Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

Income

£21.9bn

FY20: £21.8bn

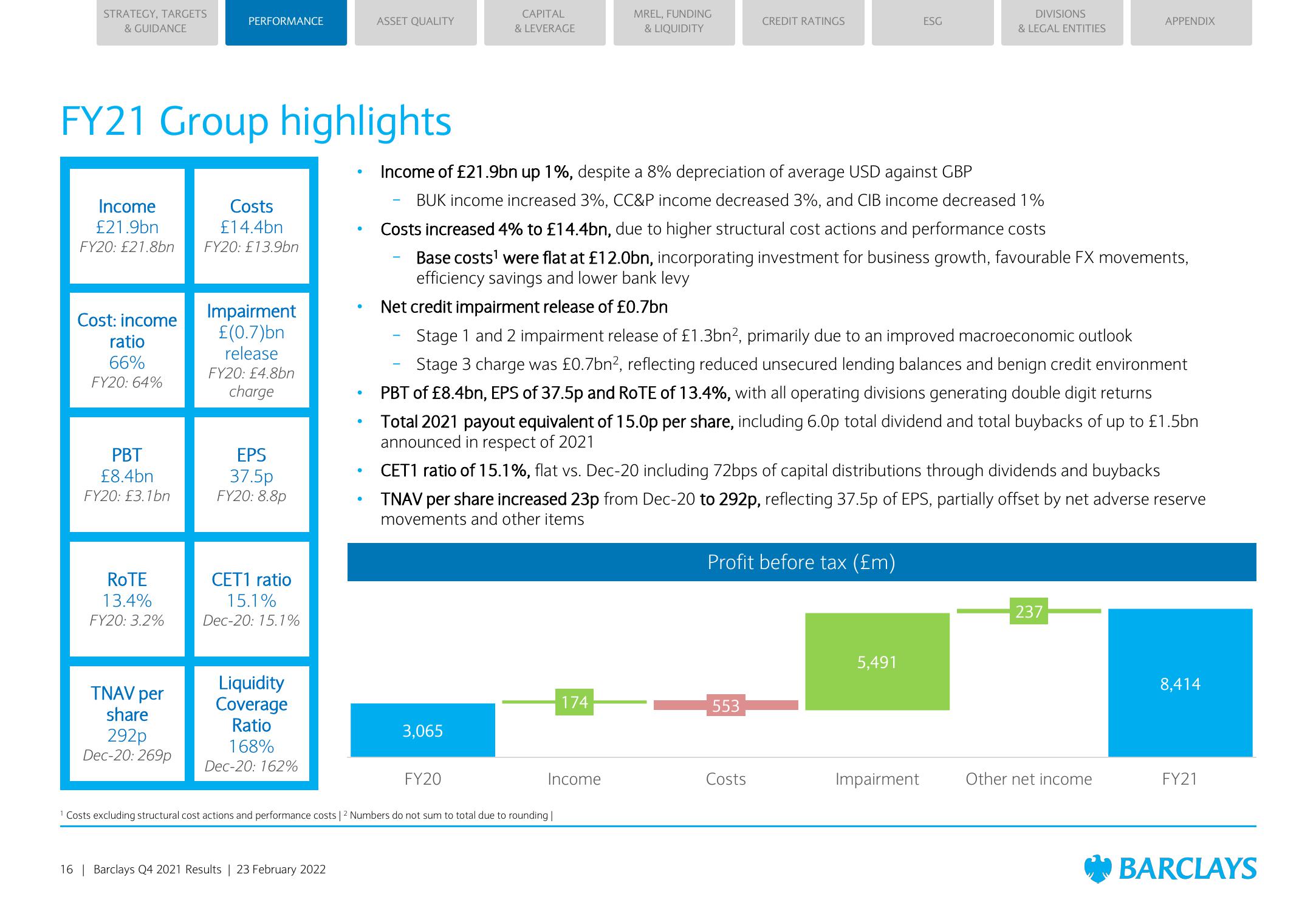

FY21 Group highlights

Cost: income

ratio

66%

FY20: 64%

PBT

£8.4bn

FY20: £3.1bn

ROTE

13.4%

FY20: 3.2%

PERFORMANCE

TNAV per

share

292p

Dec-20:269p

Costs

£14.4bn

FY20: £13.9bn

Impairment

£(0.7)bn

release

FY20: £4.8bn

charge

EPS

37.5p

FY20: 8.8p

CET1 ratio

15.1%

Dec-20: 15.1%

Liquidity

Coverage

Ratio

168%

Dec-20: 162%

●

16 | Barclays Q4 2021 Results | 23 February 2022

●

●

●

●

ASSET QUALITY

●

CAPITAL

& LEVERAGE

3,065

Income of £21.9bn up 1%, despite a 8% depreciation of average USD against GBP

BUK income increased 3%, CC&P income decreased 3%, and CIB income decreased 1%

FY20

MREL, FUNDING

& LIQUIDITY

Costs increased 4% to £14.4bn, due to higher structural cost actions and performance costs

Base costs¹ were flat at £12.0bn, incorporating investment for business growth, favourable FX movements,

efficiency savings and lower bank levy

¹ Costs excluding structural cost actions and performance costs | ² Numbers do not sum to total due to rounding |

Net credit impairment release of £0.7bn

Stage 1 and 2 impairment release of £1.3bn², primarily due to an improved macroeconomic outlook

Stage 3 charge was £0.7bn², reflecting reduced unsecured lending balances and benign credit environment

PBT of £8.4bn, EPS of 37.5p and ROTE of 13.4%, with all operating divisions generating double digit returns

Total 2021 payout equivalent of 15.0p per share, including 6.0p total dividend and total buybacks of up to £1.5bn

announced in respect of 2021

174

Income

CREDIT RATINGS

CET1 ratio of 15.1%, flat vs. Dec-20 including 72bps of capital distributions through dividends and buybacks

TNAV per share increased 23p from Dec-20 to 292p, reflecting 37.5p of EPS, partially offset by net adverse reserve

movements and other items

Profit before tax (£m)

553

ESG

Costs

DIVISIONS

& LEGAL ENTITIES

5,491

Impairment

APPENDIX

237

Other net income

8,414

FY21

BARCLAYSView entire presentation