Ashtead Group Results Presentation Deck

SPECIALTY TRADING

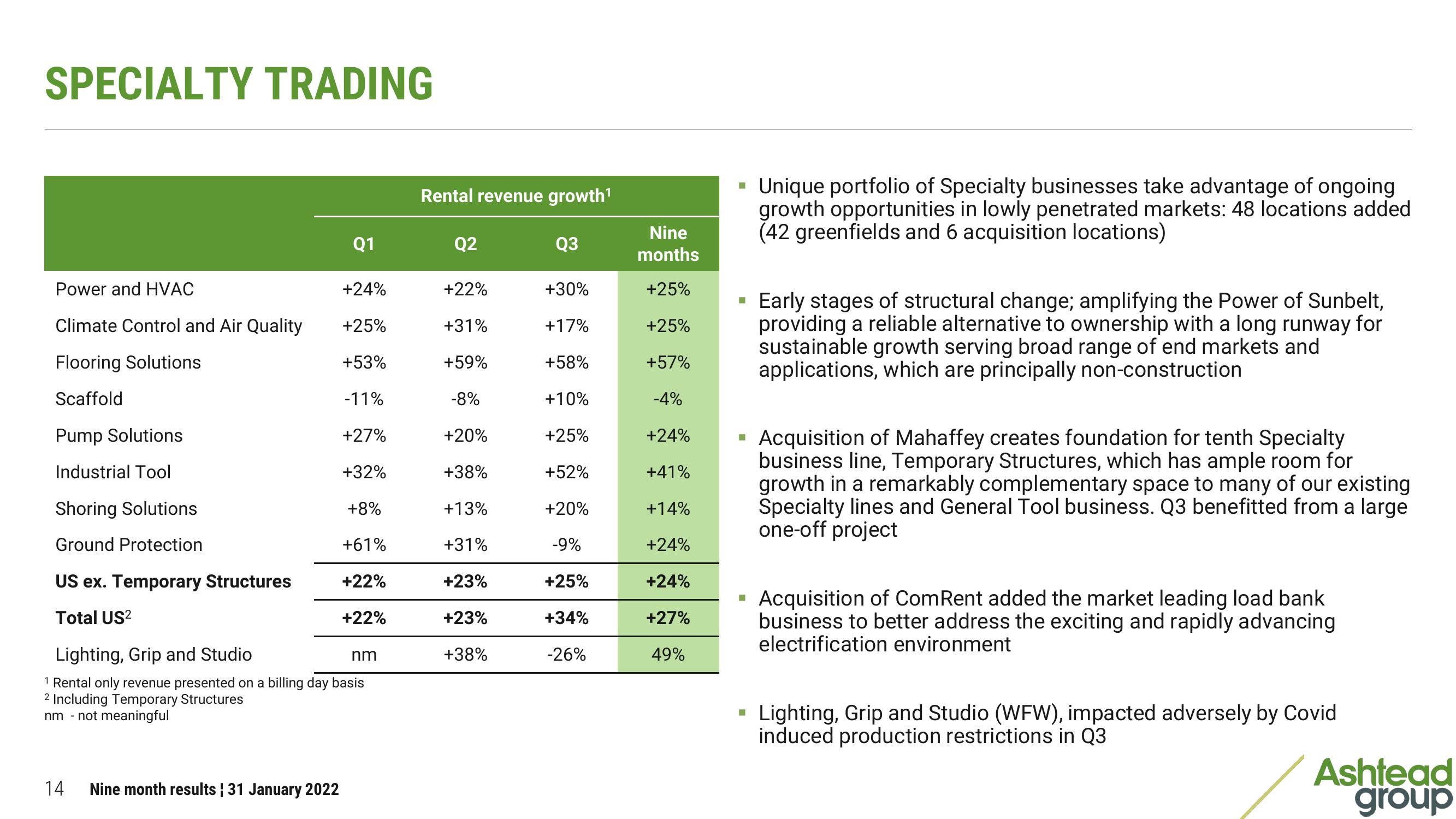

Power and HVAC

Climate Control and Air Quality

Flooring Solutions

Scaffold

Pump Solutions

Industrial Tool

Shoring Solutions

Ground Protection

US ex. Temporary Structures

Total US²

Q1

14 Nine month results ¦ 31 January 2022

+24%

+25%

+53%

-11%

+27%

+32%

+8%

+61%

+22%

+22%

Lighting, Grip and Studio

1 Rental only revenue presented on a billing day basis

2 Including Temporary Structures

nm - not meaningful

nm

Rental revenue growth¹

Q2

+22%

+31%

+59%

-8%

+20%

+38%

+13%

+31%

+23%

+23%

+38%

Q3

+30%

+17%

+58%

+10%

+25%

+52%

+20%

-9%

+25%

+34%

-26%

Nine

months

+25%

+25%

+57%

-4%

+24%

+41%

+14%

+24%

+24%

+27%

49%

■

■

Unique portfolio of Specialty businesses take advantage of ongoing

growth opportunities in lowly penetrated markets: 48 locations added

(42 greenfields and 6 acquisition locations)

H

Early stages of structural change; amplifying the Power of Sunbelt,

providing a reliable alternative to ownership with a long runway for

sustainable growth serving broad range of end markets and

applications, which are principally non-construction

▪ Acquisition of Mahaffey creates foundation for tenth Specialty

business line, Temporary Structures, which has ample room for

growth in a remarkably complementary space to many of our existing

Specialty lines and General Tool business. Q3 benefitted from a large

one-off project

Acquisition of Com Rent added the market leading load bank

business to better address the exciting and rapidly advancing

electrification environment

▪ Lighting, Grip and Studio (WFW), impacted adversely by Covid

induced production restrictions in Q3

Ashtead

groupView entire presentation