Deutsche Bank Results Presentation Deck

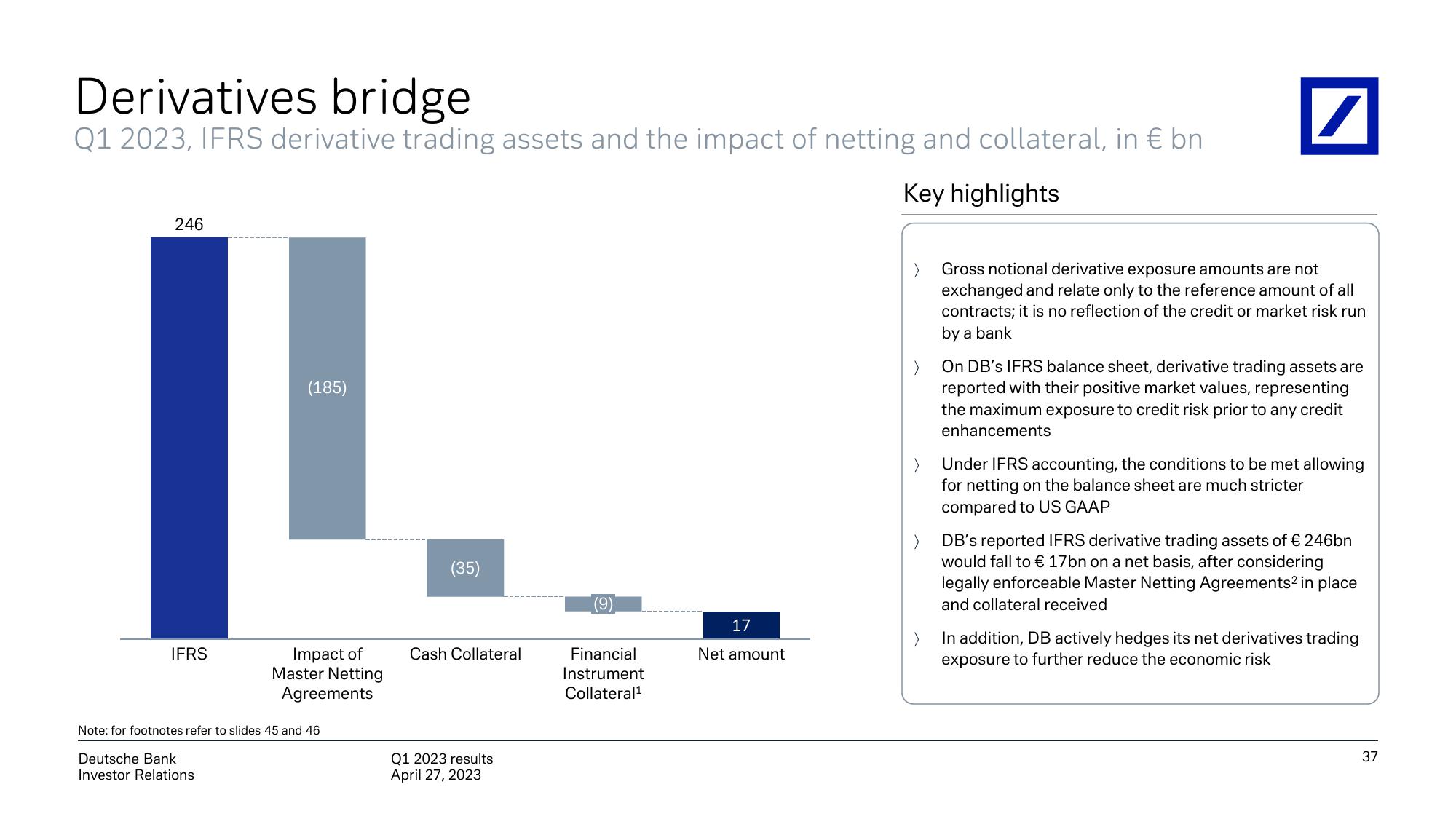

Derivatives bridge

Q1 2023, IFRS derivative trading assets and the impact of netting and collateral, in € bn

Key highlights

246

I

IFRS

(185)

Impact of

Master Netting

Agreements

Note: for footnotes refer to slides 45 and 46

Deutsche Bank

Investor Relations

(35)

Cash Collateral

Q1 2023 results

April 27, 2023

(9)

Financial

Instrument

Collateral¹

17

Net amount

/

Gross notional derivative exposure amounts are not

exchanged and relate only to the reference amount of all

contracts; it is no reflection of the credit or market risk run

by a bank

On DB's IFRS balance sheet, derivative trading assets are

reported with their positive market values, representing

the maximum exposure to credit risk prior to any credit

enhancements

Under IFRS accounting, the conditions to be met allowing

for netting on the balance sheet are much stricter

compared to US GAAP

DB's reported IFRS derivative trading assets of € 246bn

would fall to € 17bn on a net basis, after considering

legally enforceable Master Netting Agreements² in place

and collateral received

>

In addition, DB actively hedges its net derivatives trading

exposure to further reduce the economic risk

37View entire presentation