Olaplex Investor Presentation Deck

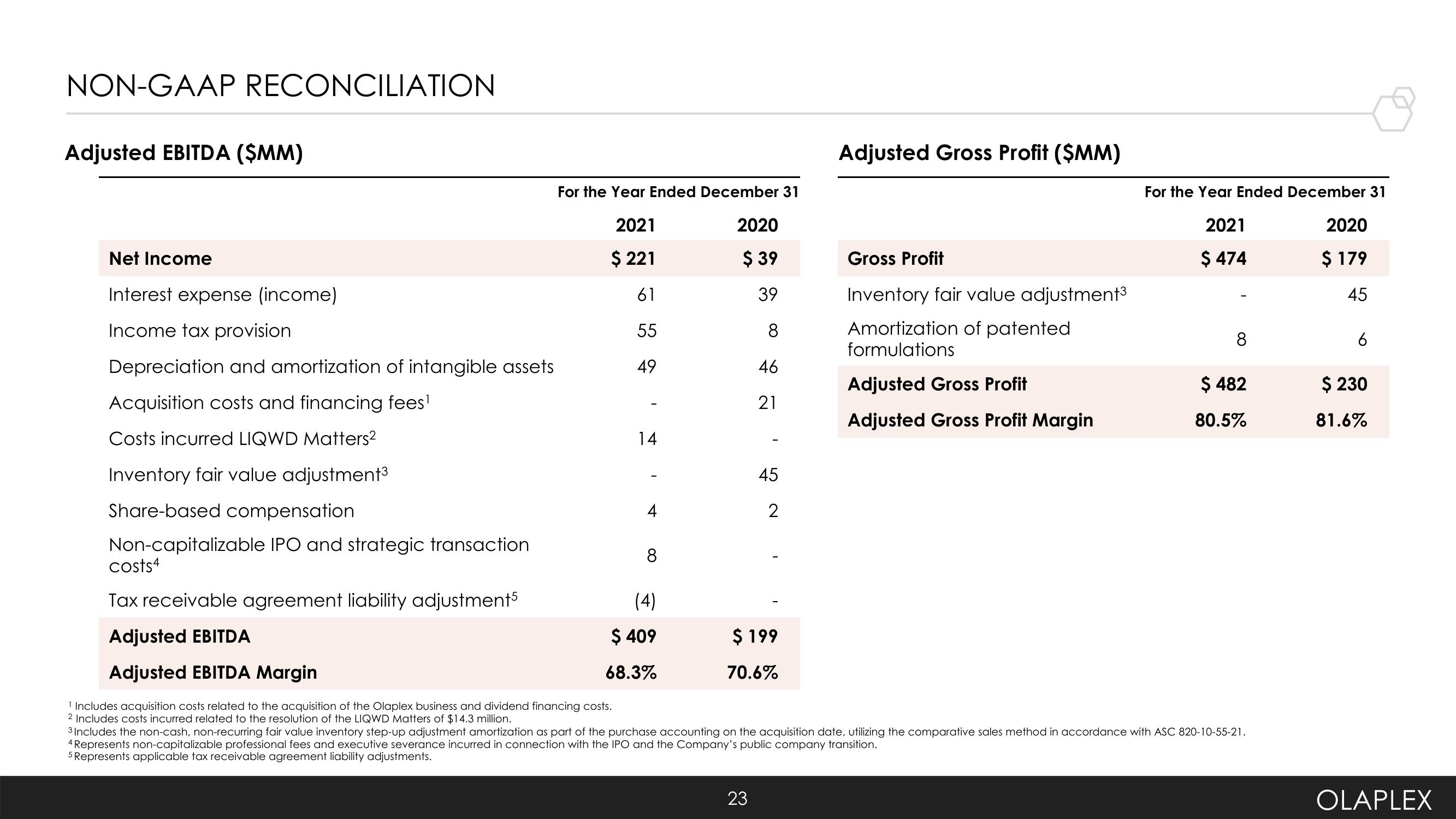

NON-GAAP RECONCILIATION

Adjusted EBITDA ($MM)

Net Income

Interest expense (income)

Income tax provision

Depreciation and amortization of intangible assets

Acquisition costs and financing fees¹

Costs incurred LIQWD Matters²

Inventory fair value adjustment³

Share-based compensation

Non-capitalizable IPO and strategic transaction

costs4

Tax receivable agreement liability adjustment5

For the Year Ended December 31

2021

$ 221

61

55

49

14

Adjusted EBITDA

Adjusted EBITDA Margin

1 Includes acquisition costs related to the acquisition of the Olaplex business and dividend financing costs.

2 Includes costs incurred related to the resolution of the LIQWD Matters of $14.3 million.

4

8

(4)

$ 409

68.3%

2020

$ 39

39

8

46

21

45

2

$ 199

70.6%

23

Adjusted Gross Profit ($MM)

Gross Profit

Inventory fair value adjustment³

Amortization of patented

formulations

Adjusted Gross Profit

Adjusted Gross Profit Margin

For the Year Ended December 31

2021

$ 474

8

$ 482

80.5%

3 Includes the non-cash, non-recurring fair value inventory step-up adjustment amortization as part of the purchase accounting on the acquisition date, utilizing the comparative sales method in accordance with ASC 820-10-55-21.

4 Represents non-capitalizable professional fees and executive severance incurred in connection with the IPO and the Company's public company transition.

5 Represents applicable tax receivable agreement liability adjustments.

2020

$ 179

45

6

$ 230

81.6%

OLAPLEXView entire presentation