Morgan Stanley Investment Banking Pitch Book

Q1 2016

.

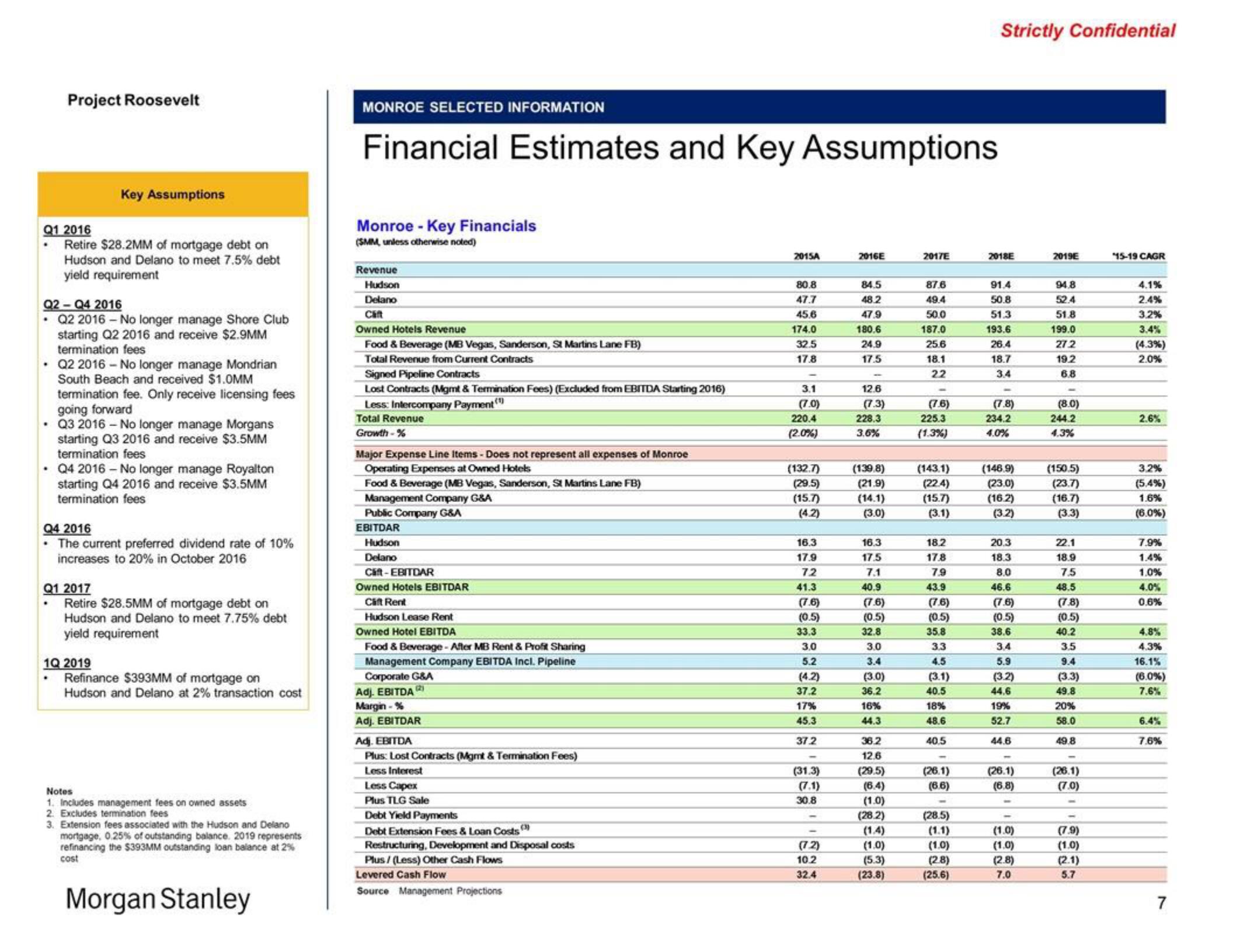

Project Roosevelt

Retire $28.2MM of mortgage debt on

Hudson and Delano to meet 7.5% debt

yield requirement

Q2-Q4 2016

.Q2 2016 - No longer manage Shore Club

starting Q2 2016 and receive $2.9MM

termination fees

• Q2 2016 - No longer manage Mondrian

South Beach and received $1.0MM

termination fee. Only receive licensing fees

going forward

• Q3 2016 - No longer manage Morgans

starting Q3 2016 and receive $3.5MM

termination fees

Key Assumptions

.

