Credit Suisse Results Presentation Deck

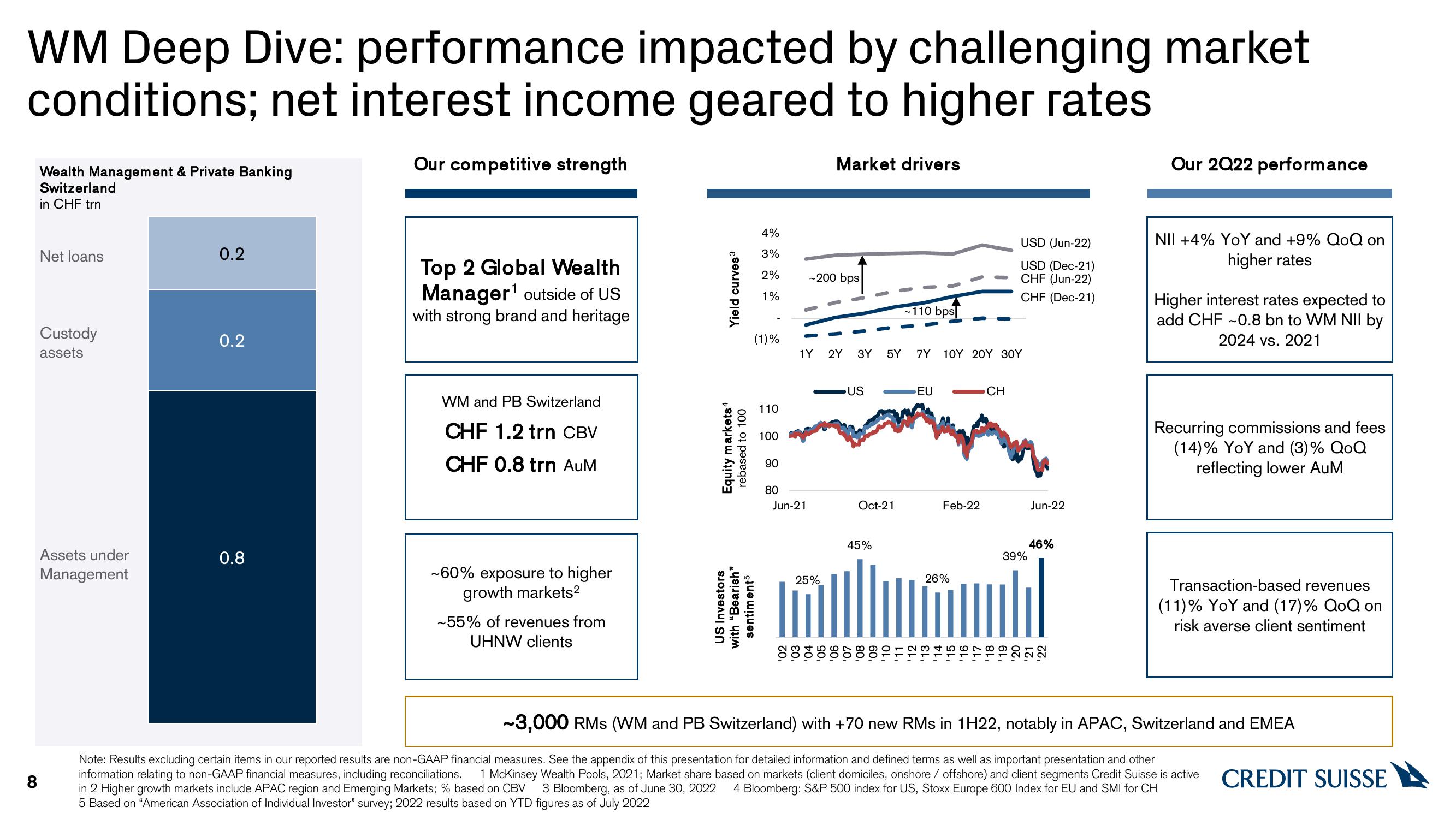

WM Deep Dive: performance impacted by challenging market

conditions; net interest income geared to higher rates

Our competitive strength

Wealth Management & Private Banking

Switzerland

in CHF trn

8

Net loans

Custody

assets

Assets under

Management

0.2

0.2

0.8

Top 2 Global Wealth

Manager¹ outside of US

with strong brand and heritage

WM and PB Switzerland

CHF 1.2 trn CBV

CHF 0.8 trn AuM

-60% exposure to higher

growth markets²

~55% of revenues from

UHNW clients

Yield curves³

Equity markets 4

rebased to 100

4%

3%

2%

1%

(1)%

US Investors

with "Bearish"

sentiment5

110

100

90

80

Jun-21

Market drivers

~200 bps

25%

1Y 2Y 3Y 5Y 7Y 1ΟΥ 2ΟΥ 3ΟΥ

US

Oct-21

-110 bps

45%

EU

Feb-22

26%

USD (Jun-22)

USD (Dec-21)

CHF (Jun-22)

CHF (Dec-21)

CH

39%

Jun-22

46%

2222

Our 2022 performance

NII +4% YoY and +9% QoQ on

higher rates

Higher interest rates expected to

add CHF ~0.8 bn to WM NII by

2024 vs. 2021

Recurring commissions and fees

(14)% YoY and (3)% QoQ

reflecting lower AuM

Transaction-based revenues

(11) % YoY and (17)% QoQ on

risk averse client sentiment

~3,000 RMS (WM and PB Switzerland) with +70 new RMs in 1H22, notably in APAC, Switzerland and EMEA

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important presentation and other

information relating to non-GAAP financial measures, including reconciliations. 1 McKinsey Wealth Pools, 2021; Market share based on markets (client domiciles, onshore / offshore) and client segments Credit Suisse is active

in 2 Higher growth markets include APAC region and Emerging Markets; % based on CBV 3 Bloomberg, as of June 30, 2022 4 Bloomberg: S&P 500 index for US, Stoxx Europe 600 Index for EU and SMI for CH

5 Based on "American Association of Individual Investor" survey; 2022 results based on YTD figures as of July 2022

CREDIT SUISSEView entire presentation