Thomson Reuters Mergers and Acquisitions Presentation Deck

7

●

-

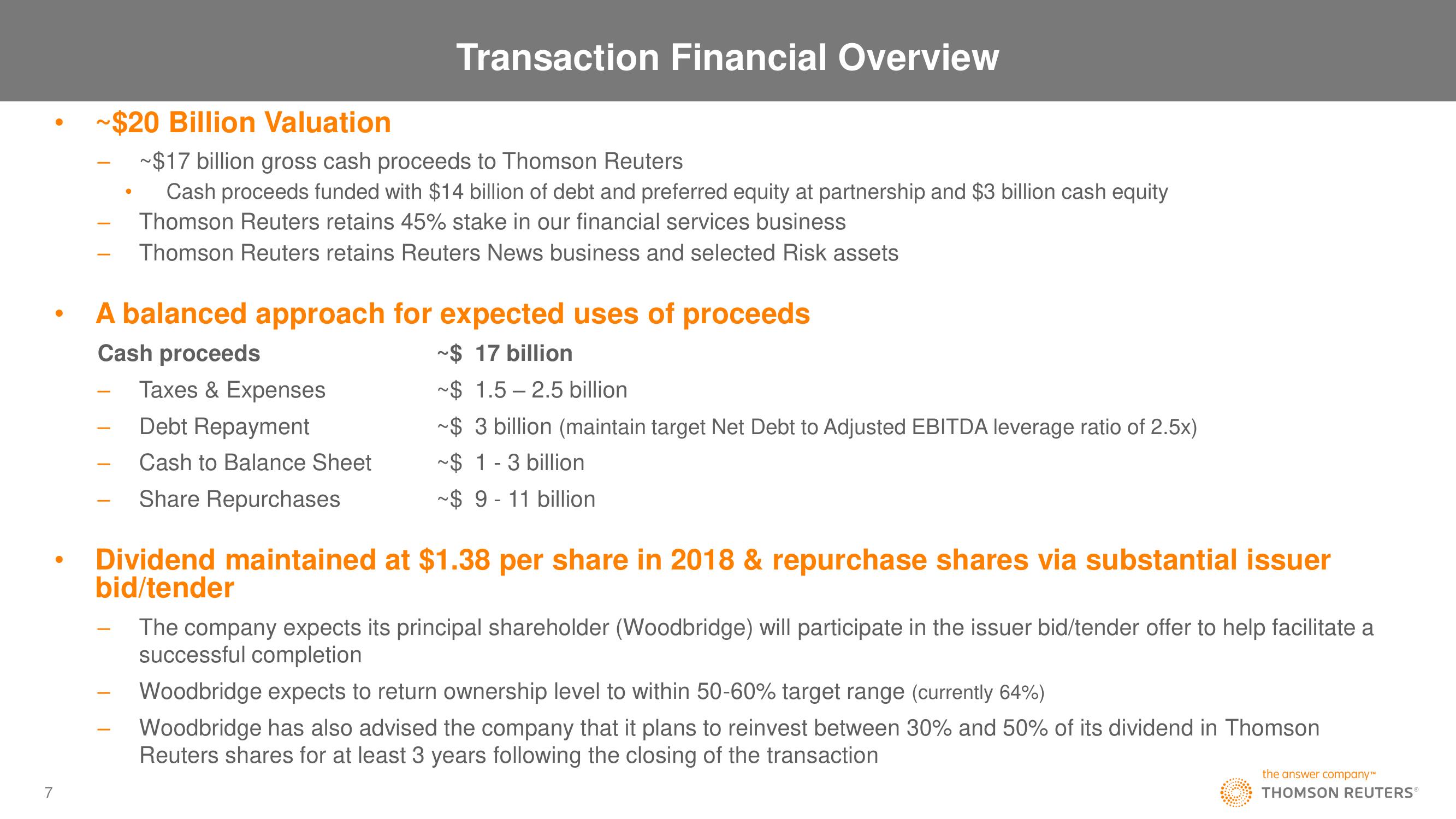

A balanced approach for expected uses of proceeds

Cash proceeds

~$ 17 billion

~$ 1.5-2.5 billion

Taxes & Expenses

Debt Repayment

Cash to Balance Sheet

~$ 3 billion (maintain target Net Debt to Adjusted EBITDA leverage ratio of 2.5x)

~$ 1-3 billion

Share Repurchases

~$ 9-11 billion

-

Transaction Financial Overview

$20 Billion Valuation

~$17 billion gross cash proceeds to Thomson Reuters

Cash proceeds funded with $14 billion of debt and preferred equity at partnership and $3 billion cash equity

Thomson Reuters retains 45% stake in our financial services business

Thomson Reuters retains Reuters News business and selected Risk assets

-

Dividend maintained at $1.38 per share in 2018 & repurchase shares via substantial issuer

bid/tender

The company expects its principal shareholder (Woodbridge) will participate in the issuer bid/tender offer to help facilitate a

successful completion

Woodbridge expects to return ownership level to within 50-60% target range (currently 64%)

Woodbridge has also advised the company that it plans to reinvest between 30% and 50% of its dividend in Thomson

Reuters shares for at least 3 years following the closing of the transaction

the answer company™

THOMSON REUTERS®View entire presentation