Q4 2016 - No longer manage Royalton

starting Q4 2016 and receive $3.5MM

termination fees

Q4 2016

• The current preferred dividend rate of 10%

increases to 20% in October 2016

Q1 2017

1Q 2019

Retire $28.5MM of mortgage debt on

Hudson and Delano to meet 7.75% debt

yield requirement

Refinance $393MM of mortgage on

Hudson and Delano at 2% transaction cost

Notes

1. Includes management fees on owned assets

2. Excludes termination fees

3. Extension fees associated with the Hudson and Delano

mortgage, 0.25% of outstanding balance. 2019 represents

refinancing the $393MM outstanding loan balance at 2%

cost

Morgan Stanley

MONROE SELECTED INFORMATION

Financial Estimates and Key Assumptions

Monroe - Key Financials

(SMM, unless otherwise noted)

Revenue

Hudson

Delano

Caft

Owned Hotels Revenue

Food & Beverage (MB Vegas, Sanderson, St Martins Lane FB)

Total Revenue from Current Contracts

Signed Pipeline Contracts

Lost Contracts (Mgmt & Termination Fees) (Excluded from EBITDA Starting 2016)

Less: Intercompany Payment

Total Revenue

Growth-%

Major Expense Line Items - Does not represent all expenses of Monroe

Operating Expenses at Owned Hotels

Food & Beverage (MB Vegas, Sanderson, St Martins Lane FB)

Management Company G&A

Public Company G&A

EBITDAR

Hudson

Delano

Caft-EBITDAR

Owned Hotels EBITDAR

Cift Rent

Hudson Lease Rent

Owned Hotel EBITDA

Food & Beverage- After MB Rent & Profit Sharing

Management Company EBITDA Incl. Pipeline

Corporate G&A

Adj. EBITDA)

Margin-%

Adj. EBITDAR

Adj. EBITDA

Plus: Lost Contracts (Mgmt & Termination Fees)

Less Interest

Less Capex

Plus TLG Sale

Debt Yield Payments

Debt Extension Fees & Loan Costs

Restructuring, Development and Disposal costs

Plus / (Less) Other Cash Flows

Levered Cash Flow

Source Management Projections

2015A

80.8

47.7

45,6

174.0

32.5

17.8

3.1

(7.0)

220.4

(2.0%)

(132.7)

(29.5)

(15.7)

(4.2)

16.3

17.9

72

41.3

(7.6)

(0.5)

33.3

3.0

5.2

(4.2)

37.2

17%

45.3

37.2

(31.3)

(7.1)

30.8

-

(72)

10.2

32.4

2016E

84.5

48.2

47.9

180.6

24.9

17.5

12.6

(7.3)

228.3

3.6%

(139.8)

(21.9)

(14.1)

(3.0)

16.3

17.5

7.1

40.9

(7.6)

(0.5)

32.8

3.0

3.4

(3.0)

36.2

16%

44.3

36.2

12.6

(29.5)

(6.4)

(1.0)

(28.2)

(1.4)

(1.0)

(5.3)

(23.8)

2017E

87.6

49.4

50.0

187.0

25.6

18.1

22

(7.6)

225.3

(1.3%)

(143.1)

(22.4)

(15.7)

(3.1)

18.2

17.8

7.9

43.9

(7.6)

(0.5)

35.8

3.3

4.5

(3.1)

40.5

18%

48.6

40.5

(26.1)

(6.6)

(28.5)

(1.1)

(1.0)

(2.8)

(25.6)

Strictly Confidential

2018E

91.4

50.8

51.3

193.6

26.4

18.7

3.4

(7.8)

234.2

4.0%

(146.9)

(23.0)

(16.2)

(3.2)

20.3

18.3

8.0

46.6

(7.6)

(0.5)

38.6

3.4

5.9

(3.2)

44.6

19%

52.7

44.6

(26.1)

(6.8)

(1.0)

(1.0)

(2.8)

7.0

2019E

94.8

52.4

51.8

199.0

27.2

19.2

6.8

(8.0)

244.2

4.3%

(150.5)

(23.7)

(16.7)

(3.3)

22.1

18.9

7.5

48.5

(7.8)

(0.5)

40.2

3.5

9.4

(3.3)

49.8

20%

58.0

49.8

(26.1)

(7.0)

(7.9)

(1.0)

(2.1)

5.7

15-19 CAGR

4.1%

2.4%

3.2%

3.4%

(4.3%)

2.0%

2.6%

3,2%

(5.4%)

1.6%

(6.0%)

7.9%

1.4%

1.0%

4.0%

0.6%

4.8%

4.3%

16.1%

(6.0%)

7.6%

6.4%

7.6%

7View entire presentation