J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

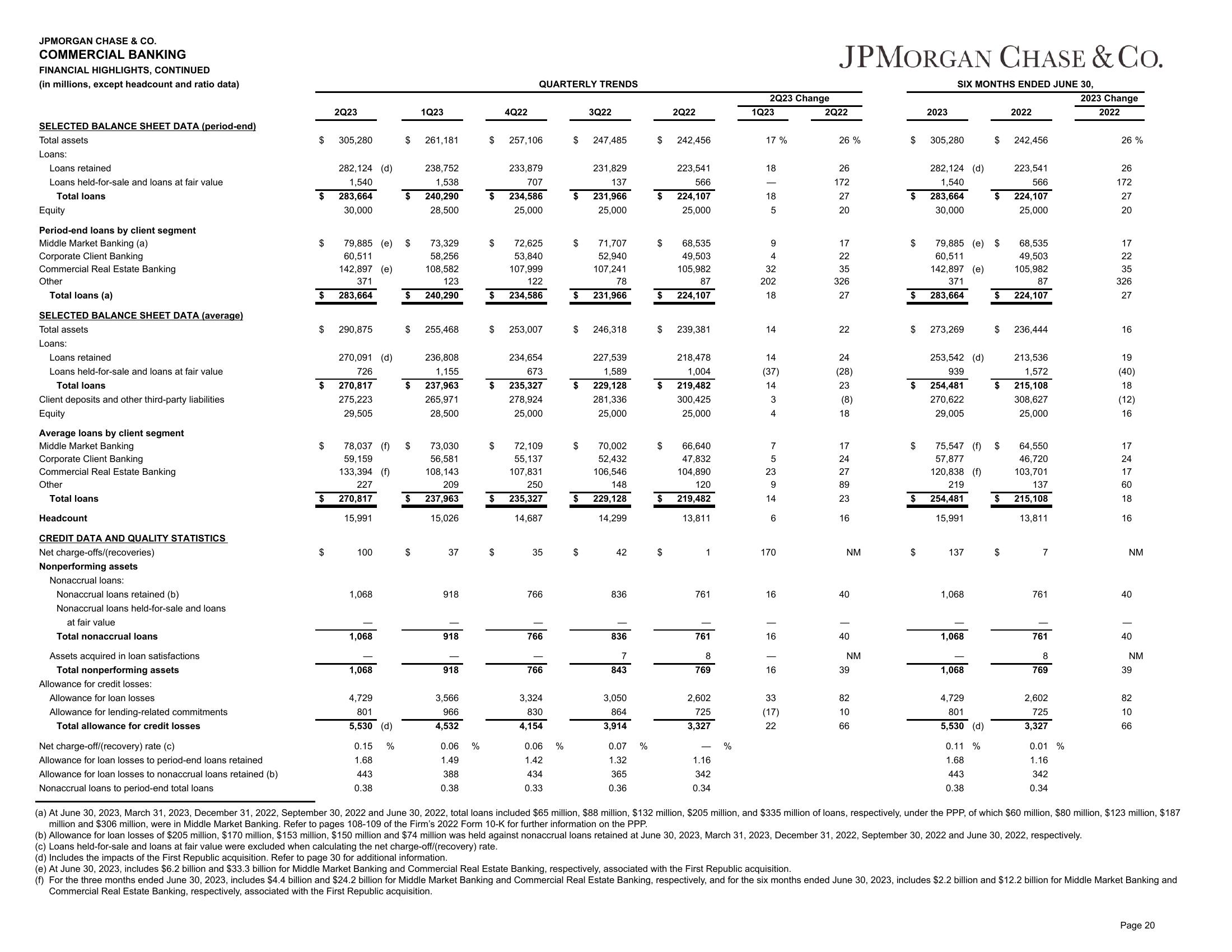

COMMERCIAL BANKING

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except headcount and ratio data)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans:

Loans retained

Loans held-for-sale and loans at fair value

Total loans

Equity

Period-end loans by client segment

Middle Market Banking (a)

Corporate Client Banking

Commercial Real Estate Banking

Other

Total loans (a)

SELECTED BALANCE SHEET DATA (average)

Total assets

Loans:

Loans retained

Loans held-for-sale and loans at fair value

Total loans

Client deposits and other third-party liabilities

Equity

Average loans by client segment

Middle Market Banking

Corporate Client Banking

Commercial Real Estate Banking

Other

Total loans

Headcount

CREDIT DATA AND QUALITY STATISTICS

Net charge-offs/(recoveries)

Nonperforming assets

Nonaccrual loans:

Nonaccrual loans retained (b)

Nonaccrual loans held-for-sale and loans

at fair value

Total nonaccrual loans

Assets acquired in loan satisfactions

Total nonperforming assets

Allowance for credit losses:

