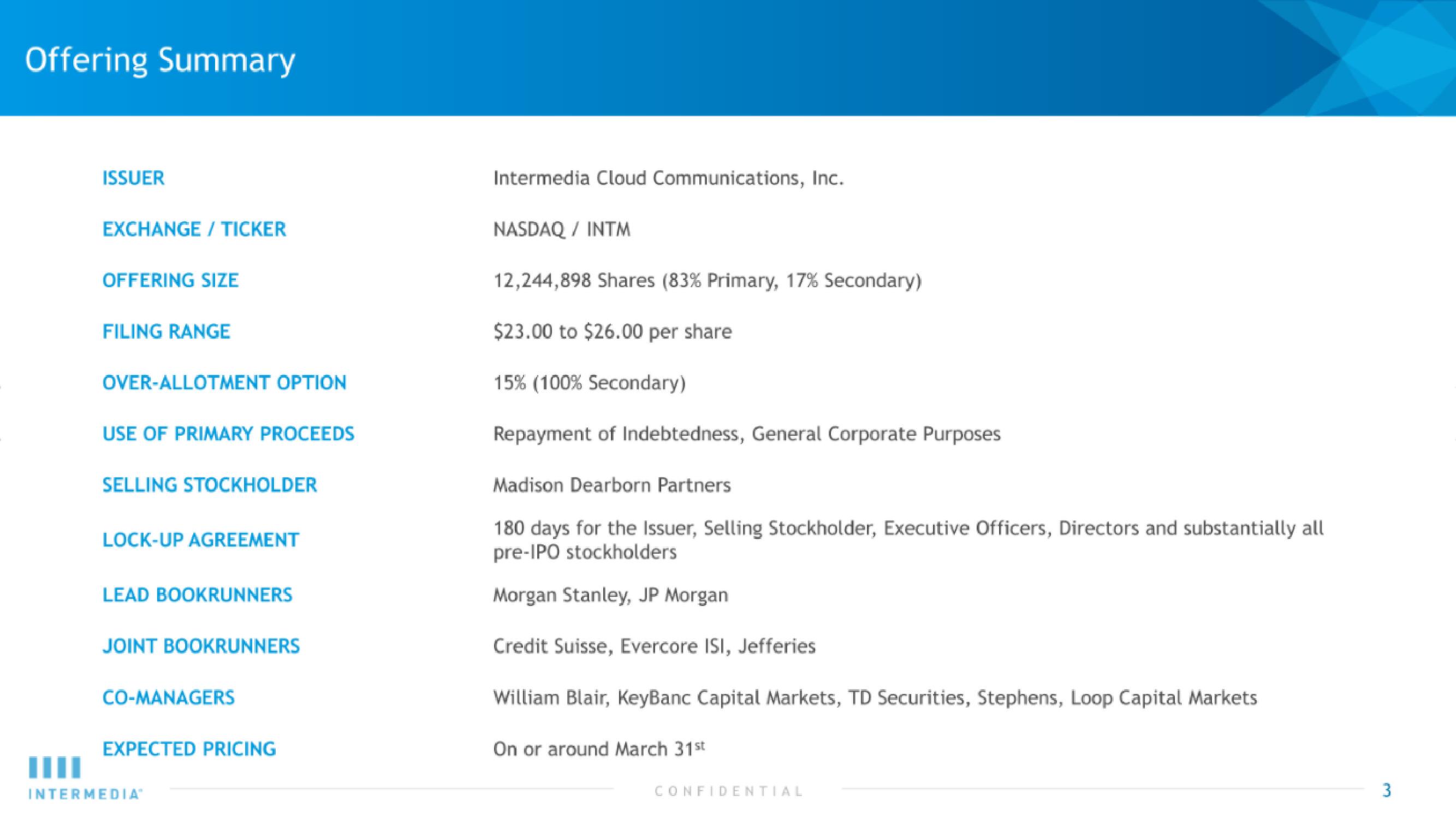

Intermedia IPO Presentation Deck

Offering Summary

||||

ISSUER

EXCHANGE/TICKER

OFFERING SIZE

FILING RANGE

OVER-ALLOTMENT OPTION

USE OF PRIMARY PROCEEDS

SELLING STOCKHOLDER

LOCK-UP AGREEMENT

LEAD BOOKRUNNERS

JOINT BOOKRUNNERS

CO-MANAGERS

EXPECTED PRICING

INTERMEDIAⓇ

Intermedia Cloud Communications, Inc.

NASDAQ / INTM

12,244,898 Shares (83% Primary, 17% Secondary)

$23.00 to $26.00 per share

15% (100% Secondary)

Repayment of Indebtedness, General Corporate Purposes

Madison Dearborn Partners

180 days for the Issuer, Selling Stockholder, Executive Officers, Directors and substantially all

pre-IPO stockholders

Morgan Stanley, JP Morgan

Credit Suisse, Evercore ISI, Jefferies

William Blair, KeyBanc Capital Markets, TD Securities, Stephens, Loop Capital Markets

On or around March 31st

CONFIDENTIAL

الها

3View entire presentation