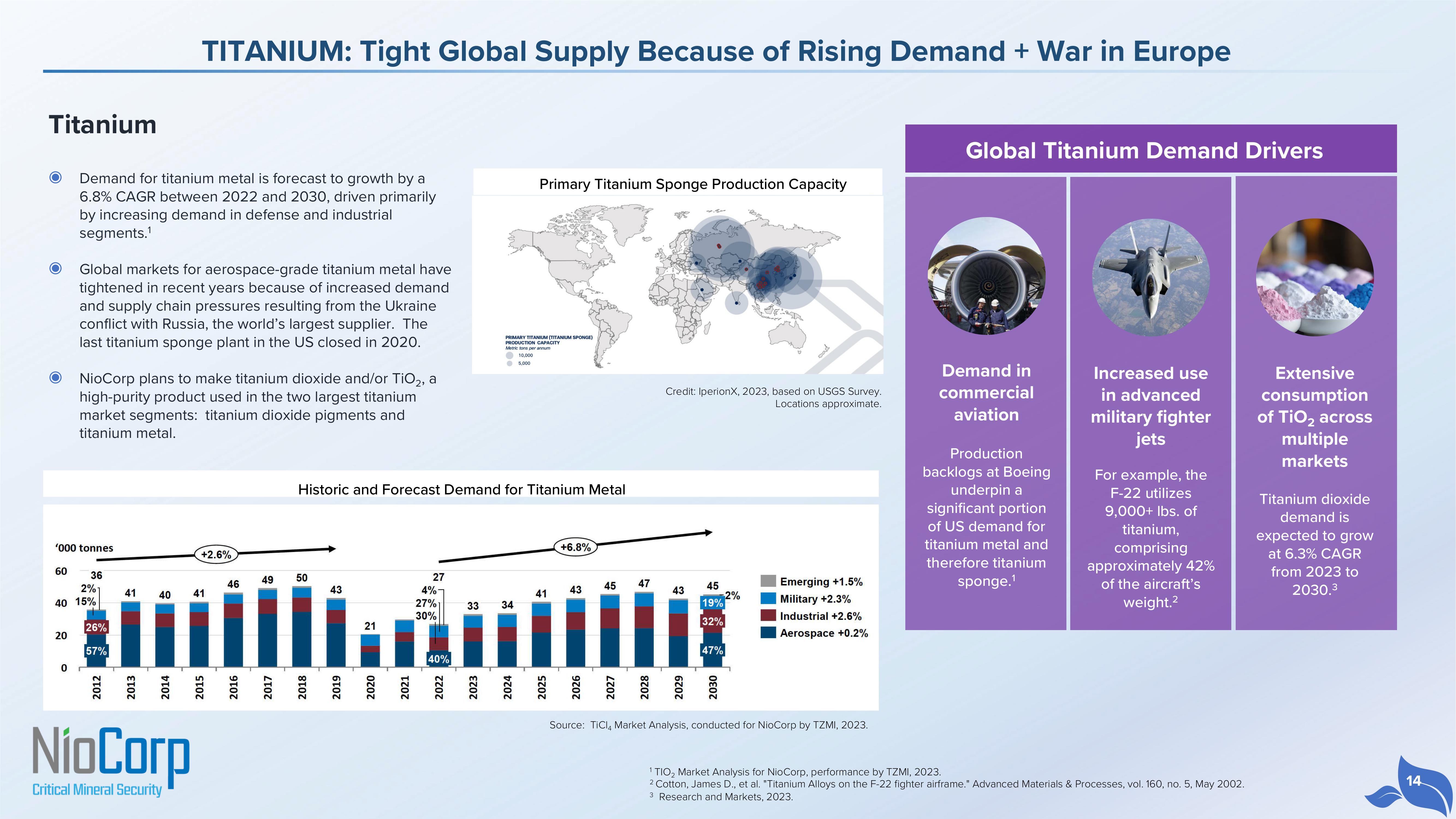

Demand for titanium metal is forecast to growth by a

6.8% CAGR between 2022 and 2030, driven primarily

by increasing demand in defense and industrial

segments.¹

'000 tonnes

20

Global markets for aerospace-grade titanium metal have

tightened in recent years because of increased demand

and supply chain pressures resulting from the Ukraine

conflict with Russia, the world's largest supplier. The

last titanium sponge plant in the US closed in 2020.

NioCorp plans to make titanium dioxide and/or TiO₂, a

high-purity product used in the two largest titanium

market segments: titanium dioxide pigments and

titanium metal.

36

2%1

40 15%

26%

57%

0 r

TITANIUM: Tight Global Supply Because of Rising Demand + War in Europe

41

40

NioCorp

Critical Mineral Security

+2.6%

41

46

9107

49 50

2017

2018

Historic and Forecast Demand for Titanium Metal

43

2019

21

T

27

4%

27%

30%

T

40%

T

PRIMARY TITANIUM (TITANIUM SPONGE)

PRODUCTION CAPACITY

33 34

T

5,000

Primary Titanium Sponge Production Capacity

T

41

+6.8%

43

45 47

Credit: IperionX, 2023, based on USGS Survey.

Locations approximate.

43

T

45

19%

32%

-2%

47%

7

Emerging +1.5%

Military +2.3%

Industrial +2.6%

Aerospace +0.2%

Source: TiCl4 Market Analysis, conducted for NioCorp by TZMI, 2023.

Global Titanium Demand Drivers

Demand in

commercial

aviation

Production

backlogs at Boeing

underpin a

significant portion

of US demand for

titanium metal and

therefore titanium

sponge.¹

Increased use

in advanced

military fighter

jets

For example, the

F-22 utilizes

9,000+ lbs. of

titanium,

comprising

approximately 42%

of the aircraft's

weight.²

¹ TIO₂ Market Analysis for NioCorp, performance by TZMI, 2023.

2 Cotton, James D., et al. "Titanium Alloys on the F-22 fighter airframe." Advanced Materials & Processes, vol. 160, no. 5, May 2002.

3 Research and Markets, 2023.

Extensive

consumption

of TiO₂ across

multiple

markets

Titanium dioxide

demand is

expected to grow

at 6.3% CAGR

from 2023 to

2030.³

14View entire presentation