Flutter Results Presentation Deck

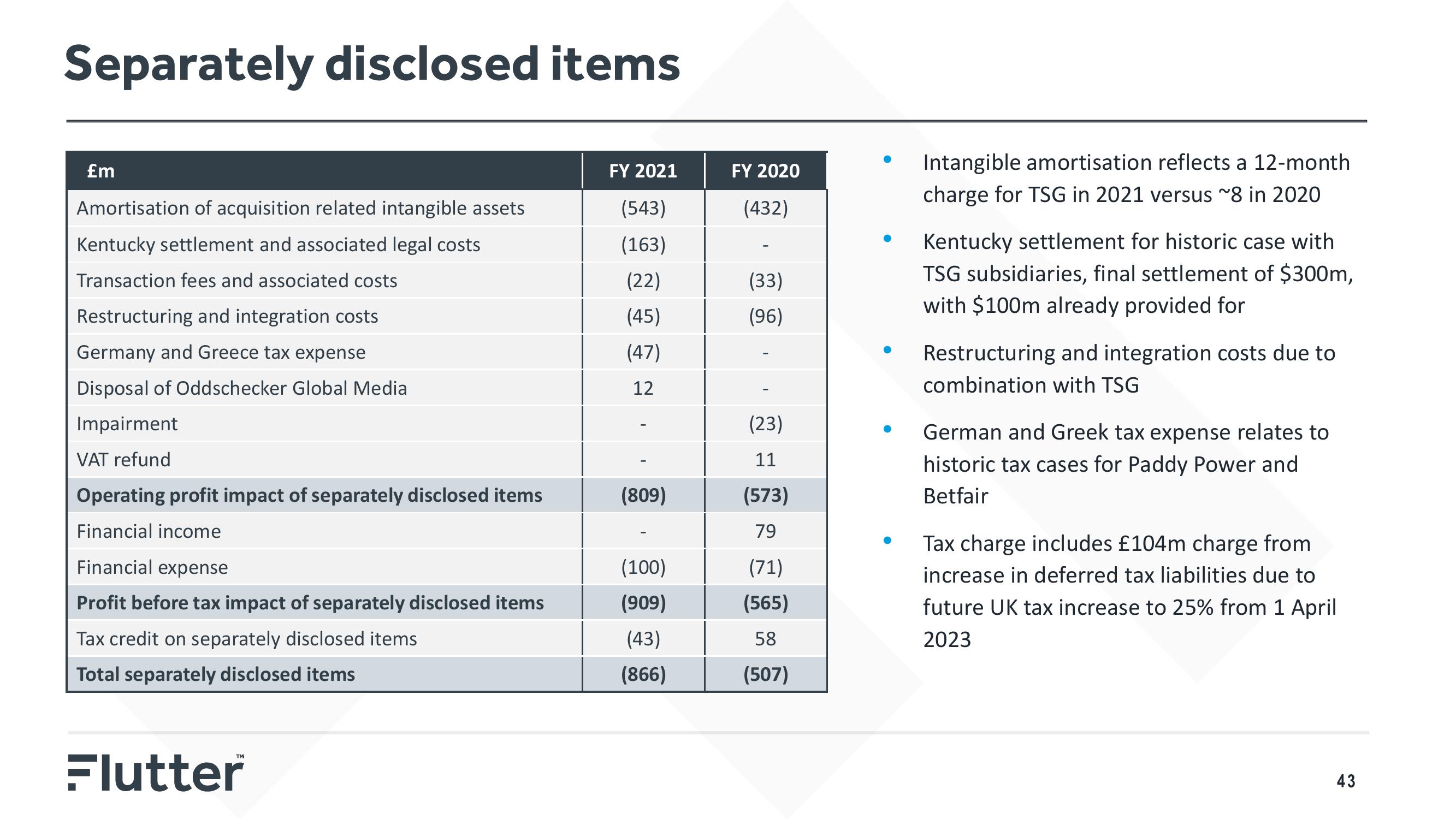

Separately disclosed items

£m

Amortisation of acquisition related intangible assets

Kentucky settlement and associated legal costs

Transaction fees and associated costs

Restructuring and integration costs

Germany and Greece tax expense

Disposal of Oddschecker Global Media

Impairment

VAT refund

Operating profit impact of separately disclosed items

Financial income

Financial expense

Profit before tax impact of separately disclosed items

Tax credit on separately disclosed items

Total separately disclosed items

Flutter

FY 2021

(543)

(163)

(22)

(45)

(47)

12

(809)

(100)

(909)

(43)

(866)

FY 2020

(432)

(33)

(96)

I

(23)

11

(573)

79

(71)

(565)

58

(507)

●

Intangible amortisation reflects a 12-month

charge for TSG in 2021 versus ~8 in 2020

Kentucky settlement for historic case with

TSG subsidiaries, final settlement of $300m,

with $100m already provided for

Restructuring and integration costs due to

combination with TSG

German and Greek tax expense relates to

historic tax cases for Paddy Power and

Betfair

Tax charge includes £104m charge from

increase in deferred tax liabilities due to

future UK tax increase to 25% from 1 April

2023

43View entire presentation