Elms SPAC Presentation Deck

Case Study: Forum Merger I / ConvergeOne

H

ConvergeOne

FORUM

MERGER

CORPORATION

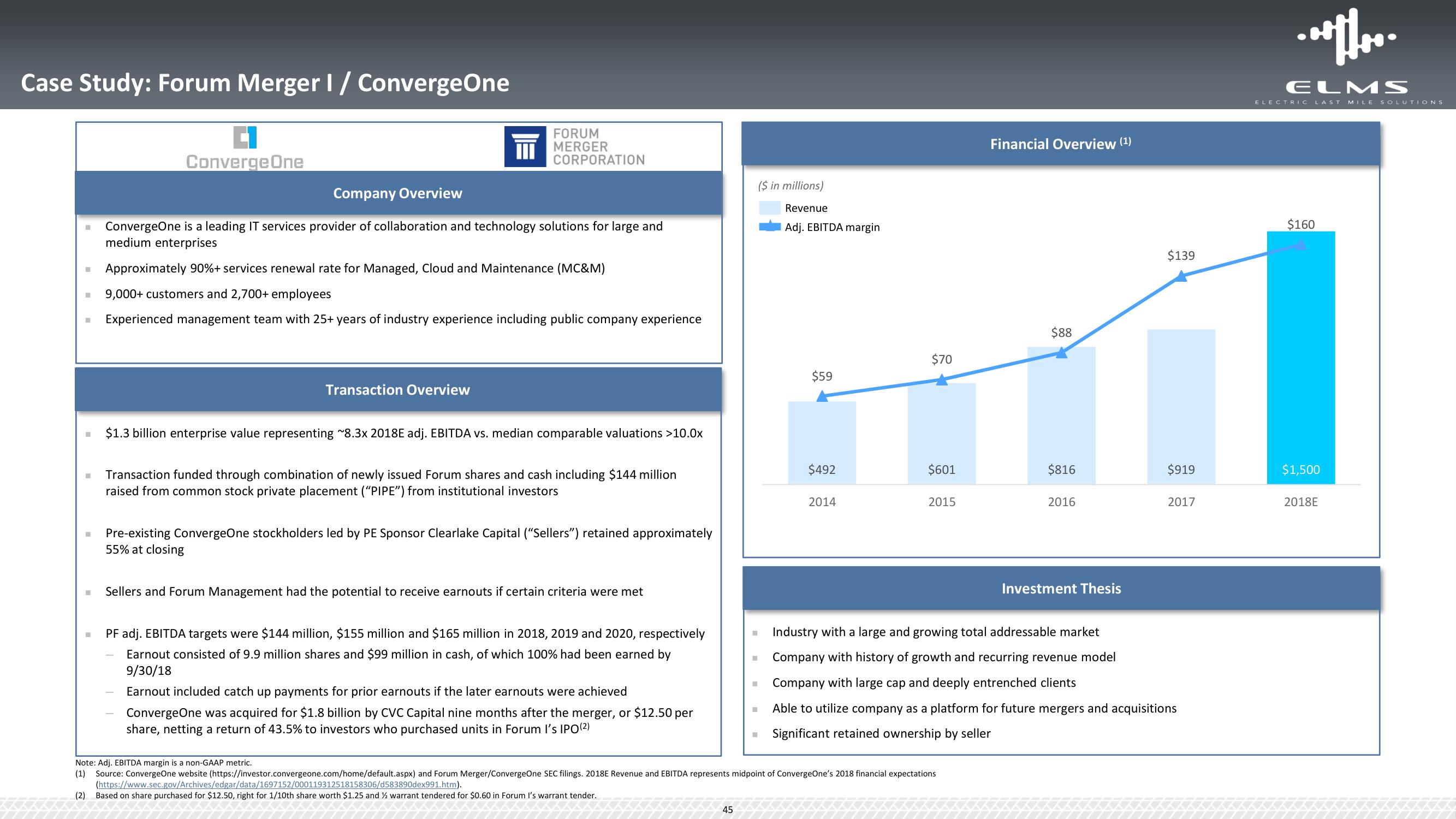

Company Overview

ConvergeOne is a leading IT services provider of collaboration and technology solutions for large and

medium enterprises

Approximately 90%+ services renewal rate for Managed, Cloud and Maintenance (MC&M)

9,000+ customers and 2,700+ employees

Experienced management team with 25+ years of industry experience including public company experience

Transaction Overview

$1.3 billion enterprise value representing ~8.3x 2018E adj. EBITDA vs. median comparable valuations >10.0x

Transaction funded through combination of newly issued Forum shares and cash including $144 million

raised from common stock private placement ("PIPE") from institutional investors

Pre-existing ConvergeOne stockholders led by PE Sponsor Clearlake Capital ("Sellers") retained approximately

55% at closing

Sellers and Forum Management had the potential to receive earnouts if certain criteria were met

PF adj. EBITDA targets were $144 million, $155 million and $165 million in 2018, 2019 and 2020, respectively

Earnout consisted of 9.9 million shares and $99 million in cash, of which 100% had been earned by

9/30/18

Earnout included catch up payments for prior earnouts if the later earnouts were achieved

ConvergeOne was acquired for $1.8 billion by CVC Capital nine months after the merger, or $12.50 per

share, netting a return of 43.5% to investors who purchased units in Forum I's IPO (²)

(https://www.sec.gov/Archives/edgar/data/1697152/000119312518158306/d583890dex991.htm).

(2) Based on share purchased for $12.50, right for 1/10th share worth $1.25 and ½ warrant tendered for $0.60 in Forum I's warrant tender.

45

($ in millions)

Revenue

Adj. EBITDA margin

■

$59

$492

2014

$70

$601

2015

Note: Adj. EBITDA margin is a non-GAAP metric.

(1) Source: ConvergeOne website (https://investor.convergeone.com/home/default.aspx) and Forum Merger/ConvergeOne SEC filings. 2018E Revenue and EBITDA represents midpoint of ConvergeOne's 2018 financial expectations

Financial Overview (¹)

$88

$816

2016

Investment Thesis

$139

$919

Industry with a large and growing total addressable market

H Company with history of growth and recurring revenue model

1 Company with large cap and deeply entrenched clients

Able to utilize company as a platform for future mergers and acquisitions

Significant retained ownership by seller

2017

ELMS

ELECTRIC LAST MILE SOLUTIONS

$160

$1,500

2018EView entire presentation