BlackRock Results Presentation Deck

8%

14%

$172

$39

$133

13%

7%

$68

13% 13%

$81

$23

$60

Long-term

$(2)

6%

Q1

Q3

Q2

2021 2021 2021

12%

$75

$75

$98

$(12)

$(10)

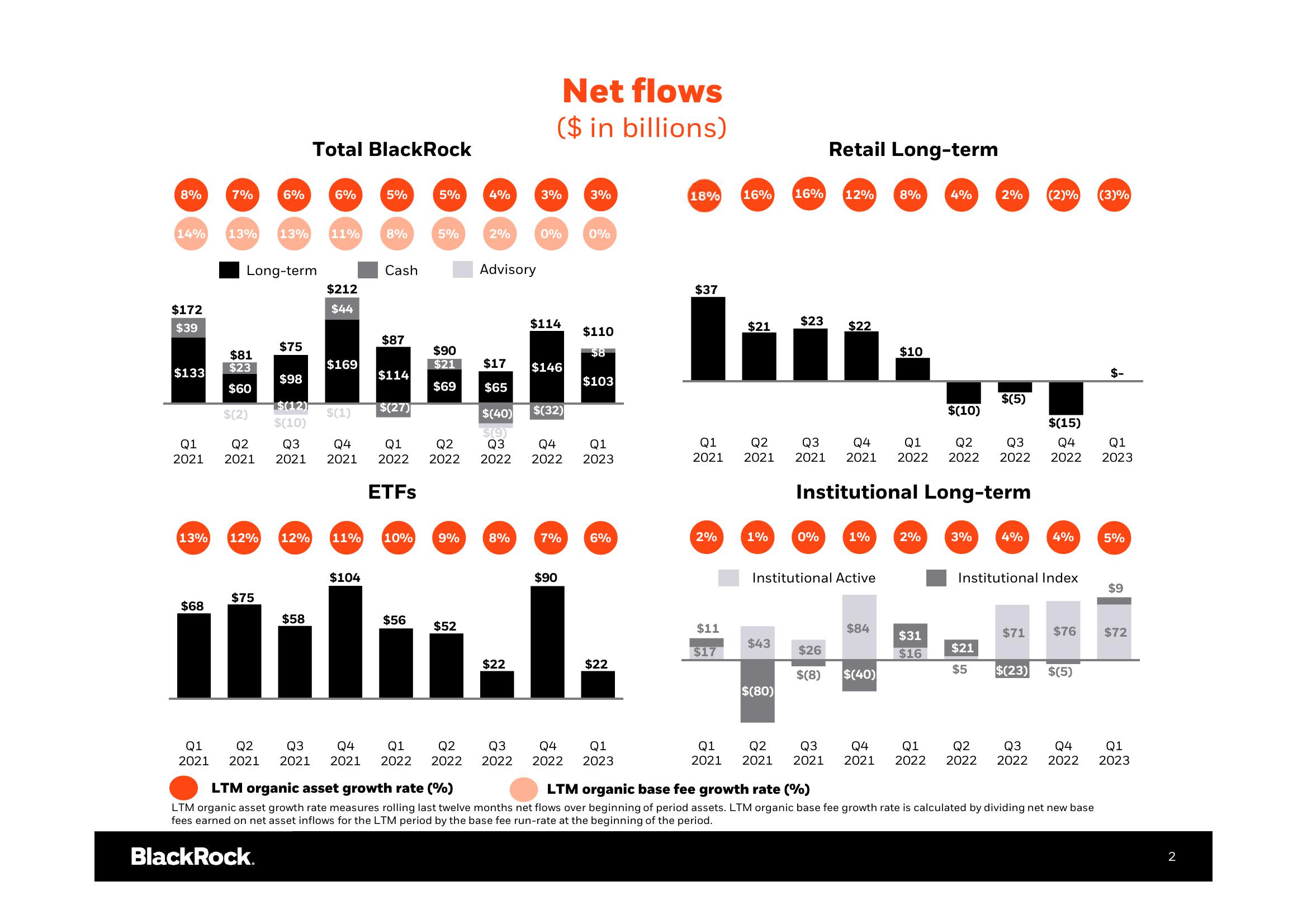

Total BlackRock

$58

6%

11%

$212

$44

$169

$(1)

Q4

2021

12% 11%

$104

5%

8%

Cash

$87

$114

$(27)

10%

5%

$56

5%

9%

$52

4%

$90

$21 $17 $146

$69

$65

$(40)

$(9)

Q1

Q3

Q2

2022 2022 2022

ETFs

Q1

Q1 Q2 Q3 Q4

Q2

2021 2021 2021 2021 2022 2022

2%

Advisory

8%

$22

Net flows

($ in billions)

Q3

2022

3%

0%

$114

$(32)

Q4

2022

7%

$90

3%

0%

$110

$8

$103

Q1

2023

6%

$22

Q4 Q1

2022 2023

18%

$37

Q1

2021

2%

$11

$17

16% 16%

$21

Q2

2021

1%

$43

$23

$(80)

0%

Retail Long-term

12%

$26

$(8)

$22

Institutional Active

1%

$84

8%

$(10)

$(15)

Q3 Q4 Q1 Q2 Q3 Q4

2021 2021 2022 2022 2022 2022

Institutional Long-term

$(40)

$10

2%

4%

$31

$16

3%

2%

$(5)

$21

$5

(2)% (3)%

4%

4%

Institutional Index

$71 $76

$(23) $(5)

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2021 2021 2021 2021 2022 2022 2022 2022

LTM organic base fee growth rate (%)

LTM organic asset growth rate (%)

LTM organic asset growth rate measures rolling last twelve months net flows over beginning of period assets. LTM organic base fee growth rate is calculated by dividing net new base

fees earned on net asset inflows for the LTM period by the base fee run-rate at the beginning of the period.

BlackRock.

$-

Q1

2023

5%

$9

$72

Q1

2023

2View entire presentation