Allowance for loan losses

Allowance for lending-related commitments

Total allowance for credit losses

Net charge-off/(recovery) rate (c)

Allowance for loan losses to period-end loans retained

Allowance for loan losses to nonaccrual loans retained (b)

Nonaccrual loans to period-end total loans

$

$

$

$

$

$

2Q23

$

305,280

282,124 (d)

1,540

283,664

30,000

79,885 (e)

60,511

142,897 (e)

371

283,664

290,875

270,091 (d)

726

270,817

275,223

29,505

100

1,068

1,068

78,037 (f) $

59,159

133,394 (f)

227

$ 270,817

15,991

1,068

4,729

801

5,530 (d)

$

0.15 %

1.68

443

0.38

$

$

$

$

$

$

$

1Q23

261,181

238,752

1,538

240,290

28,500

73,329

58,256

108,582

123

240,290

255,468

236,808

1,155

237,963

265,971

28,500

73,030

56,581

108,143

209

237,963

15,026

37

918

918

918

3,566

966

4,532

0.06

1.49

388

0.38

%

$

$

$

$

$

$

$

$

4Q22

QUARTERLY TRENDS

257,106

233,879

707

234,586

25,000

72,625

53,840

107,999

122

234,586

253,007

234,654

673

235,327

278,924

25,000

72,109

55,137

107,831

250

235,327

14,687

35

766

766

766

3,324

830

4,154

0.06

1.42

434

0.33

%

$

$

$

$

$

$

$

$

$

3Q22

247,485

231,829

137

231,966

25,000

71,707

52,940

107,241

78

231,966

246,318

227,539

1,589

229,128

281,336

25,000

70,002

52,432

106,546

148

229,128

14,299

42

836

836

7

843

3,050

864

3,914

0.07 %

1.32

365

0.36

$ 242,456

$

$

$

$

$

$

2Q22

$

223,541

566

224,107

25,000

68,535

49,503

105,982

87

224,107

239,381

218,478

1,004

219,482

300,425

25,000

66,640

47,832

104,890

120

219,482

13,811

1

761

761

8

769

2,602

725

3,327

1.16

342

0.34

%

2Q23 Change

1Q23

17%

18

18

5

9

32

202

18

14

14

(37)

14

3

4

7

5

23

9

14

6

170

16

- 16 - 16 33 (17) 22

JPMORGAN CHASE & Co.

SIX MONTHS ENDED JUNE 30,

2Q22

26 %

26

172

27

20

17

22

35

326

27

22

24

(28)

23

(8)

18

17

24

27

89

23

16

NM

40

40

NM

39

82

10

66

$

$

$

$

$

$

2023

305,280

$

282,124 (d)

1,540

283,664

30,000

273,269

$ 254,481

270,622

29,005

79,885 (e) $

60,511

142,897 (e)

371

283,664

253,542 (d)

939

75,547 (f)

57,877

120,838 (f)

219

$ 254,481

15,991

137

1,068

1,068

1,068

4,729

801

5,530 (d)

$

0.11 %

1.68

443

0.38

$

$

$

$

$

$

2022

242,456

223,541

566

224,107

25,000

68,535

49,503

105,982

87

224,107

236,444

213,536

1,572

215,108

308,627

25,000

64,550

46,720

103,701

137

215,108

13,811

7

761

761

8

769

2,602

725

3,327

0.01 %

1.16

342

0.34

2023 Change

2022

26%

26

172

27

20

17

22

35

326

27

16

19

(40)

18

(12)

16

17

24

17

60

18

16

NM

40

40

NM

39

82

10

66

(a) At June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, total loans included $65 million, $88 million, $132 million, $205 million, and $335 million of loans, respectively, under the PPP, of which $60 million, $80 million, $123 million, $187

million and $306 million, were in Middle Market Banking. Refer to pages 108-109 of the Firm's 2022 Form 10-K for further information on the PPP.

(b) Allowance for loan losses of $205 million, $170 million, $153 million, $150 million and $74 million was held against nonaccrual loans retained at June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, respectively.

(c) Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate.

(d) Includes the impacts of the First Republic acquisition. Refer to page 30 for additional information.

(e) At June 30, 2023, includes $6.2 billion and $33.3 billion for Middle Market Banking and Commercial Real Estate Banking, respectively, associated with the First Republic acquisition.

(f) For the three months ended June 30, 2023, includes $4.4 billion and $24.2 billion for Middle Market Banking and Commercial Real Estate Banking, respectively, and for the six months ended June 30, 2023, includes $2.2 billion and $12.2 billion for Middle Market Banking and

Commercial Real Estate Banking, respectively, associated with the First Republic acquisition.

Page 20View entire presentation