OpenText Investor Day Presentation Deck

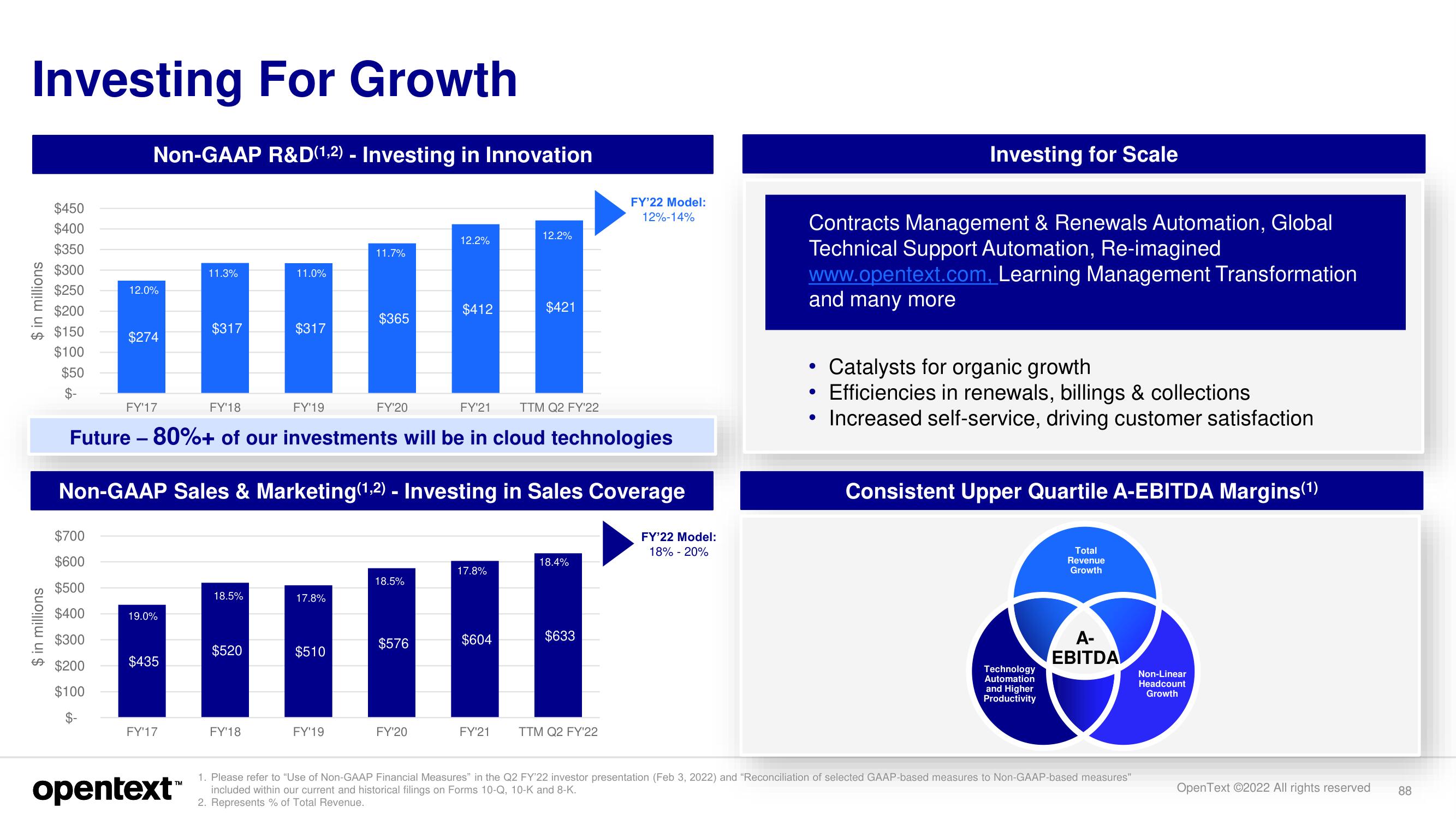

Investing For Growth

$ in millions

$ in millions

$450

$400

$350

$300

$250

$200

$150

$100

$50

$-

Non-GAAP R&D(1,2)- Investing in Innovation

$700

$600

$500

$400

$300

$200

$100

$-

12.0%

$274

19.0%

$435

FY'17

11.3%

opentext™

$317

18.5%

$520

11.0%

FY'18

$317

FY'17

FY'18

FY'21

Future - 80%+ of our investments will be in cloud technologies

Non-GAAP Sales & Marketing (1,2)- Investing in Sales Coverage

FY'19

17.8%

$510

11.7%

FY'19

$365

FY'20

18.5%

$576

12.2%

FY'20

$412

17.8%

$604

12.2%

FY'21

$421

TTM Q2 FY'22

18.4%

$633

FY'22 Model:

12%-14%

TTM Q2 FY'22

FY'22 Model:

18% - 20%

Investing for Scale

Contracts Management & Renewals Automation, Global

Technical Support Automation, Re-imagined

www.opentext.com, Learning Management Transformation

and many more

●

Catalysts for organic growth

• Efficiencies in renewals, billings & collections

• Increased self-service, driving customer satisfaction

Consistent Upper Quartile A-EBITDA Margins (1)

Technology

Automation

and Higher

Productivity

Total

Revenue

Growth

A-

EBITDA

1. Please refer to "Use of Non-GAAP Financial Measures" in the Q2 FY'22 investor presentation (Feb 3, 2022) and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures"

included within our current and historical filings on Forms 10-Q, 10-K and 8-K.

2. Represents % of Total Revenue.

Non-Linear

Headcount

Growth

OpenText ©2022 All rights reserved

88View entire presentation