Trian Partners Activist Presentation Deck

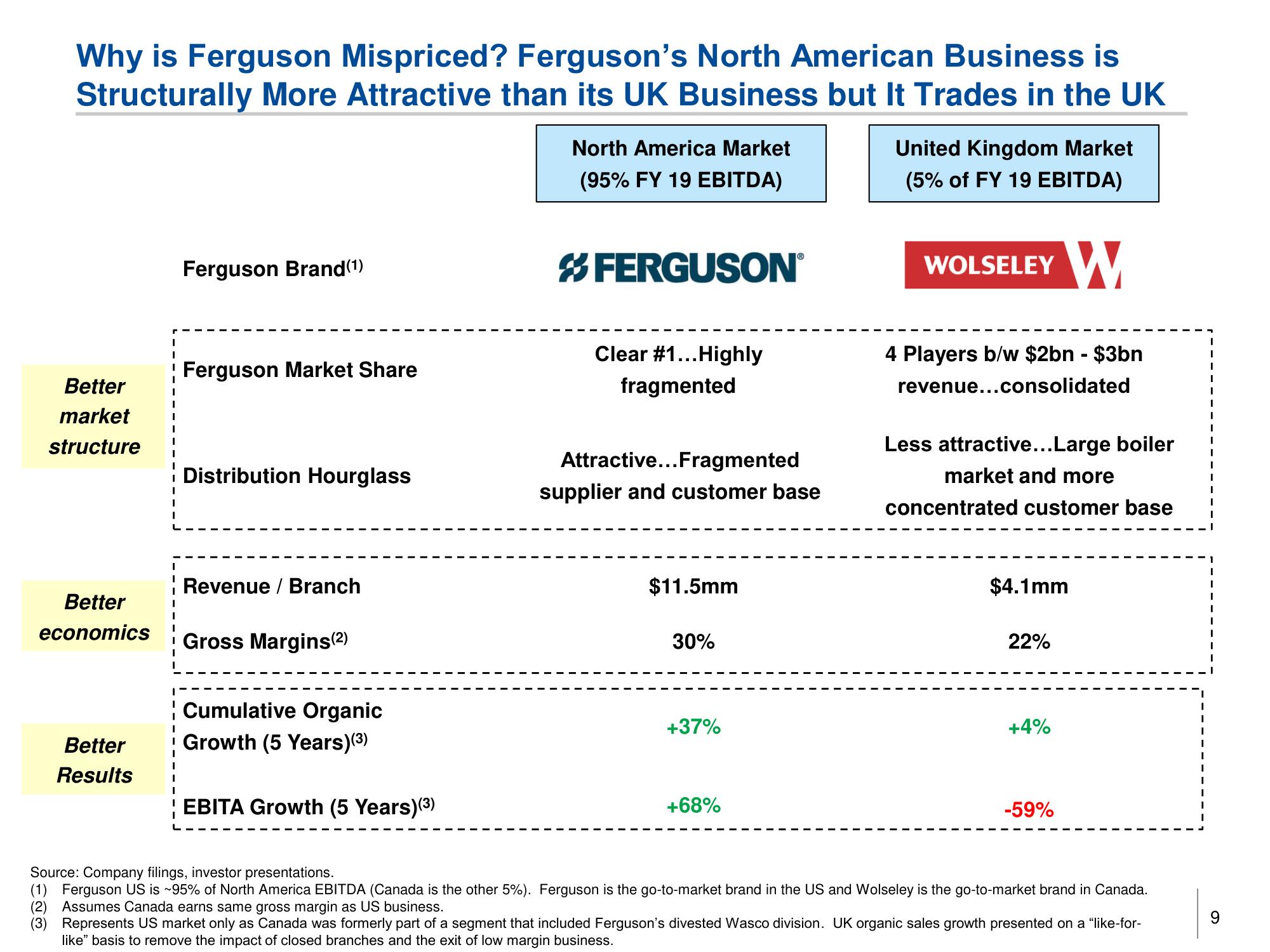

Why is Ferguson Mispriced? Ferguson's North American Business is

Structurally More Attractive than its UK Business but It Trades in the UK

Better

market I

I

I

structure

I

I

Better

economics

I

I

Better

Results

I

I

I

I

I

I

I

I

I

I

I

I

Ferguson Brand(1)

Ferguson Market Share

Distribution Hourglass

Revenue / Branch

Gross Margins(²)

Cumulative Organic

Growth (5 Years)(³)

EBITA Growth (5 Years) (3)

North America Market

(95% FY 19 EBITDA)

FERGUSONⓇ

Clear #1... Highly

fragmented

Attractive...Fragmented

supplier and customer base

$11.5mm

30%

+37%

+68%

United Kingdom Market

(5% of FY 19 EBITDA)

W

WOLSELEY

4 Players b/w $2bn - $3bn

revenue...consolidated

Less attractive...Large boiler

market and more

concentrated customer base

$4.1mm

22%

+4%

-59%

Source: Company filings, investor presentations.

(1) Ferguson US is ~95% of North America EBITDA (Canada is the other 5%). Ferguson is the go-to-market brand in the US and Wolseley is the go-to-market brand in Canada.

(2) Assumes Canada earns same gross margin as US business.

(3) Represents US market only as Canada was formerly part of a segment that included Ferguson's divested Wasco division. UK organic sales growth presented on a "like-for-

like" basis to remove the impact of closed branches and the exit of low margin business.

I

I

I

I

I

I

1View entire presentation