Consistent Progress Investor Presentation

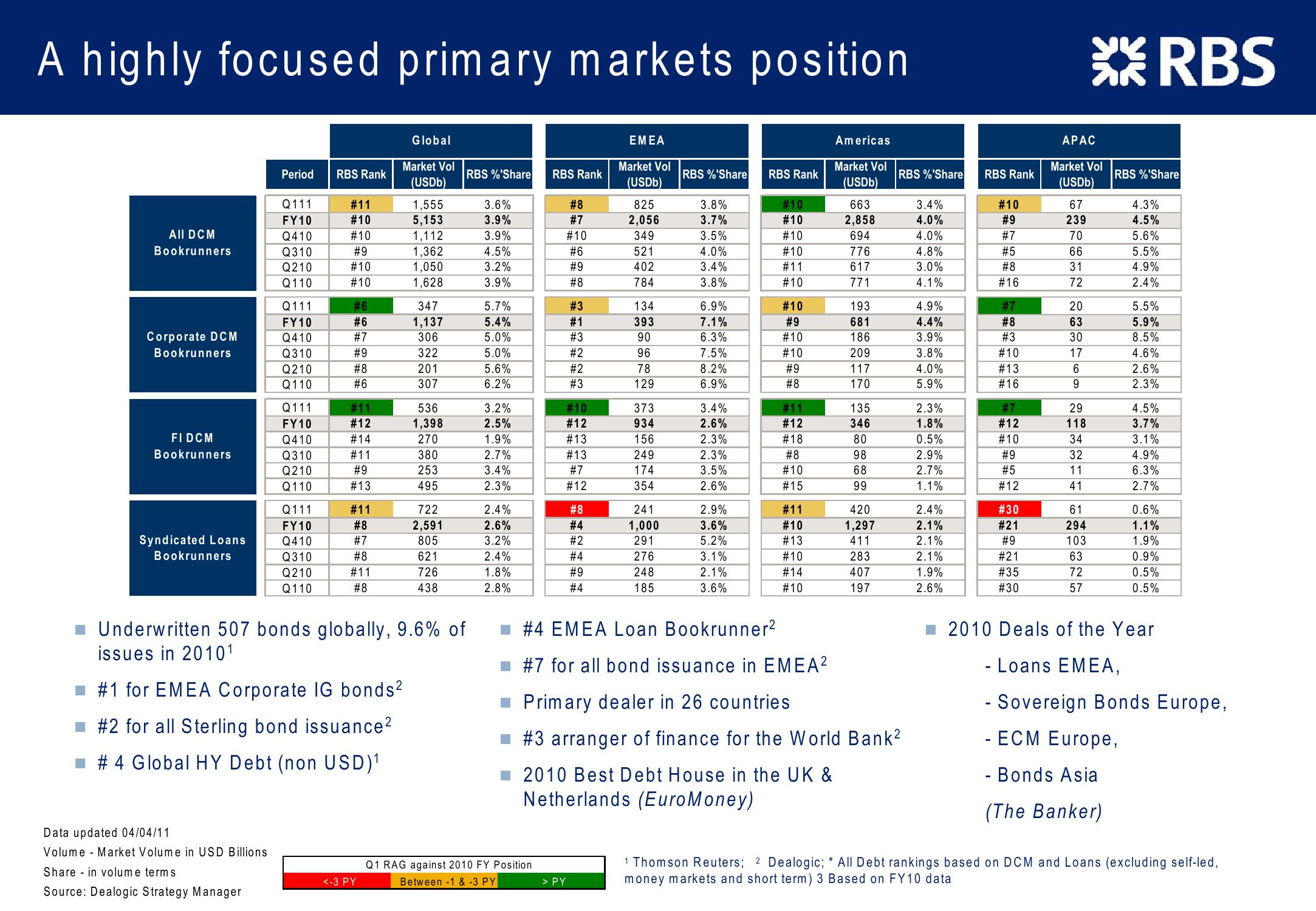

A highly focused primary markets position

RBS

Global

EMEA

Americas

APAC

Market Vol

Market Vol

Market Vol

Market Vol

Period

RBS Rank

RBS %'Share RBS Rank

RBS %'Share RBS Rank

RBS %'Share

RBS Rank

RBS %'Share

(USDb)

