Bakkt Results Presentation Deck

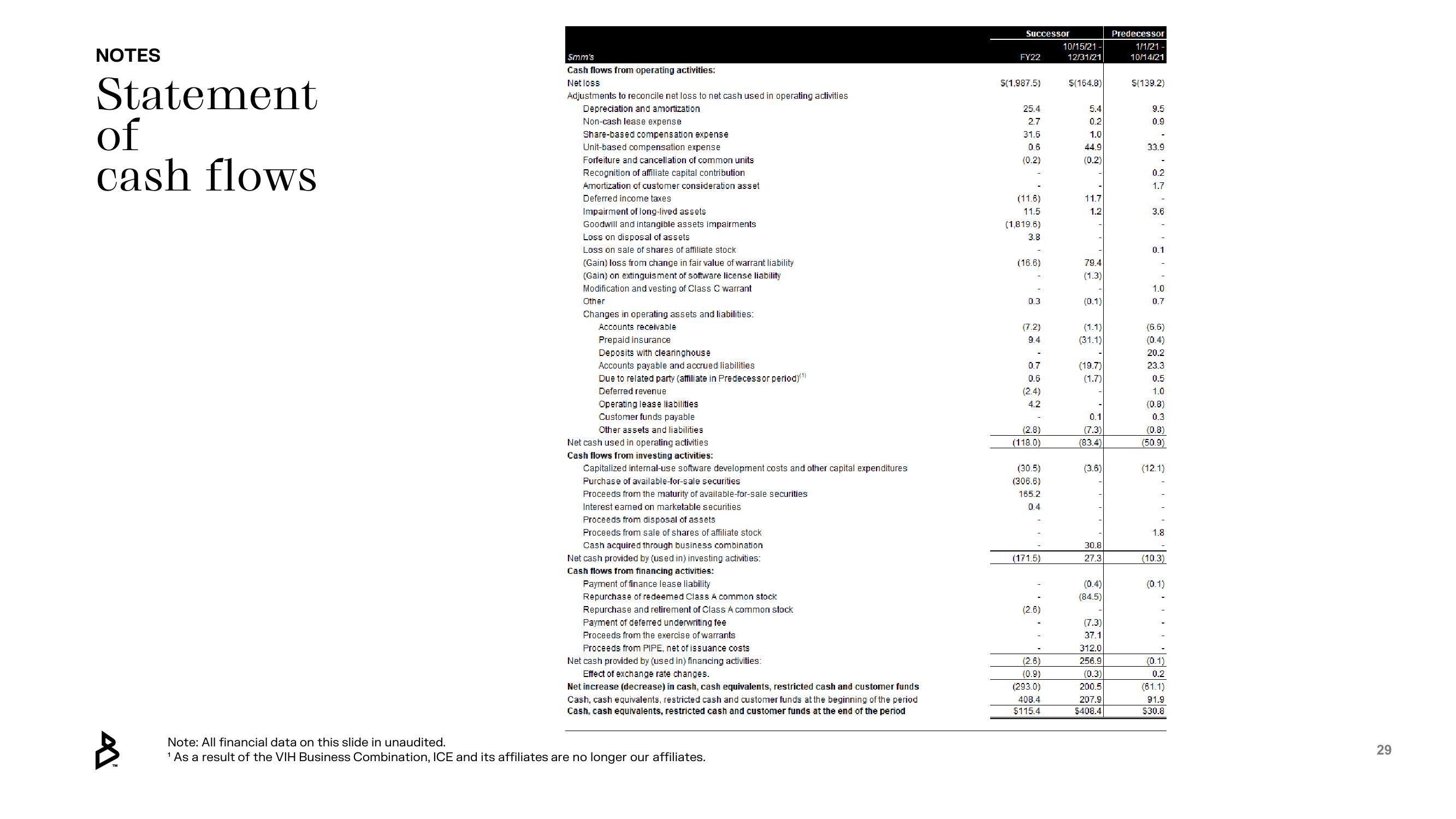

NOTES

Statement

of

cash flows

A

$mm's

Cash flows from operating activities:

Net loss

Adjustments to reconcile net loss to net cash used in operating activities

Depreciation and amortization

Non-cash lease expense

Share-based compensation expense

Unit-based compensation expense

Forfeiture and cancellation of common units

Recognition of affiliate capital contribution

Amortization of customer consideration asset

Deferred income taxes

Impairment of long-lived assets

Goodwill and intangible assets impairments

Loss on disposal of assets

Loss on sale of shares of affiliate stock

(Gain) loss from change in fair value of warrant liability

(Gain) on extinguisment of software license liability

Modification and vesting of Class C warrant

Other

Changes in operating assets and liabilities:

Accounts receivable

Prepaid insurance

Deposits with clearinghouse

Accounts payable and accrued liabilities

Due to related party (affiliate in Predecessor period)(¹)

Deferred revenue.

Operating lease liabilities

Customer funds payable

Other assets and liabilities

Net cash used in operating activities

Cash flows from investing activities:

Capitalized internal-use software development costs and other capital expenditures

Purchase of available-for-sale securities

Proceeds from the maturity of available-for-sale securities

Interest earned on marketable securities

Proceeds from disposal of assets

Proceeds from sale of shares of affiliate stock

Cash acquired through business combination

Net cash provided by (used in) investing activities:

Cash flows from financing activities:

Payment of finance lease liability

Repurchase of redeemed Class A common stock

Repurchase and retirement of Class A common stock

Payment of deferred underwriting fee

Proceeds from the exercise of warrants

Proceeds from PIPE, net of issuance costs

Net cash provided by (used in) financing activities:

Effect of exchange rate changes.

Net increase (decrease) in cash, cash equivalents, restricted cash and customer funds

Cash, cash equivalents, restricted cash and customer funds at the beginning of the period

Cash, cash equivalents, restricted cash and customer funds at the end of the period

Note: All financial data on this slide in unaudited.

¹ As a result of the VIH Business Combination, ICE and its affiliates are no longer our affiliates.

Successor

FY22

$(1,987.5)

25.4

2.7

31.6

0.6

(0.2)

(11.6)

11.5

(1,819.6)

3.8

(16.6)

0.3

(7.2)

9.4

0.7

0.6

(2.4)

4.2

(2.8)

(118.0)

(30.5)

(306.6)

165.2

0.4

(171.5)

(2.6)

(2.6)

(0.9)

(293.0)

408.4

$115.4

10/15/21 -

12/31/21

$(164.8)

5.4

0.2

1.0

44.9

(0.2)

11.7

1.2

79.4

(1.3)

(0.1)

(1.1)

(31.1)

(19.7)

(1.7)

0.1

(7.3)

(83.4)

(3.6)

30.8

27.3

(0.4)

(84.5)

(7.3)

37.1

312.0

256.9

(0.3)

200.5

207.9

$408.4

Predecessor

1/1/21 -

10/14/21

$(139.2)

9.5

0.9

33.9

0.2

1.7

3.6

0.1

1.0

0.7

(6.6)

(0.4)

20.2

23.3

0.5

1.0

(0.8)

0.3

(0.8)

(50.9)

(12.1)

1.8

(10.3)

(0.1)

(0.1)

0.2

(61.1)

91.9

$30.8

29View entire presentation