MaxCyte IPO Presentation Deck

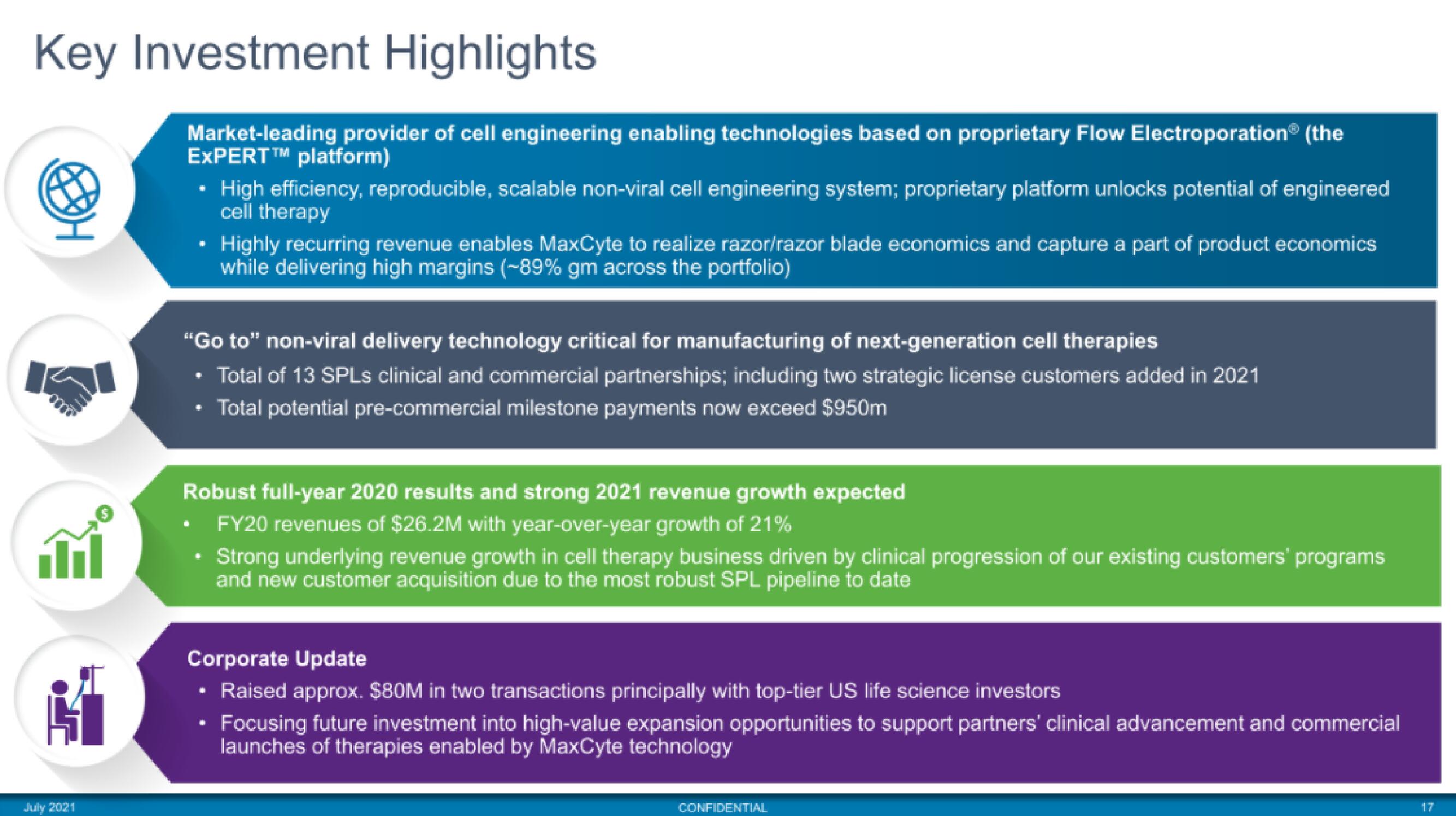

Key Investment Highlights

July 2021

Market-leading provider of cell engineering enabling technologies based on proprietary Flow Electroporation® (the

EXPERT™ platform)

High efficiency, reproducible, scalable non-viral cell engineering system; proprietary platform unlocks potential of engineered

cell therapy

• Highly recurring revenue enables MaxCyte to realize razor/razor blade economics and capture a part of product economics

while delivering high margins (~89% gm across the portfolio)

"Go to" non-viral delivery technology critical for manufacturing of next-generation cell therapies

Total of 13 SPLs clinical and commercial partnerships; including two strategic license customers added in 2021

• Total potential pre-commercial milestone payments now exceed $950m

M

Robust full-year 2020 results and strong 2021 revenue growth expected

FY20 revenues of $26.2M with year-over-year growth of 21%

Strong underlying revenue growth in cell therapy business driven by clinical progression of our existing customers' programs

and new customer acquisition due to the most robust SPL pipeline to date

Corporate Update

• Raised approx. $80M in two transactions principally with top-tier US life science investors

Focusing future investment into high-value expansion opportunities to support partners' clinical advancement and commercial

launches of therapies enabled by MaxCyte technology

CONFIDENTIAL

17View entire presentation