Apollo Global Management Mergers and Acquisitions Presentation Deck

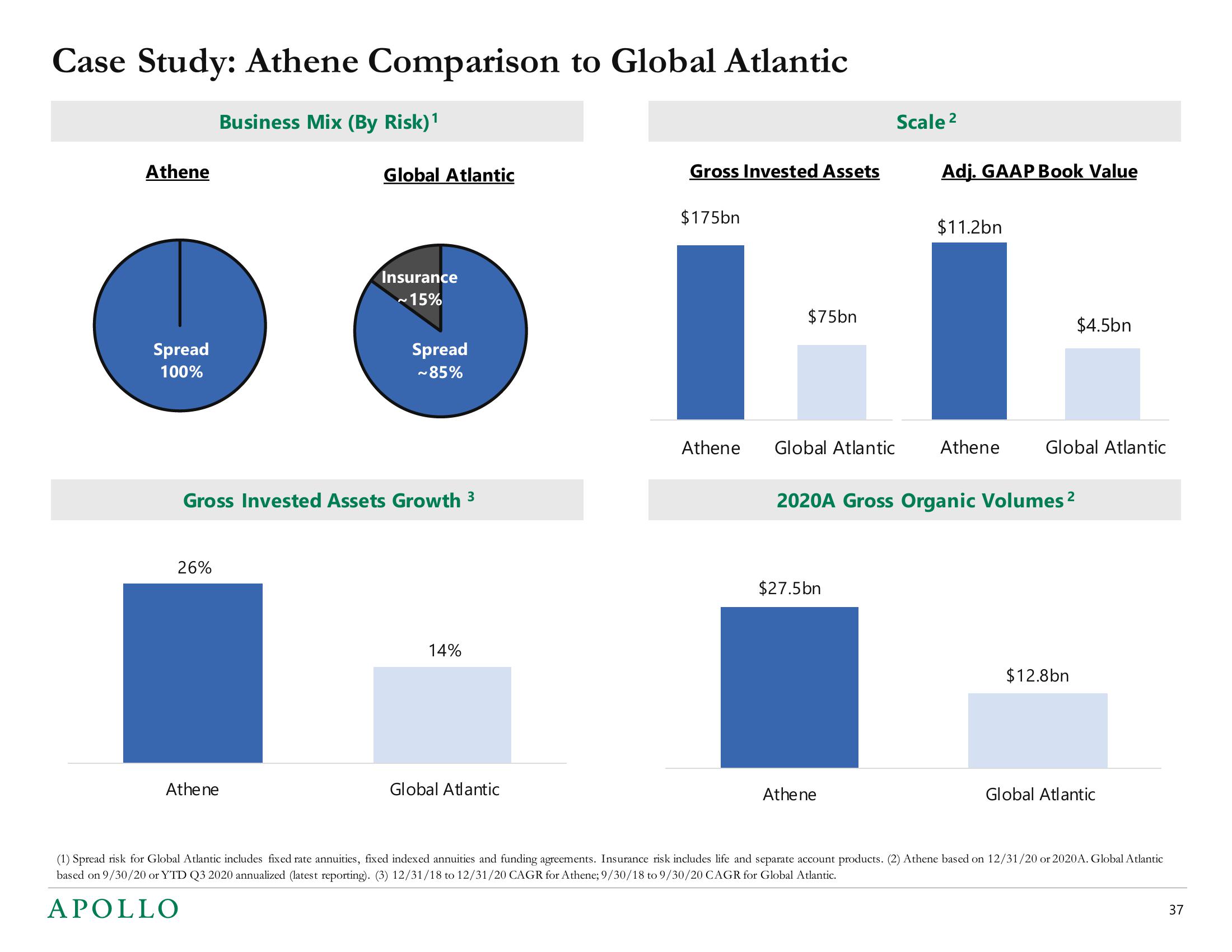

Case Study: Athene Comparison to Global Atlantic

Business Mix (By Risk) ¹

Athene

Spread

100%

26%

Global Atlantic

Athene

Insurance

~15%

Gross Invested Assets Growth 3

Spread

~85%

14%

Global Atlantic

Gross Invested Assets

$175bn

$75bn

Athene Global Atlantic

$27.5bn

Scale ²

Athene

Adj. GAAP Book Value

$11.2bn

Athene

2020A Gross Organic Volumes ²

Global Atlantic

$4.5bn

$12.8bn

Global Atlantic

(1) Spread risk for Global Atlantic includes fixed rate annuities, fixed indexed annuities and funding agreements. Insurance risk includes life and separate account products. (2) Athene based on 12/31/20 or 2020A. Global Atlantic

based on 9/30/20 or YTD Q3 2020 annualized (latest reporting). (3) 12/31/18 to 12/31/20 CAGR for Athene; 9/30/18 to 9/30/20 CAGR for Global Atlantic.

APOLLO

37View entire presentation