Melrose Results Presentation Deck

Highlights

Melrose

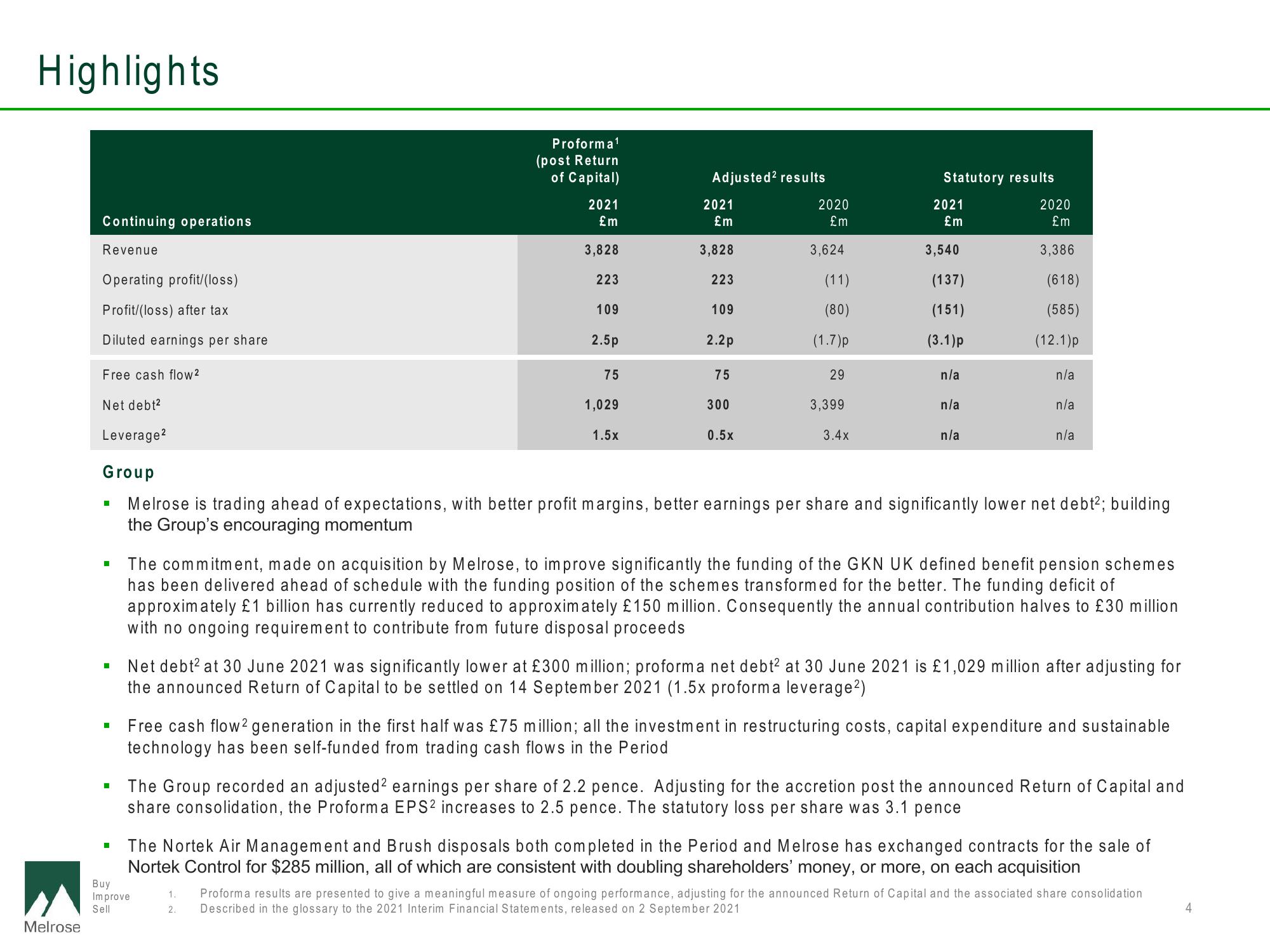

Continuing operations

Revenue

Operating profit/(loss)

Profit/(loss) after tax

Diluted earnings per share

Free cash flow ²

Net debt²

Leverage ²

Group

■

I

■

Proforma¹

(post Return

of Capital)

2021

£m

3,828

223

109

2.5p

75

1,029

1.5x

Buy

Improve

Sell

Adjusted² results

2021

£m

3,828

223

109

2.2p

75

300

0.5x

2020

£m

3,624

(11)

(80)

(1.7)p

29

3,399

3.4x

Statutory results

2021

£m

3,540

(137)

(151)

(3.1)p

n/a

n/a

n/a

2020

£m

3,386

(618)

(585)

(12.1)p

n/a

n/a

n/a

Melrose is trading ahead of expectations, with better profit margins, better earnings per share and significantly lower net debt²; building

the Group's encouraging momentum

The commitment, made on acquisition by Melrose, to improve significantly the funding of the GKN UK defined benefit pension schemes

has been delivered ahead of schedule with the funding position of the schemes transformed for the better. The funding deficit of

approximately £1 billion has currently reduced to approximately £150 million. Consequently the annual contribution halves to £30 million

with no ongoing requirement to contribute from future disposal proceeds

Net debt² at 30 June 2021 was significantly lower at £300 million; proforma net debt² at 30 June 2021 is £1,029 million after adjusting for

the announced Return of Capital to be settled on 14 September 2021 (1.5x proforma leverage²)

Free cash flow² generation in the first half was £75 million; all the investment in restructuring costs, capital expenditure and sustainable

technology has been self-funded from trading cash flows in the Period

The Group recorded an adjusted2 earnings per share of 2.2 pence. Adjusting for the accretion post the announced Return of Capital and

share consolidation, the Proforma EPS2 increases to 2.5 pence. The statutory loss per share was 3.1 pence

The Nortek Air Management and Brush disposals both completed in the Period and Melrose has exchanged contracts for the sale of

Nortek Control for $285 million, all of which are consistent with doubling shareholders' money, or more, on each acquisition

1. Proforma results are presented to give a meaningful measure of ongoing performance, adjusting for the announced Return of Capital and the associated share consolidation

2. Described in the glossary to the 2021 Interim Financial Statements, released on 2 September 2021View entire presentation