Antero Midstream Partners Mergers and Acquisitions Presentation Deck

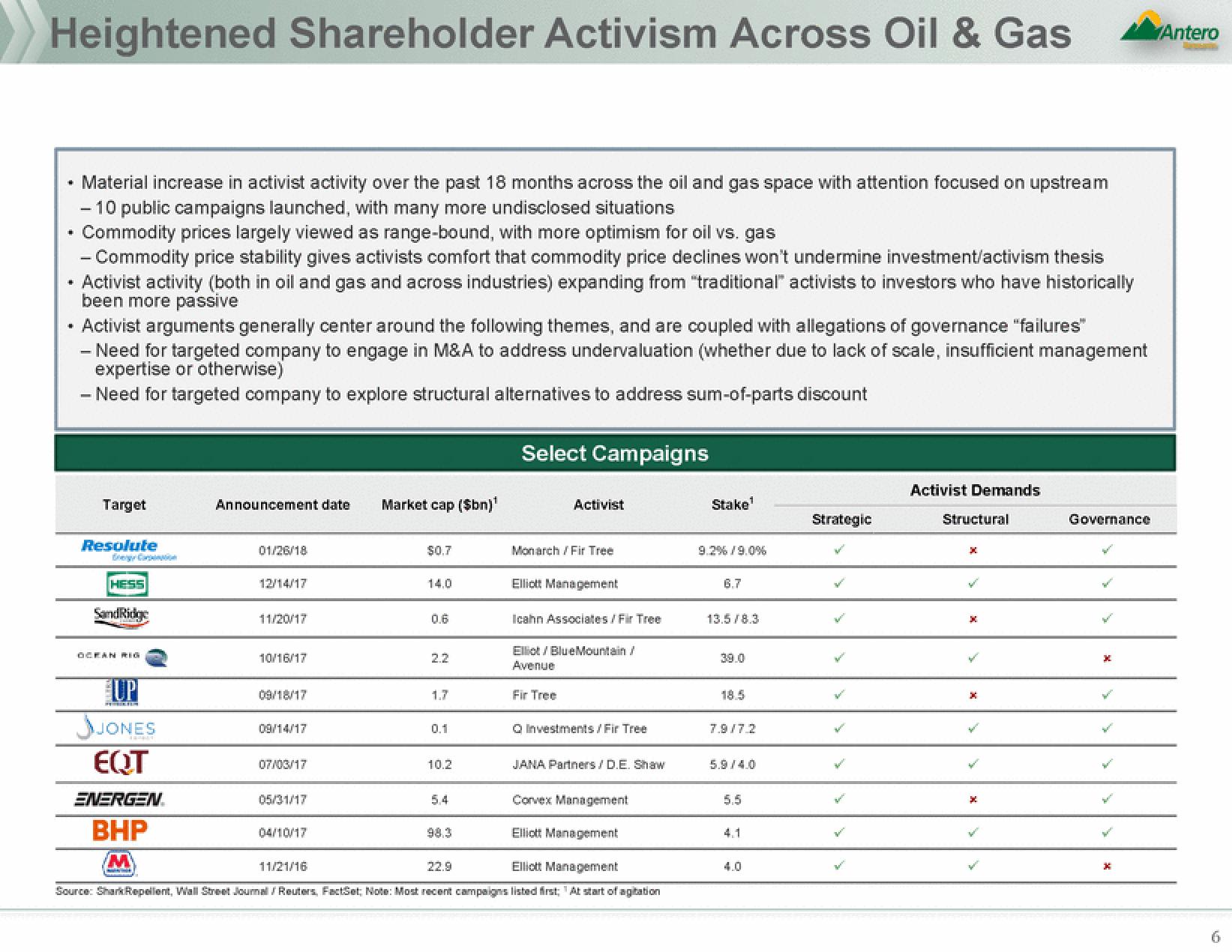

Heightened Shareholder Activism Across Oil & Gas

Material increase in activist activity over the past 18 months across the oil and gas space with attention focused on upstream

- 10 public campaigns launched, with many more undisclosed situations

Commodity prices largely viewed as range-bound, with more optimism for oil vs. gas

- Commodity price stability gives activists comfort that commodity price declines won't undermine investment/activism thesis

Activist activity (both in oil and gas and across industries) expanding from "traditional activists to investors who have historically

been more passive

* Activist arguments generally center around the following themes, and are coupled with allegations of governance "failures"

- Need for targeted company to engage in M&A to address undervaluation (whether due to lack of scale, insufficient management

expertise or otherwise)

- Need for targeted company to explore structural alternatives to address sum-of-parts discount

Target

Resolute

Bergy C

HESS

SandRidge

OCEAN

UP

JONES

EQT

Announcement date

ENERGEN

BHP

M

01/26/18

12/14/17

11/20/17

10/16/17

09/18/17

09/14/17

07/03/17

05/31/17

Market cap ($bn)¹

04/10/17

$0.7

14.0

2.2

10.2

5.4

Select Campaigns

98.3

Activist

Monarch / Fir Tree

Elliott Management

Icahn Associates / Fir Tree

Corvex Management

Elliott Management

11/21/16

22.9

Elliott Management

Source: SharkRepellent, Wall Street Journal / Reuters, FactSet, Note: Most recent campaigns listed first; At start of agitation

Elliot / Blue Mountain/

Avenue

Fir Tree

Q Investments / Fir Tree

JANA Partners / D.E. Shaw

Stake¹

9.2%/9.0%

6.7

13.5/8.3

39.0

18.5

7.9/7.2

5.9/4.0

5.5

4.1

Strategic

3

w

W

Activist Demands

Structural

X

30

y

x

Bavim

Ba

X

M

Governance

AnteroView entire presentation