Morgan Stanley Investment Banking Pitch Book

Project Roosevelt

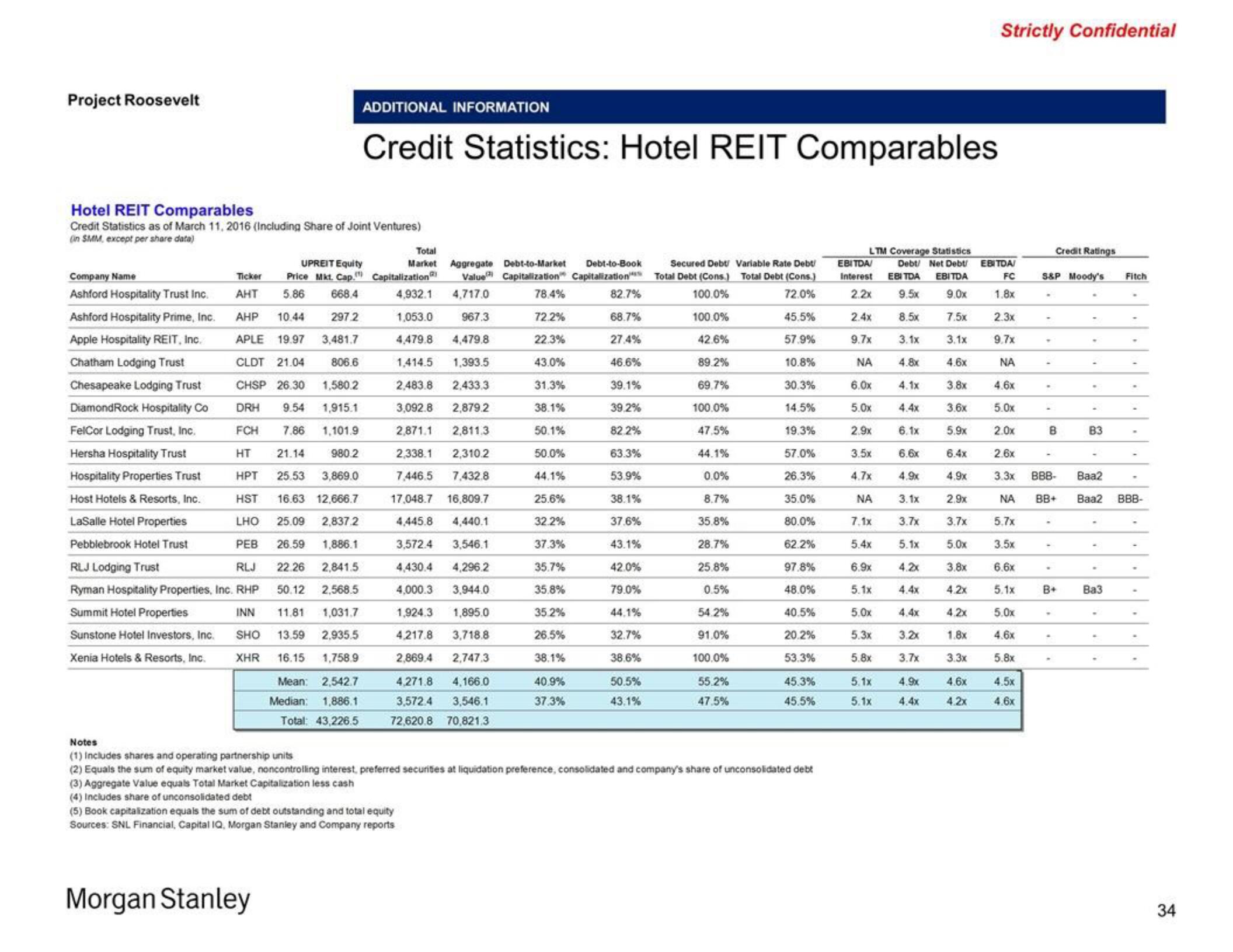

Hotel REIT Comparables

Credit Statistics as of March 11, 2016 (Including Share of Joint Ventures)

On SMM, except per share data)

ADDITIONAL INFORMATION

Credit Statistics: Hotel REIT Comparables

Company Name

Ashford Hospitality Trust Inc.

Ashford Hospitality Prime, Inc.

Apple Hospitality REIT, Inc.

Chatham Lodging Trust

Chesapeake Lodging Trust

DiamondRock Hospitality Co

FelCor Lodging Trust, Inc.

Hersha Hospitality Trust

Hospitality Properties Trust

Host Hotels & Resorts, Inc.

