Morgan Stanley Investment Banking Pitch Book

Project Roosevelt

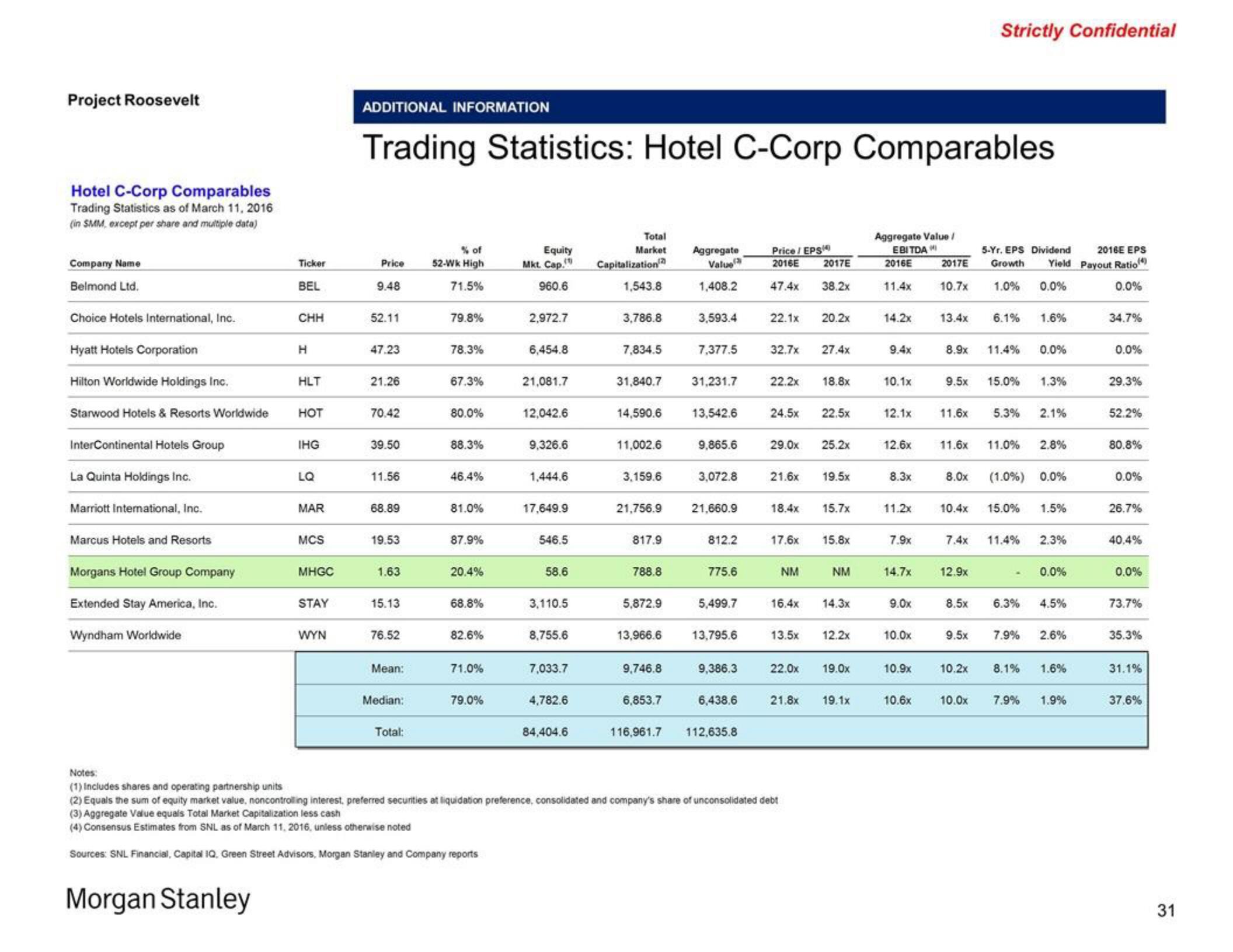

Hotel C-Corp Comparables

Trading Statistics as of March 11, 2016

(in SMM, except per share and multiple data)

Company Name

Belmond Ltd.

Choice Hotels International, Inc.

Hyatt Hotels Corporation

Hilton Worldwide Holdings Inc.

Starwood Hotels & Resorts Worldwide

InterContinental Hotels Group

La Quinta Holdings Inc.

Marriott International, Inc.

Marcus Hotels and Resorts

Morgans Hotel Group Company

Extended Stay America, Inc.

Wyndham Worldwide

Ticker

BEL

Morgan Stanley

CHH

H

HLT

HOT

IHG

LQ

MAR

MCS

MHGC

STAY

WYN

ADDITIONAL INFORMATION

Trading Statistics: Hotel C-Corp Comparables

Price

9.48

52.11

47.23

21.26

70.42

39.50

11.56

68.89

19.53

1.63

15.13

76.52

Mean:

Median:

Total:

% of

52-Wk High

71.5%

79.8%

78.3%

67.3%

80.0%

88.3%

46.4%

81.0%

87.9%

20.4%

68.8%

82.6%

71.0%

79.0%

Equity

Mkt. Cap.

960.6

2,972.7

6,454.8

21,081.7

12,042.6

9,326.6

1,444.6

17,649.9

546.5

58.6

3,110.5

8,755.6

7,033.7

4,782.6

84,404.6

Total

Market

Capitalization

1,543.8

3,786.8

7,834.5

31,840.7

11,002.6

3,159.6

21,756.9

14,590.6 13,542.6

817.9

788.8

5,872.9

13,966.6

9,746.8

Aggregate

Value

1,408.2

6,853.7

3,593.4

7,377.5

31,231.7

9,865.6

3,072.8

21,660.9

812.2

775.6

5,499.7

13,795.6

9,386.3

6,438.6

116,961.7 112,635.8

Price/ EPS

2016E

47.4x

32.7x

22.1x 20.2x

22.2x

24.5×

17.6x

2017E

38.2x

29.0x 25.2x

NM

21.6x 19.5x

27.4x

18.4x 15.7x

22.0x

Notes:

(1) Includes shares and operating partnership units

(2) Equals the sum of equity market value, noncontrolling interest, preferred securities at liquidation preference, consolidated and company's share of unconsolidated debt

(3) Aggregate Value equals Total Market Capitalization less cash

(4) Consensus Estimates from SNL as of March 11, 2016, unless otherwise noted

Sources: SNL Financial, Capital IQ. Green Street Advisors, Morgan Stanley and Company reports

18.8x

21.8x

22,5×

16.4x 14.3x

15.8x

13.5x 12.2x

NM

19.0x

19.1x

Aggregate Value /

EBITDAI

2016E

11.4x

14.2x

9.4x

10.1x

12.6x

8.3x

11.2x

12.1x 11.6x

7.9x

14.7x

9.0x

10.0x

2016E EPS

5-Yr. EPS Dividend

2017E Growth Yield Payout Ratio (4)

10.7x

1.0%

0.0%

0.0%

13.4x

10.6x

8.9x

9.5x

7.4x

Strictly Confidential

12.9x

8.5x

9.5x

10.9x 10.2x

6.1% 1.6%

11.6x 11.0% 2.8%

10.4x 15.0%

11.4% 0.0%

8.0x (1.0%) 0.0%

10.0x

15.0%

5.3%

11.4%

6.3%

1.3%

2.1%

8.1%

7.9%

1.5%

2.3%

0.0%

7.9% 2.6%

4.5%

1.6%

1.9%

34.7%

0.0%

29.3%

52.2%

80.8%

0.0%

26.7%

40.4%

0.0%

73.7%

35.3%

31.1%

37.6%

31View entire presentation