CorpAcq SPAC Presentation Deck

6

CorpAcq to Go Public in Partnership With

Churchill Capital VII

1

2

3

4

5

6

7

CHURCHILL

CAPITAL VII CorpAcq

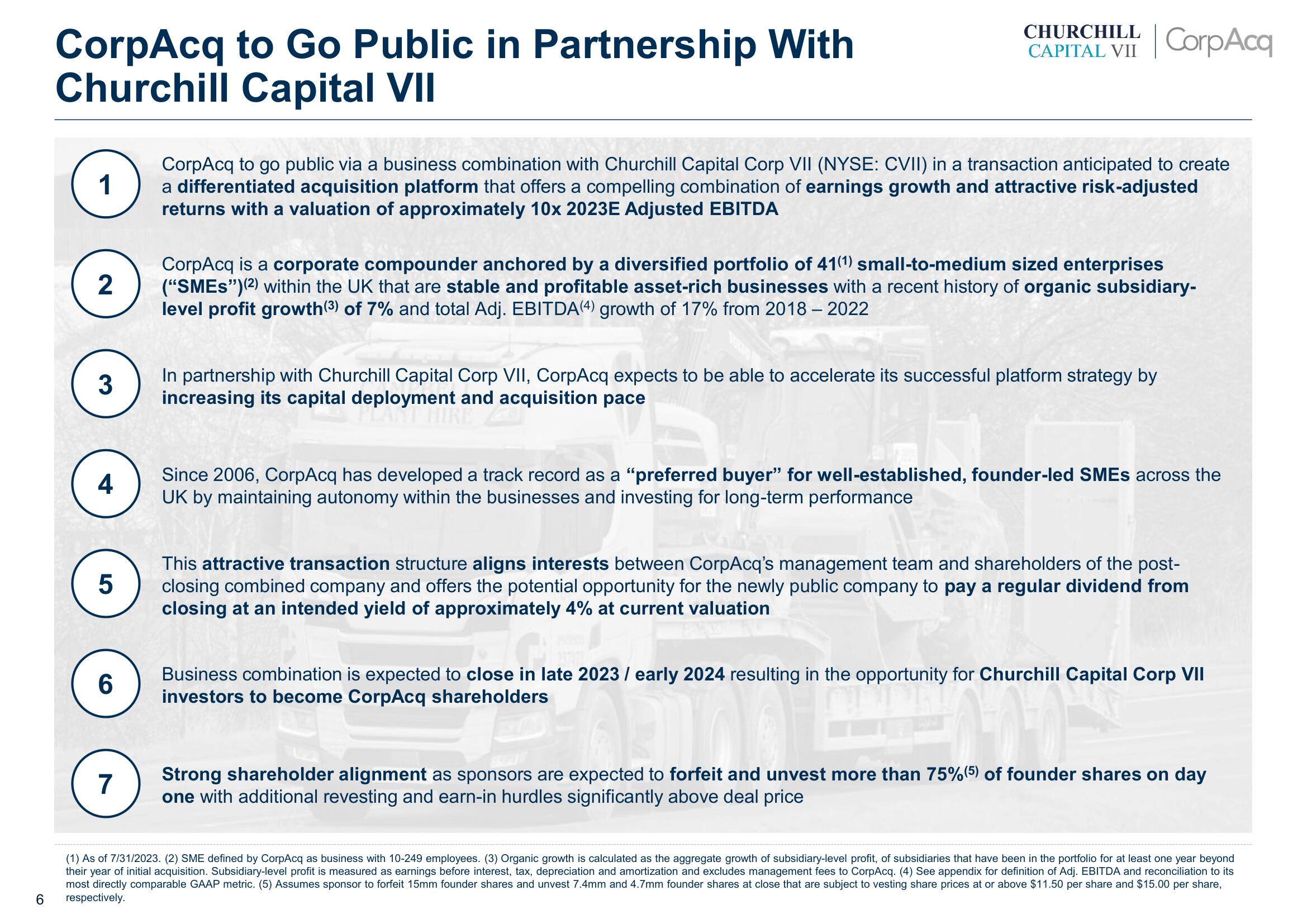

CorpAcq to go public via a business combination with Churchill Capital Corp VII (NYSE: CVII) in a transaction anticipated to create

a differentiated acquisition platform that offers a compelling combination of earnings growth and attractive risk-adjusted

returns with a valuation of approximately 10x 2023E Adjusted EBITDA

CorpAcq is a corporate compounder anchored by a diversified portfolio of 41(1) small-to-medium sized enterprises

("SMES") (2) within the UK that are stable and profitable asset-rich businesses with a recent history of organic subsidiary-

level profit growth (3) of 7% and total Adj. EBITDA (4) growth of 17% from 2018 - 2022

25

In partnership with Churchill Capital Corp VII, CorpAcq expects to be able to accelerate its successful platform strategy by

increasing its capital deployment and acquisition pace

Since 2006, CorpAcq has developed a track record as a "preferred buyer" for well-established, founder-led SMEs across the

UK by maintaining autonomy within the businesses and investing for long-term performance

This attractive transaction structure aligns interests between CorpAcq's management team and shareholders of the post-

closing combined company and offers the potential opportunity for the newly public company to pay a regular dividend from

closing at an intended yield of approximately 4% at current valuation

Business combination is expected to close in late 2023 / early 2024 resulting in the opportunity for Churchill Capital Corp VII

investors to become CorpAcq shareholders

Strong shareholder alignment as sponsors are expected to forfeit and unvest more than 75%(5) of founder shares on day

one with additional revesting and earn-in hurdles significantly above deal price

(1) As of 7/31/2023. (2) SME defined by CorpAcq as business with 10-249 employees. (3) Organic growth is calculated as the aggregate growth of subsidiary-level profit, of subsidiaries that have been in the portfolio for at least one year beyond

their year of initial acquisition. Subsidiary-level profit is measured as earnings before interest, tax, depreciation and amortization and excludes management fees to CorpAcq. (4) See appendix for definition of Adj. EBITDA and reconciliation to its

most directly comparable GAAP metric. (5) Assumes sponsor to forfeit 15mm founder shares and unvest 7.4mm and 4.7mm founder shares at close that are subject to vesting share prices at or above $11.50 per share and $15.00 per share,

respectively.View entire presentation