Q2 2018 Fixed Income Investor Conference Call

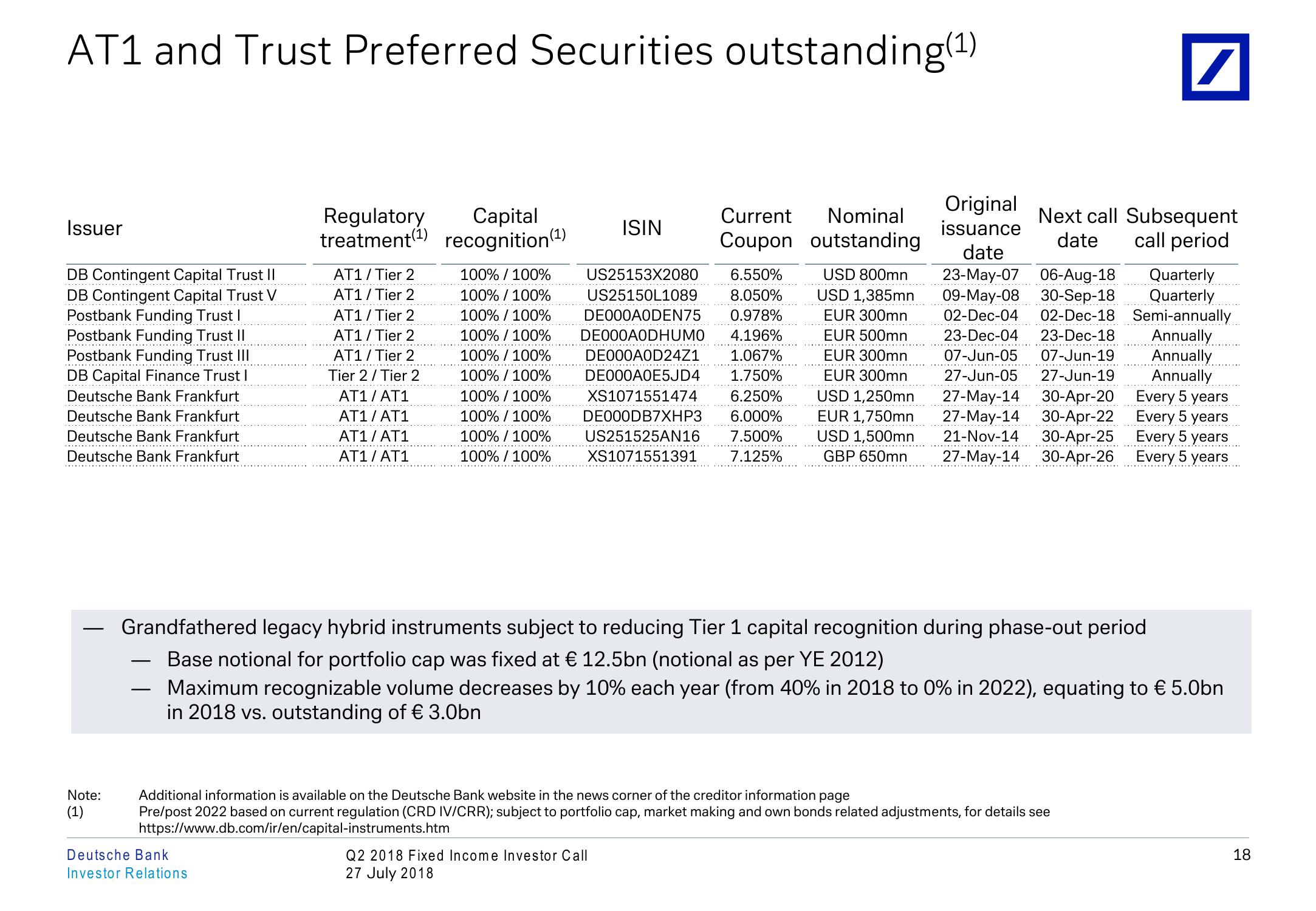

AT1 and Trust Preferred Securities outstanding (1)

Issuer

DB Contingent Capital Trust II

DB Contingent Capital Trust V

Postbank Funding Trust I

Postbank Funding Trust II

Postbank Funding Trust III

DB Capital Finance Trust I

Deutsche Bank Frankfurt

Deutsche Bank Frankfurt

Deutsche Bank Frankfurt

Regulatory Capital

treatment (1) recognition (1)

ISIN

Current Nominal

Coupon outstanding

Original

issuance

AT1 / Tier 2

AT1 / Tier 2

AT1 / Tier 2

AT1/Tier 2

AT1 / Tier 2

Tier 2 / Tier 2

AT1/AT1

100%/100%

100% / 100%

100%/100%

100% / 100%

100% / 100%

100%/100%

100%/100%

AT1/AT1

100%/100%

AT1/AT1

100%/100%

Deutsche Bank Frankfurt

AT1/AT1

100% 100%

US25153X2080 6.550%

US25150L1089 8.050%

DE000A0DEN75 0.978%

DE000AODHUMO 4.196%

DE000A0D24Z1 1.067%

DE000A0E5JD4 1.750%

XS1071551474 6.250%

DE000DB7XHP3 6.000%

US251525AN16 7.500%

XS1071551391 7.125%

USD 800mn

USD 1,385mn

EUR 300mn

EUR 500mn

EUR 300mn

EUR 300mn

USD 1,250mn

EUR 1,750mn

USD 1,500mn

GBP 650mn

07-Jun-05 07-Jun-19

27-Jun-05 27-Jun-19

27-May-14

27-May-14

Quarterly

date

23-May-07 06-Aug-18

09-May-08 30-Sep-18 Quarterly

02-Dec-04 02-Dec-18 Semi-annually

23-Dec-04 23-Dec-18 Annually

Annually

Next call Subsequent

date call period

Annually

30-Apr-20

Every 5 years

30-Apr-22

Every 5 years

21-Nov-14 30-Apr-25

27-May-14 30-Apr-26

Every 5 years

Every 5 years

Grandfathered legacy hybrid instruments subject to reducing Tier 1 capital recognition during phase-out period

-

Base notional for portfolio cap was fixed at € 12.5bn (notional as per YE 2012)

Maximum recognizable volume decreases by 10% each year (from 40% in 2018 to 0% in 2022), equating to € 5.0bn

in 2018 vs. outstanding of € 3.0bn

Note:

(1)

Additional information is available on the Deutsche Bank website in the news corner of the creditor information page

Pre/post 2022 based on current regulation (CRD IV/CRR); subject to portfolio cap, market making and own bonds related adjustments, for details see

https://www.db.com/ir/en/capital-instruments.htm

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

18View entire presentation