SmileDirectClub Results Presentation Deck

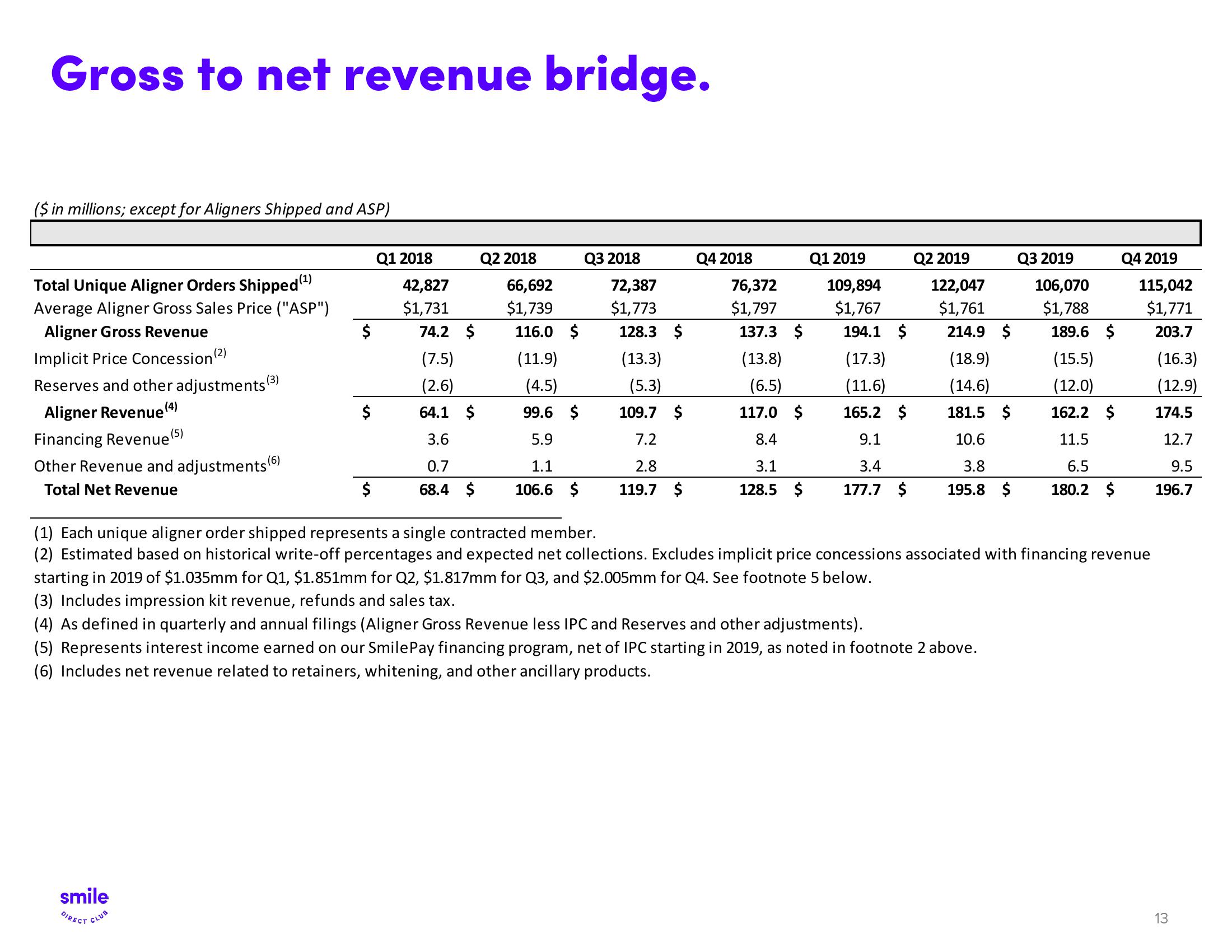

Gross to net revenue bridge.

($ in millions; except for Aligners Shipped and ASP)

Total Unique Aligner Orders Shipped (¹)

Average Aligner Gross Sales Price ("ASP")

Aligner Gross Revenue

Implicit Price Concession (2)

Reserves and other adjustments (³)

(4)

Aligner Revenue

Financing Revenue (5)

Other Revenue and adjustments (6)

Total Net

$

$

smile

DIRECT CLUB

$

Q1 2018

42,827

$1,731

74.2 $

(7.5)

(2.6)

64.1 $

3.6

0.7

68.4 $

Q2 2018

66,692

$1,739

116.0 $

(11.9)

(4.5)

99.6 $

5.9

1.1

106.6 $

Q3 2018

72,387

$1,773

128.3 $

(13.3)

(5.3)

109.7 $

7.2

2.8

9.7 $

Q4 2018

76,372

$1,797

137.3 $

(13.8)

(6.5)

117.0 $

8.4

3.1

128.5 $

Q1 2019

109,894

$1,767

194.1 $

(17.3)

(11.6)

165.2 $

9.1

3.4

177.7

Q2 2019

122,047

$1,761

214.9 $

(18.9)

(14.6)

181.5 $

10.6

3.8

195.8

(3) Includes impression kit revenue, refunds and sales tax.

(4) As defined in quarterly and annual filings (Aligner Gross Revenue less IPC and Reserves and other adjustments).

(5) Represents interest income earned on our SmilePay financing program, net of IPC starting in 2019, as noted in footnote 2 above.

(6) Includes net revenue related to retainers, whitening, and other ancillary products.

Q3 2019

106,070

$1,788

189.6 $

(15.5)

(12.0)

162.2 $

11.5

6.5

180.2 $

Q4 2019

(1) Each unique aligner order shipped represents a single contracted member.

(2) Estimated based on historical write-off percentages and expected net collections. Excludes implicit price concessions associated with financing revenue

starting in 2019 of $1.035mm for Q1, $1.851mm for Q2, $1.817mm for Q3, and $2.005mm for Q4. See footnote 5 below.

115,042

$1,771

203.7

(16.3)

(12.9)

174.5

12.7

9.5

196.7

13View entire presentation