Blackwells Capital Activist Presentation Deck

$80

$70

$60

$50

$40

$30

$20

$10

$0

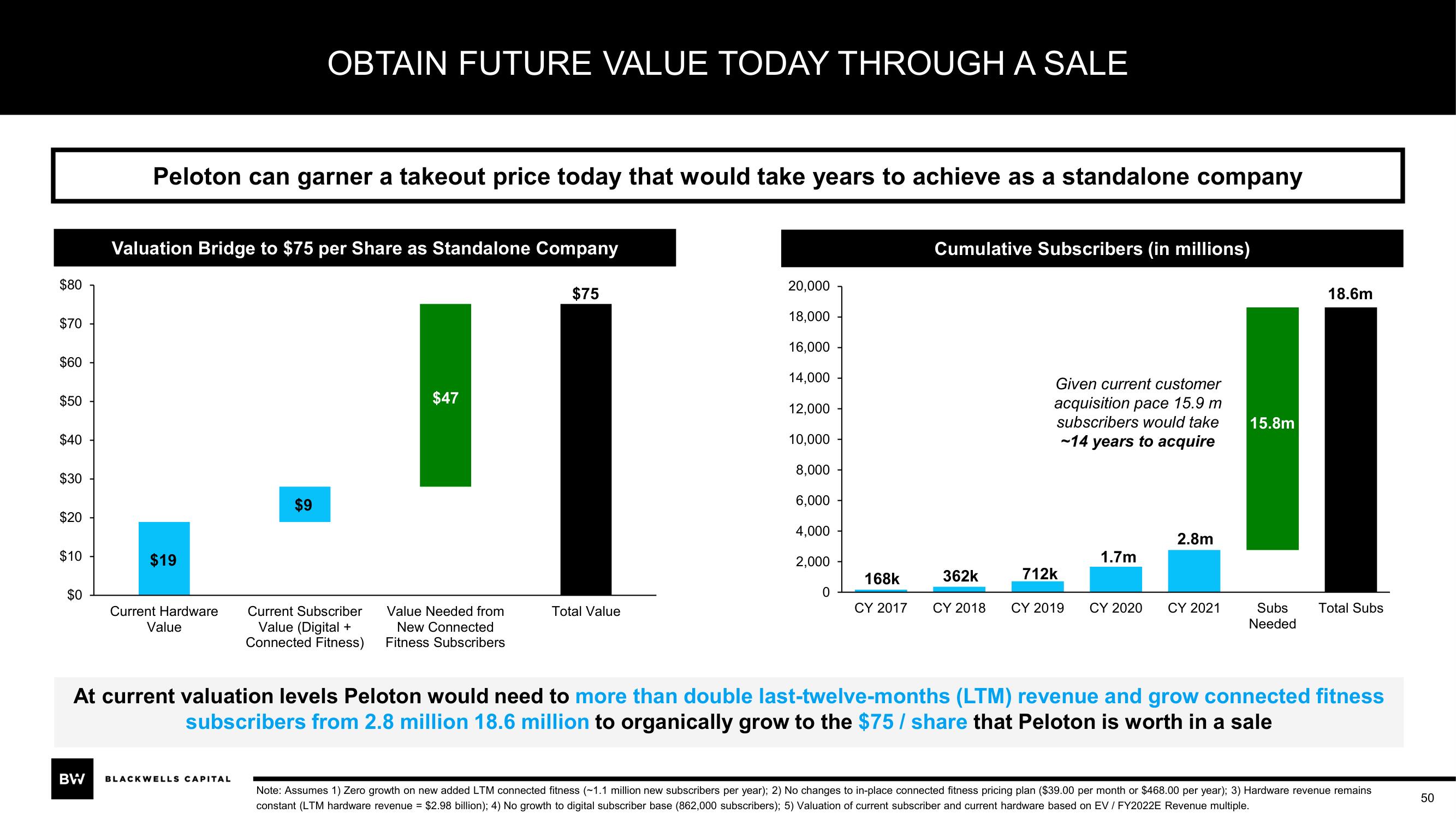

Peloton can garner a takeout price today that would take years to achieve as a standalone company

Valuation Bridge to $75 per Share as Standalone Company

$19

Current Hardware

Value

OBTAIN FUTURE VALUE TODAY THROUGH A SALE

$9

BW BLACKWELLS CAPITAL

Current Subscriber

Value (Digital +

Connected Fitness)

$47

Value Needed from

New Connected

Fitness Subscribers

$75

Total Value

20,000

18,000

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

Cumulative Subscribers (in millions)

Given current customer

acquisition pace 15.9 m

subscribers would take

-14 years to acquire

362k

712k

168k

CY 2017 CY 2018 CY 2019

1.7m

2.8m

CY 2020 CY 2021

15.8m

Subs

Needed

18.6m

Total Subs

At current valuation levels Peloton would need to more than double last-twelve-months (LTM) revenue and grow connected fitness

subscribers from 2.8 million 18.6 million to organically grow to the $75/ share that Peloton is worth in a sale

Note: Assumes 1) Zero growth on new added LTM connected fitness (~1.1 million new subscribers per year); 2) No changes to in-place connected fitness pricing plan ($39.00 per month or $468.00 per year); 3) Hardware revenue remains

constant (LTM hardware revenue = $2.98 billion); 4) No growth to digital subscriber base (862,000 subscribers); 5) Valuation of current subscriber and current hardware based on EV / FY2022E Revenue multiple.

50View entire presentation