SmileDirectClub Results Presentation Deck

●

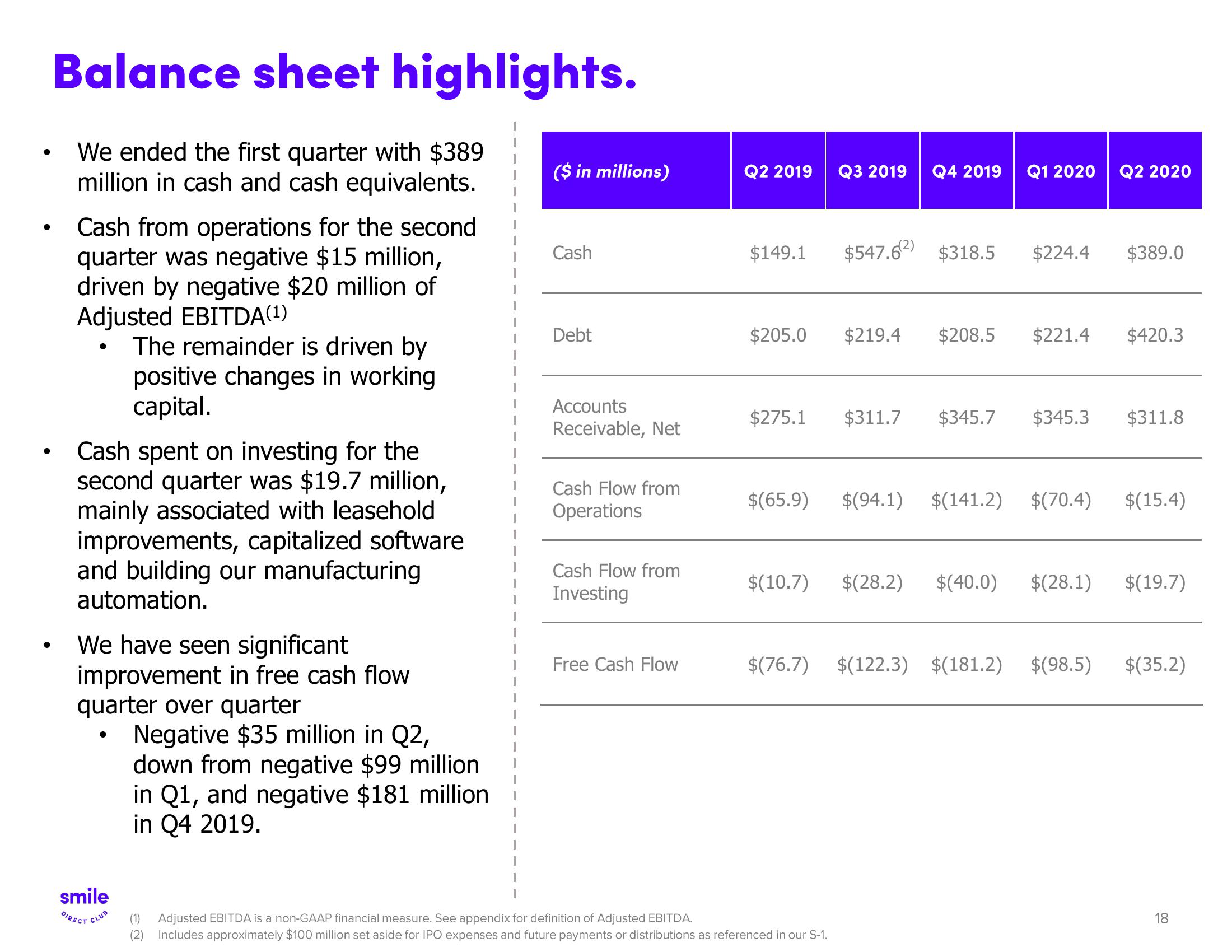

Balance sheet highlights.

We ended the first quarter with $389

million in cash and cash equivalents.

Cash from operations for the second

quarter was negative $15 million,

driven by negative $20 million of

Adjusted EBITDA(1)

The remainder is driven by

positive changes in working

capital.

Cash spent on investing for the

second quarter was $19.7 million,

mainly associated with leasehold

improvements, capitalized software

and building our manufacturing

automation.

We have seen significant

improvement in free cash flow

quarter over quarter

Negative $35 million in Q2,

●

smile

DIRECT CLUB

down from negative $99 million

in Q1, and negative $181 million

in Q4 2019.

($ in millions)

Cash

Debt

Accounts

Receivable, Net

Cash Flow from

Operations

Cash Flow from

Investing

Free Cash Flow

Q2 2019

$149.1

$205.0

$275.1

Q3 2019 Q4 2019

$547.62 $318.5

Q1 2020 Q2 2020

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA.

(2) Includes approximately $100 million set aside for IPO expenses and future payments or distributions as referenced in our S-1.

$224.4

$219.4 $208.5 $221.4 $420.3

$389.0

$311.7 $345.7 $345.3 $311.8

$(65.9) $(94.1) $(141.2) $(70.4) $(15.4)

$(10.7) $(28.2) $(40.0) $(28.1)

$(76.7) $(122.3) $(181.2) $(98.5)

$(19.7)

$(35.2)

18View entire presentation