LSE Investor Presentation Deck

EU Transition - LSEG well positioned

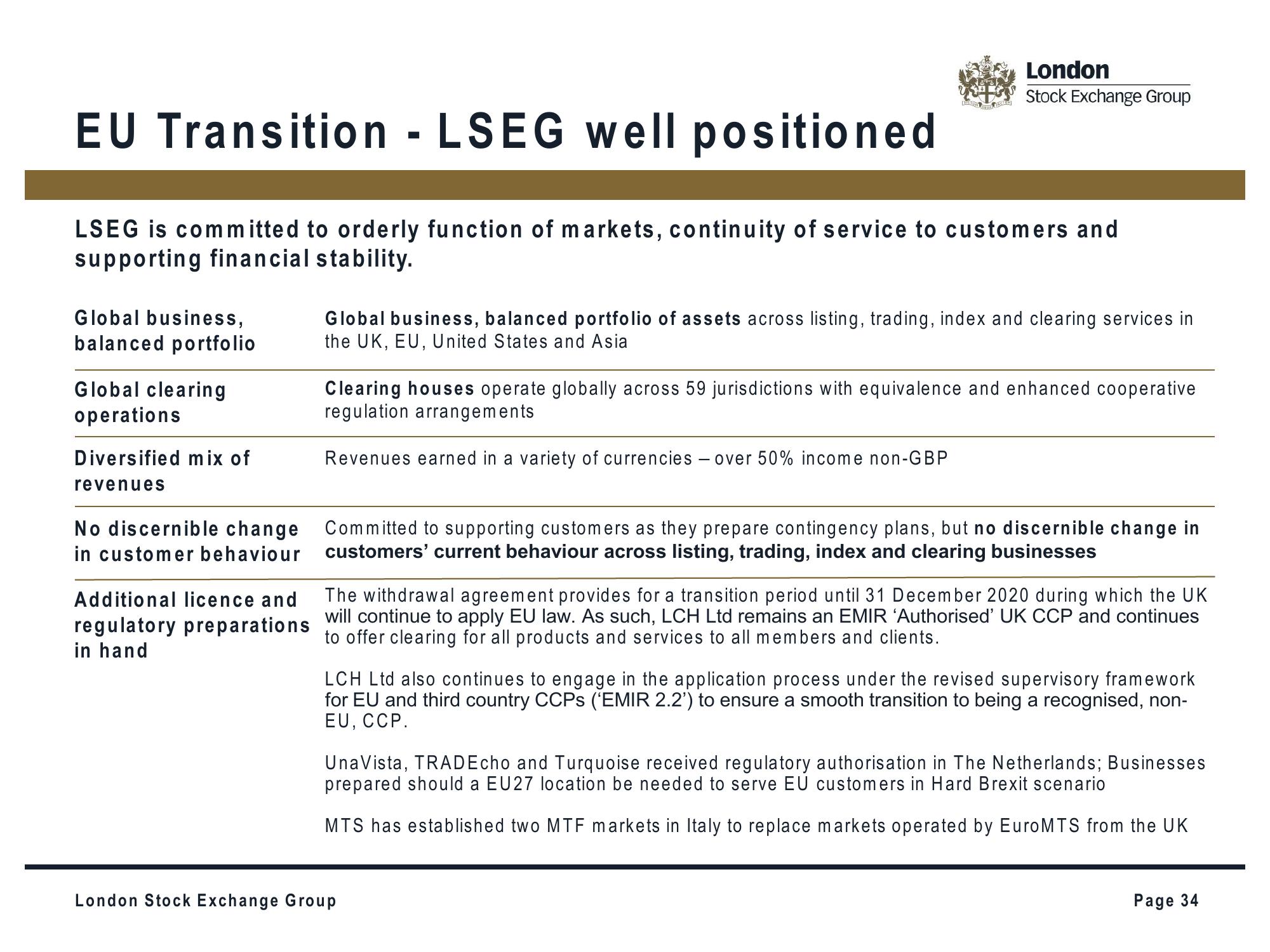

LSEG is committed to orderly function of markets, continuity of service to customers and

supporting financial stability.

Global business,

balanced portfolio

Global clearing

operations

Diversified mix of

revenues

No discernible change

in customer behaviour

London

Stock Exchange Group

Global business, balanced portfolio of assets across listing, trading, index and clearing services in

the UK, EU, United States and Asia

Clearing houses operate globally across 59 jurisdictions with equivalence and enhanced cooperative

regulation arrangements

Revenues earned in a variety of currencies over 50% income non-GBP

Committed to supporting customers as they prepare contingency plans, but no discernible change in

customers' current behaviour across listing, trading, index and clearing businesses

Additional licence and

The withdrawal agreement provides for a transition period until 31 December 2020 during which the UK

regulatory preparations will continue to apply EU law. As such, LCH Ltd remains an EMIR 'Authorised' UK CCP and continues

to offer clearing for all products and services to all members and clients.

in hand

LCH Ltd also continues to engage in the application process under the revised supervisory framework

for EU and third country CCPs ('EMIR 2.2') to ensure a smooth transition to being a recognised, non-

EU, CCP.

UnaVista, TRADEcho and Turquoise received regulatory authorisation in The Netherlands; Businesses

prepared should a EU27 location be needed to serve EU customers in Hard Brexit scenario

MTS has established two MTF markets in Italy to replace markets operated by EuroMTS from the UK

London Stock Exchange Group

Page 34View entire presentation