LaSalle Hotel Properties

UPREIT Equity

Ticker

Price Mkt. Cap.

AHT 5.86 668.4

AHP 10.44 297.2

APLE 19.97 3,481.7

CLDT 21.04 806.6

CHSP 26.30 1,580.2

DRH 9.54 1,915.1

FCH 7.86 1,101.9

HT 21.14 980.2

HPT 25.53 3,869.0

HST 16.63 12,666.7

LHO 25.09 2,837.2

Pebblebrook Hotel Trust

PEB 26.59 1,886.1

RLJ Lodging Trust

RLJ 22.26 2,841.5

Ryman Hospitality Properties, Inc. RHP 50.12 2,568.5

Summit Hotel Properties

INN 11.81 1,031.7

SHO 13.59 2,935.5

XHR 16.15 1,758.9

Mean: 2,542.7

Median: 1,886.1

Total: 43,226.5

Sunstone Hotel Investors, Inc.

Xenia Hotels & Resorts, Inc.

Morgan Stanley

Total

Market Aggregate Debt-to-Market Debt-to-Book

Value Capitalization Capitalization

78.4%

72.2%

22.3%

43.0%

31.3%

38.1%

50.1%

50.0%

44.1%

25.6%

32.2%

37.3%

35.7%

35.8%

35.2%

26.5%

38.1%

Capitalization

4,932.1 4,717.0

1,053.0 967.3

4,479.8 4,479.8

1,414.5 1,393.5

2,483.8 2,433.3

3,092.8 2,879.2

2,871.1 2,811.3

2,338.1 2,310.2

7,446.5 7,432.8

17,048.7 16,809.7

4,445.8 4,440.1

3,572.4 3,546.1

4,430.4 4,296.2

4,000.3 3,944.0

1,924.3 1,895.0

4.217.8 3,718.8

2,869.4 2,747.3

4,271.8 4,166.0

3,572.4 3,546.1

72,620.8 70,821.3

40.9%

37.3%

82.7%

68.7%

27.4%

46.6%

39.1%

39.2%

82.2%

63.3%

53.9%

38.1%

37.6%

43.1%

42.0%

79.0%

44.1%

32.7%

38.6%

50.5%

43,1%

Secured Debt

Total Debt (Cons.)

100.0%

100.0%

42.6%

89.2%

69.7%

100.0%

47.5%

44.1%

0.0%

8.7%

35.8%

28.7%

25.8%

0.5%

54.2%

91.0%

100.0%

55.2%

47.5%

Variable Rate Debt

Total Debt (Cons.)

72.0%

45.5%

57.9%

10.8%

30.3%

14.5%

19.3%

57.0%

26.3%

35.0%

80.0%

62.2%

97.8%

48.0%

40.5%

20.2%

53.3%

45.3%

45.5%

Notes

(1) Includes shares and operating partnership units

(2) Equals the sum of equity market value, noncontrolling interest, preferred securities at liquidation preference, consolidated and company's share of unconsolidated debt

(3) Aggregate Value equals Total Market Capitalization less cash

(4) Includes share of unconsolidated debt

(5) Book capitalization equals the sum of debt outstanding and total equity

Sources: SNL Financial, Capital IQ, Morgan Stanley and Company reports

LTM Coverage Statistics

EBITDA/ Debt/ Net Debt

Interest EBITDA EBITDA

2.2x 9.5x 9.0x

2.4x 8.5x 7.5x

9.7x

3.1x

3.1x

ΝΑ 4.8x

4.6x

6.0x

4.1x

3.8x

5.0x

4.4x

3.6x

2.9x

6.1x

5.9x

3.5x

6.6x

4.7x

4.9x

ΝΑ

7.1x

6.4x

4.9x

Strictly Confidential

EBITDA)

FC

1.8x

2.3x

9.7x

NA

4.6x

5.0x

2.0x

2.6x

3.3x BBB- Baa2

2,9x

NA BB+ Baa2 BBB-

3.7x

5.7x

5.0x

3.5x

3.8x

6.6x

4.2x

5.1x

4.2x 5.0x

4.6x

5.8x

3.1x

3.7x

5.4x

5.1x

6.9x

4.2x

5.1x 4.4x

5.0x

5.3x

4.4x

3.2x

1.8x

5.8x 3.7x 3.3x

5.1x

4.6x

4.9x

4.4x

5.1x

4.2x

4.5x

4.6x

S&P Moody's

.

.

Credit Ratings

B

-

.

B+

B3

Ba3

Fitch

34View entire presentation