Bank of America Investment Banking Pitch Book

Introduction

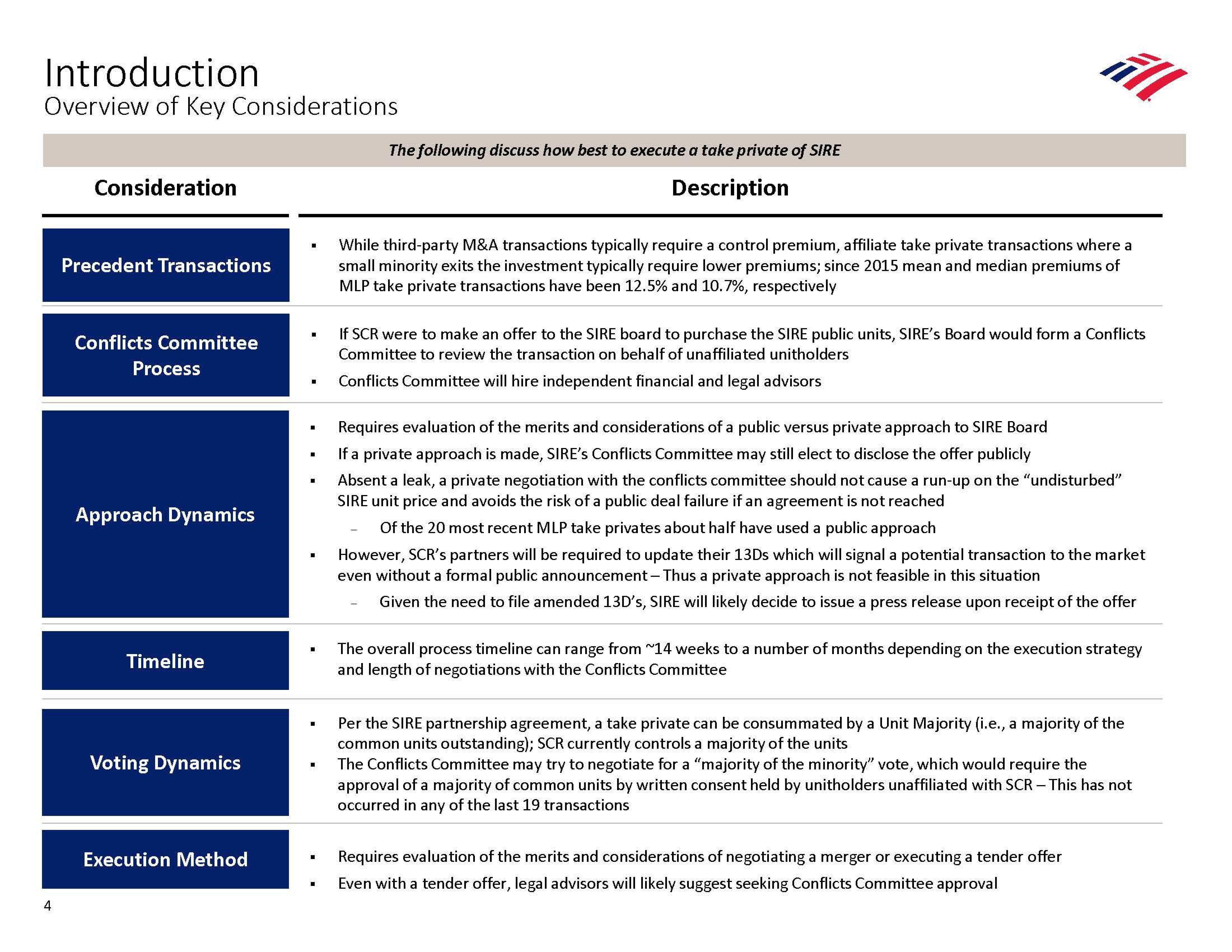

Overview of Key Considerations

4

Consideration

Precedent Transactions

Conflicts Committee

Process

Approach Dynamics

Timeline

Voting Dynamics

Execution Method

■

■

■

■

■

■

■

I

■

The following discuss how best to execute a take private of SIRE

Description

While third-party M&A transactions typically require a control premium, affiliate take private transactions where a

small minority exits the investment typically require lower premiums; since 2015 mean and median premiums of

MLP take private transactions hav been 12.5% and 10.7%, respectively

If SCR were to make an offer to the SIRE board to purchase the SIRE public units, SIRE's Board would form a Conflicts

Committee to review the transaction on behalf of unaffiliated unitholders

Conflicts Committee will hire independent financial and legal advisors

Requires evaluation of the merits and considerations of a public versus private approach to SIRE Board

If a private approach is made, SIRE's Conflicts Committee may still elect to disclose the offer publicly

Absent a leak, a private negotiation with the conflicts committee should not cause a run-up on the "undisturbed"

SIRE unit price and avoids the risk of a public deal failure if an agreement is not reached

Of the 20 most recent MLP take privates about half have used a public approach

However, SCR's partners will be required to update their 13Ds which will signal a potential transaction to the market

even without a formal public announcement - Thus a private approach is not feasible in this situation

Given the need to file amended 13D's, SIRE will likely decide to issue a press release upon receipt of the offer

The overall process timeline can range from ~14 weeks to a number of months depending on the execution strategy

and length of negotiations with the Conflicts Committee

Per the SIRE partnership agreement, a take private can be consummated by a Unit Majority (i.e., a majority of the

common units outstanding); SCR currently controls a majority of the units

The Conflicts Committee may try to negotiate for a "majority of the minority" vote, which would require the

approval of a majority of common units by written consent held by unitholders unaffiliated with SCR - This has not

occurred in any of the last 19 transactions

Requires evaluation of the merits and considerations of negotiating a merger or executing a tender offer

Even with a tender offer, legal advisors will likely suggest seeking Conflicts Committee approvalView entire presentation