Baird Investment Banking Pitch Book

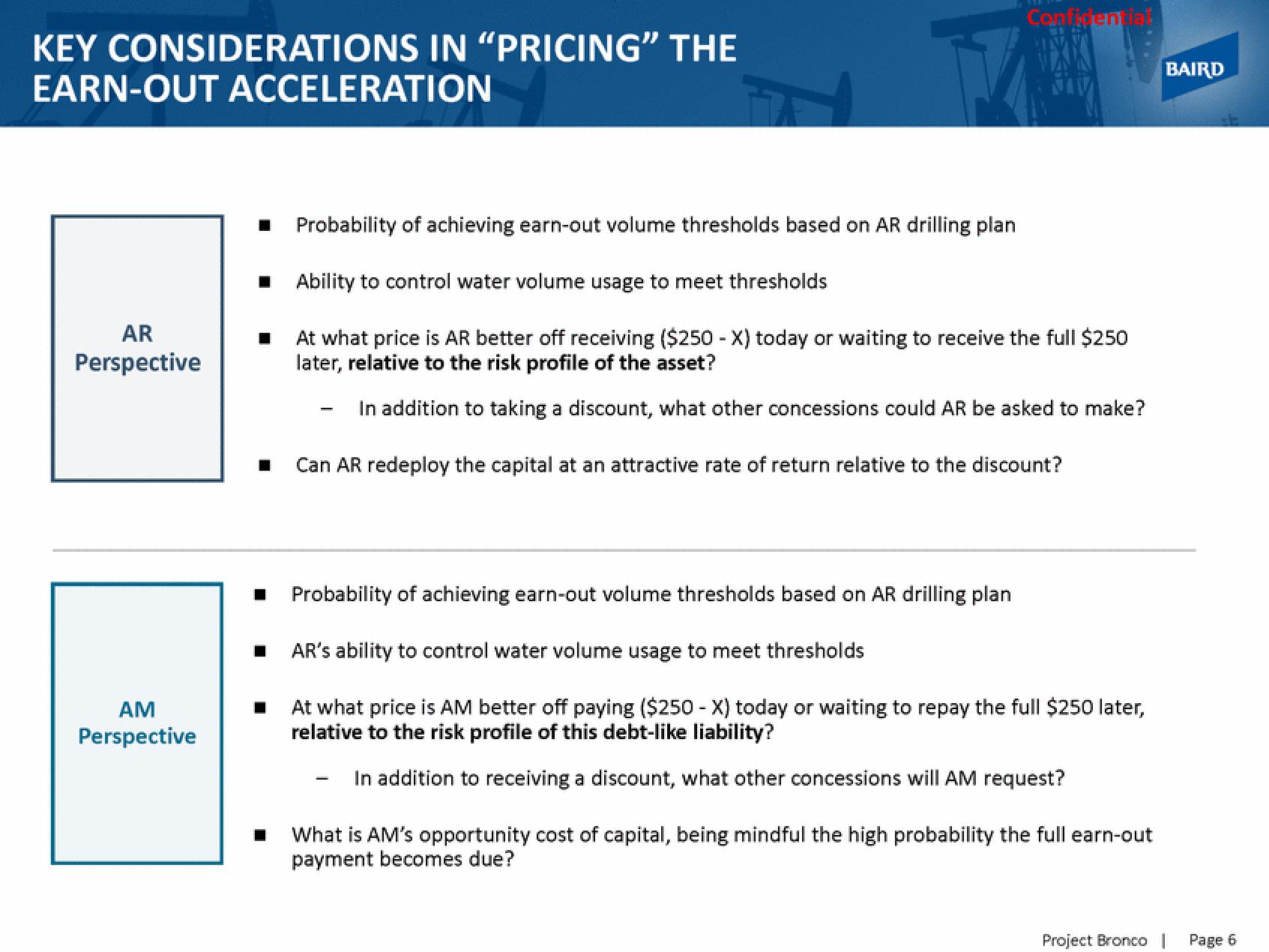

KEY CONSIDERATIONS IN "PRICING" THE

EARN-OUT ACCELERATION

AR

Perspective

AM

Perspective

■

Probability of achieving earn-out volume thresholds based on AR drilling plan

Confidential

Ability to control water volume usage to meet thresholds

At what price is AR better off receiving ($250 - X) today or waiting to receive the full $250

later, relative to the risk profile of the asset?

In addition to taking a discount, what other concessions could AR be asked to make?

Can AR redeploy the capital at an attractive rate of return relative to the discount?

Probability of achieving earn-out volume thresholds based on AR drilling plan

AR's ability to control water volume usage to meet thresholds

At what price is AM better off paying ($250-X) today or waiting to repay the full $250 later,

relative to the risk profile of this debt-like liability?

In addition to receiving a discount, what other concessions will AM request?

-

What is AM's opportunity cost of capital, being mindful the high probability the full earn-out

payment becomes due?

Project Bronco

BAIRD

Page 6View entire presentation