(USDb)

(USDb)

(USDb)

Q111

#11

1,555

3.6%

#8

825

3.8%

#10

663

3.4%

#10

67

4.3%

FY10

#10

5,153

3.9%

#7

2,056

3.7%

#10

2,858

4.0%

#9

239

4.5%

All DCM

Q410

#10

1,112

3.9%

#10

349

3.5%

#10

694

4.0%

#7

70

5.6%

Bookrunners

Q310

#9

1,362

4.5%

#6

521

4.0%

#10

776

4.8%

#5

66

5.5%

Q210

#10

1,050

3.2%

#9

402

3.4%

#11

617

3.0%

#8

31

4.9%

Q110

#10

1,628

3.9%

#8

784

3.8%

#10

771

4.1%

#16

72

2.4%

Q111

#6

347

5.7%

#3

134

6.9%

#10

193

4.9%

#7

20

5.5%

FY10

#6

1,137

5.4%

#1

393

7.1%

#9

681

4.4%

#8

63

5.9%

Corporate DCM

Q410

#7

306

5.0%

#3

90

6.3%

#10

186

3.9%

#3

30

8.5%

Bookrunners

Q310

#9

322

5.0%

#2

96

7.5%

#10

209

3.8%

#10

17

4.6%

Q210

#8

201

5.6%

#2

78

8.2%

#9

117

4.0%

#13

6

2.6%

Q110

#6

307

6.2%

#3

129

6.9%

#8

170

5.9%

#16

9

2.3%

Q111

#11

536

3.2%

#10

373

3.4%

#11

135

2.3%

#7

29

4.5%

FY10

#12

1,398

2.5%

#12

934

2.6%

#12

346

1.8%

#12

118

3.7%

FI DCM

Q410

#14

270

1.9%

#13

156

2.3%

#18

80

0.5%

#10

34

3.1%

Bookrunners

Q310

#11

380

2.7%

#13

249

2.3%

#8

98

2.9%

#9

32

4.9%

Q210

#9

253

3.4%

#7

174

3.5%

#10

68

2.7%

#5

11

6.3%

Q110

#13

495

2.3%

#12

354

2.6%

#15

99

1.1%

#12

41

2.7%

Q111

#11

722

2.4%

#8

241

2.9%

#11

420

2.4%

#30

61

0.6%

FY10

#8

2,591

2.6%

#4

1,000

3.6%

#10

1,297

2.1%

#21

294

1.1%

Syndicated Loans

Q410

#7

805

3.2%

#2

291

5.2%

#13

411

2.1%

#9

103

1.9%

Bookrunners

Q310

#8

621

2.4%

#4

276

3.1%

#10

283

2.1%

#21

63

0.9%

Q210

#11

726

1.8%

#9

248

2.1%

#14

407

1.9%

#35

72

0.5%

Q110

#8

438

2.8%

#4

185

3.6%

#10

197

2.6%

#30

57

0.5%

Underwritten 507 bonds globally, 9.6% of

issues in 20101

#1 for EMEA Corporate IG bonds²

#2 for all Sterling bond issuance²

# 4 Global HY Debt (non USD)1

Data updated 04/04/11

Volume

Share in volume terms

■ #4 EMEA Loan Bookrunner²

#7 for all bond issuance in EMEA²

Primary dealer in 26 countries

#3 arranger of finance for the World Bank2

2010 Best Debt House in the UK &

Netherlands (EuroMoney)

Market Volume in USD Billions

<-3 PY

Q1 RAG against 2010 FY Position

Between -1 & -3 PY

> PY

Source: Dealogic Strategy Manager

2010 Deals of the Year

- Loans EMEA,

- Sovereign Bonds Europe,

- ECM Europe,

- Bonds Asia

(The Banker)

1 Thomson Reuters; 2 Dealogic; * All Debt rankings based on DCM and Loans (excluding self-led,

money markets and short term) 3 Based on FY10 datalView entire presentation