Ocado Investor Day Presentation Deck

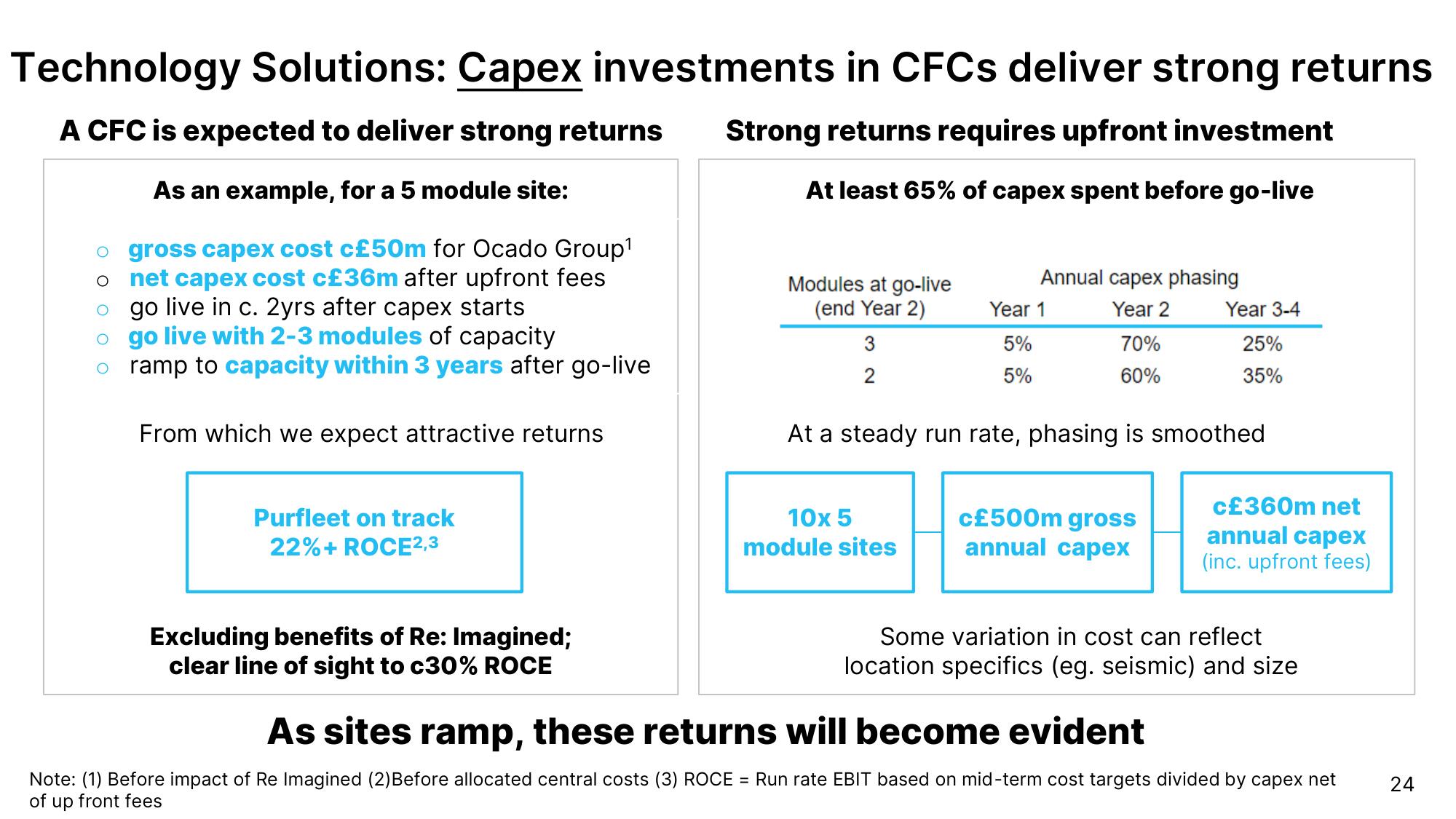

Technology Solutions: Capex investments in CFCs deliver strong returns

A CFC is expected to deliver strong returns

Strong returns requires upfront investment

As an example, for a 5 module site:

At least 65% of capex spent before go-live

gross capex cost c£50m for Ocado Group¹

net capex cost c£36m after upfront fees

go live in c. 2yrs after capex starts

o go live with 2-3 modules of capacity

ramp to capacity within 3 years after go-live

O

From which we expect attractive returns

Purfleet on track

22%+ROCE2,3

Excluding benefits of Re: Imagined;

clear line of sight to c30% ROCE

Modules at go-live

(end Year 2)

3

2

Annual capex phasing

Year 2

10x 5

module sites

Year 1

5%

5%

70%

60%

At a steady run rate, phasing is smoothed

Year 3-4

25%

35%

c£500m gross

annual capex

c£360m net

annual capex

(inc. upfront fees)

Some variation in cost can reflect

location specifics (eg. seismic) and size

As sites ramp, these returns will become evident

Note: (1) Before impact of Re Imagined (2) Before allocated central costs (3) ROCE = Run rate EBIT based on mid-term cost targets divided by capex net

of up front fees

24View entire presentation