HPS Specialty Loan Fund VI

Scale Matters: Growth of Megatranche Loans in Direct Lending

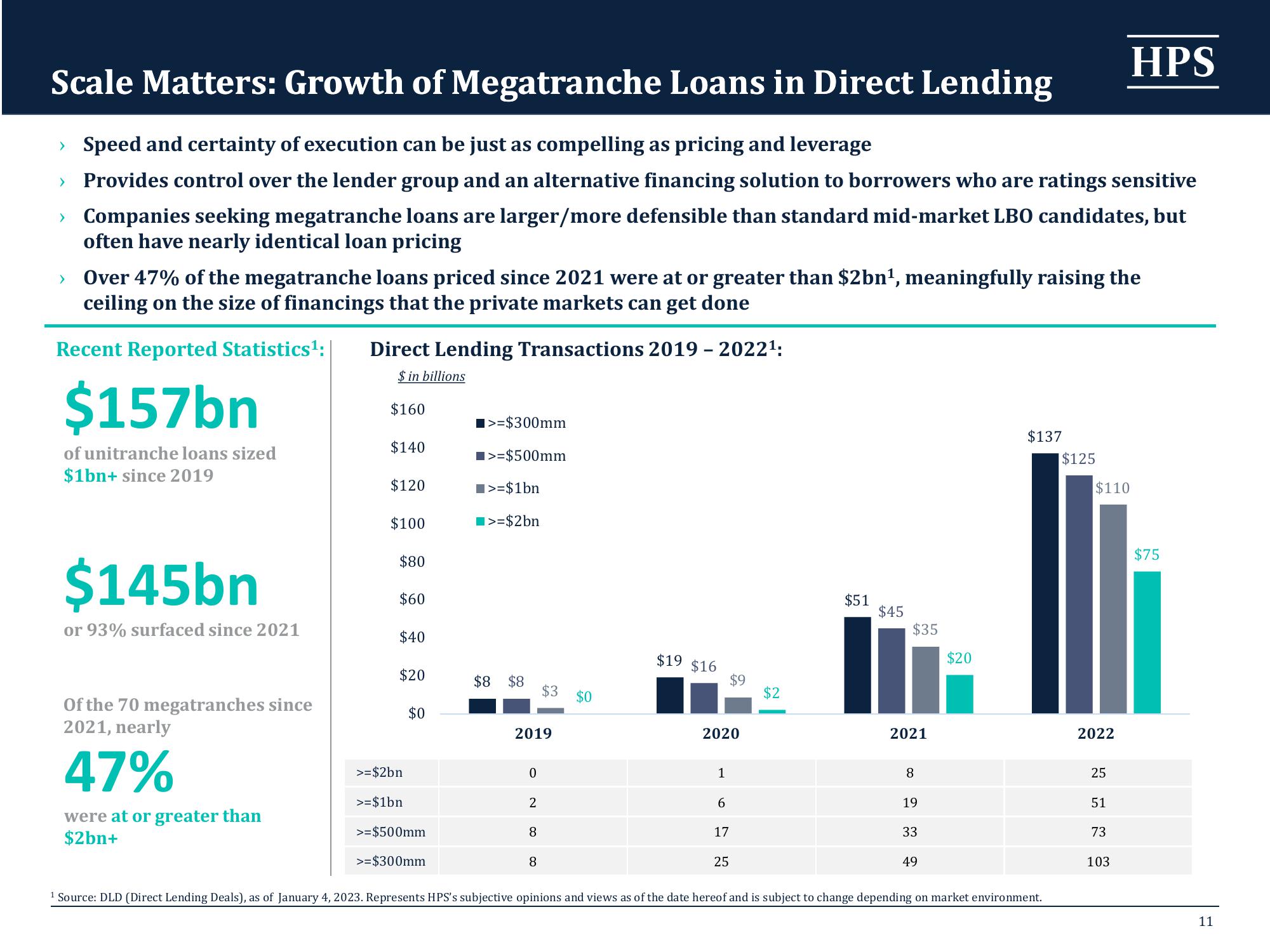

> Speed and certainty of execution can be just as compelling as pricing and leverage

> Provides control over the lender group and an alternative financing solution to borrowers who are ratings sensitive

› Companies seeking megatranche loans are larger/more defensible than standard mid-market LBO candidates, but

often have nearly identical loan pricing

Over 47% of the megatranche loans priced since 2021 were at or greater than $2bn¹, meaningfully raising the

ceiling on the size of financings that the private markets can get done

Recent Reported Statistics¹:

$157bn

of unitranche loans sized

$1bn+ since 2019

$145bn

or 93% surfaced since 2021

Of the 70 megatranches since

2021, nearly

47%

were at or greater than

$2bn+

Direct Lending Transactions 2019-2022¹:

$ in billions

$160

$140

$120

$100

$80

$60

$40

$20

$0

>= $2bn

>= $1bn

>= $500mm

>= $300mm

>=$300mm

■>=$500mm

>= $1bn

■>= $2bn

$8 $8

2019

0

2

8

$3

8

$0

$19 $16

2020

1

6

17

$9

25

$2

$51

$45

$35

2021

8

19

33

49

$20

$137

¹ Source: DLD (Direct Lending Deals), as of January 4, 2023. Represents HPS's subjective opinions and views as of the date hereof and is subject to change depending on market environment.

$125

$110

2022

HPS

25

51

73

103

$75

11View entire presentation