Commercial Metals Company Results Presentation Deck

Attractive Market Environment in North America

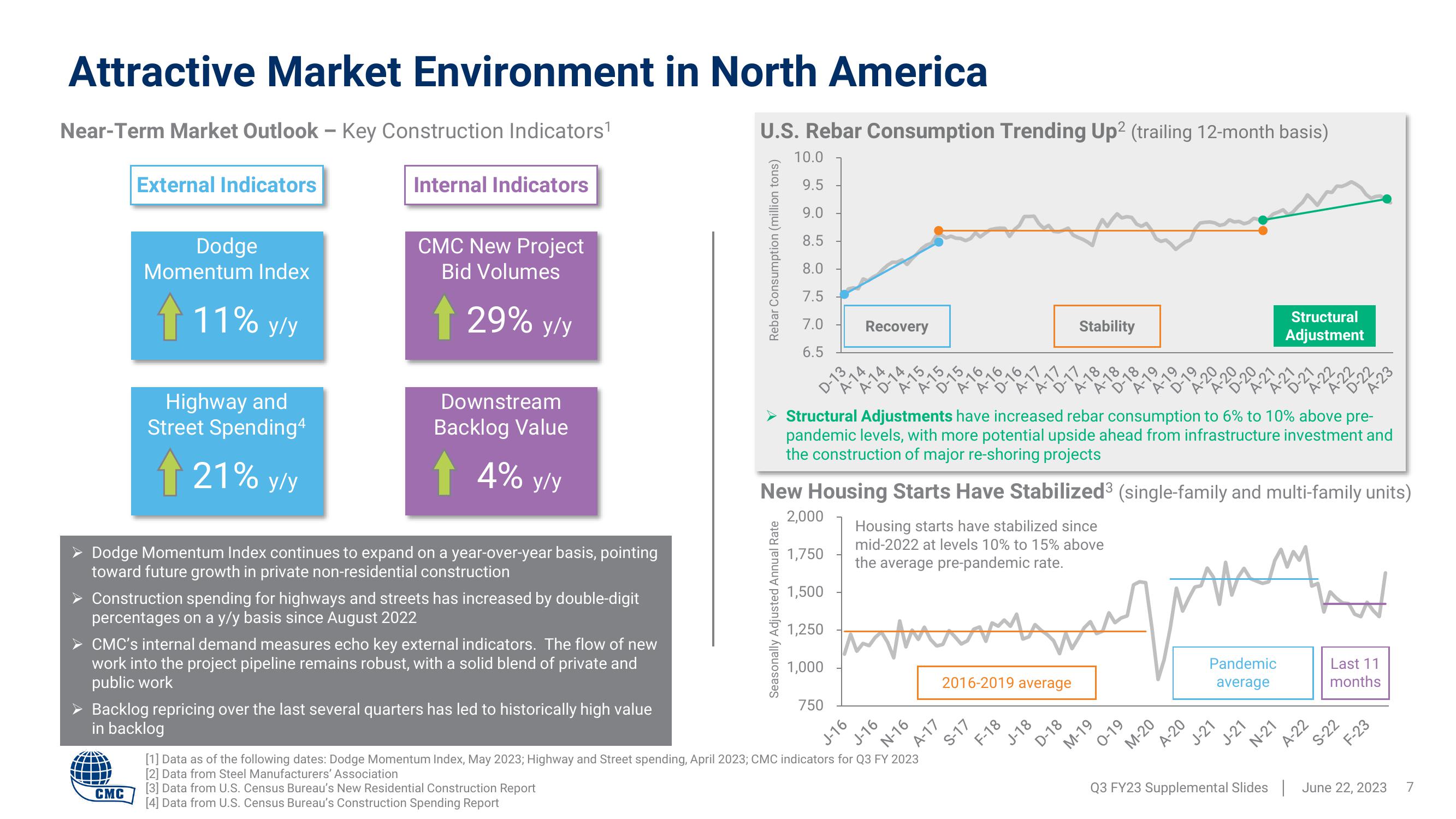

Near-Term Market Outlook - Key Construction Indicators¹

Internal Indicators

External Indicators

Dodge

Momentum Index

11% y/y

Highway and

Street Spending4

21% y/y

CMC New Project

Bid Volumes

↑ 29% y/y

CMC

Downstream

Backlog Value

4% y/y

Dodge Momentum Index continues to expand on a year-over-year basis, pointing

toward future growth in private non-residential construction

Construction spending for highways and streets has increased by double-digit

percentages on a y/y basis since August 2022

CMC's internal demand measures echo key external indicators. The flow of new

work into the project pipeline remains robust, with a solid blend of private and

public work

Backlog repricing over the last several quarters has led to historically high value

in backlog

U.S. Rebar Consumption Trending Up² (trailing 12-month basis)

10.0

9.5

9.0

8.5

8.0

7.5

7.0

6.5

Rebar Consumption (million tons)

Seasonally Adjusted Annual Rate

1,750

1,500

1,250

D-13

Structural Adjustments have increased rebar consumption to 6% to 10% above pre-

pandemic levels, with more potential upside ahead from infrastructure investment and

the construction of major re-shoring projects

New Housing Starts Have Stabilized³ (single-family and multi-family units)

2,000

Housing starts have stabilized since

mid-2022 at levels 10% to 15% above

the average pre-pandemic rate.

1,000

750

Recovery

J-16

J-16

N-16

[1] Data as of the following dates: Dodge Momentum Index, May 2023; Highway and Street spending, April 2023; CMC indicators for Q3 FY 2023

[2] Data from Steel Manufacturers' Association

[3] Data from U.S. Census Bureau's New Residential Construction Report

[4] Data from U.S. Census Bureau's Construction Spending Report

2016-2019 average

A-17

S-17

F-18

Stability

J-18

D-18

M-19

0-19

M-20

A-20

Pandemic

average

J-21

Structural

Adjustment

N-21

J-21

Last 11

months

A-22

A-23

S-22

F-23

Q3 FY23 Supplemental Slides | June 22, 2023

7View entire presentation